All nonprofits can benefit from smart and targeted outreach to donors and potential donors. This is especially true when donors are increasingly demanding more options when giving. Long gone are the days when nonprofits can simply ask donors to write a check. Rather, current and potential donors want a wide menu of choices when it comes to charitable giving—choices that give them flexibility in the type of gift, in the timing of the gift, in the tool or vehicle that maximizes their tax benefits, and in how to make their support meaningful both to themselves and to the nonprofit.

There are three methods I’ve found that work well for nonprofits to communicate the many ways donors and potential donors can maximize their charitable giving. The communication methods include (1) newsletters; (2) in-person seminars; and (3) website content. Sure, this may seem obvious, but all of these tactics should be well done for the greatest impact. I am happy to advise and assist nonprofits in developing and implementing off of these methods to create an effective and sustainable program for outreach, information, and advocacy.

Newsletters

Nonprofits interested in using newsletters to communicate with donors should start with an up-to-date email list. Next, divide the list into three groups: (1) donors/potential donors; (2) nonprofits and nonprofit personnel; and (3) professional advisors (accountants, financial advisors, insurance agents, and lawyers…anyone who may recommend or advise your nonprofit). Each group would receive its own newsletter tailored according to its connection to the nonprofit, its interests, and the relationship you want to build with it. Generally speaking, sending newsletters one a month is a good balance. More often than this and you become email clutter, less than this and you’re not keeping the nonprofit top of supporters’ minds.

Donors

The newsletter sent to current and potential donors could focus on a specific topic such as the types of and flexibility of gifts the nonprofit accepts; explanation and use of the Endow Iowa tax credit; and giving through estate planning.

Nonprofits

The newsletter sent to nonprofits and related personnel could focus on compliance controls and internal policies, such as:

- how to properly set up an endowment

- how to respond to employee concerns

- best practices associated with gift acceptance

Professional advisors

The newsletter sent to professional advisors could take deep dives into complex charitable gifting tools such as different charitable remainder trusts (CRATs, CRUTs, NIM-CRUTS, FLIP-CRUTS, etc.), donor-advised funds, and IRA charitable rollover. Illustrating these tools with real-life case studies (with details changed to preserve privacy) will help professional advisors learn how to recognize philanthropic opportunities when presented by their clients.

Seminars

Monthly seminars on charitable giving are a great way to familiarize current and potential donors about what the nonprofit does and to inform them about the many ways their support can be crafted to fit their financial situation, needs, and interests. Holding seminars at the nonprofit’s offices, rather than at a soulless hotel meeting room or corporate campus, has a number of benefits. Visitors can see where the hard work gets accomplished; they can meet staff and volunteers; and overall, they will develop a closer emotional connection to the organization.

Seminars would be customized to the nonprofit’s unique needs and its targeted audience. I have given many nonprofit-focused seminars over the years and am happy to work together to develop the perfect presentation. There are few topics in the area of nonprofits, estate planning, and charitable giving that I do not feel completely comfortable speaking on.

All presentations I give include an engaging visual presentation, handouts, and plenty of time for questions and discussion. I also send slides used in the session to attendees following the training.

In terms of promotion, it’s best to announce the seminar program well in advance, schedule seminars at the same time every month, and hold them at the same location (e.g., the third Thursday of every month, at 8 a.m., at the Nonprofit Offices).

Website Content

There are three topics I recommend every nonprofit website have no matter its size or mission:

- charitable giving through estate planning

- tools and techniques for charitable gifting

- professional advisors

These topics should each have their own webpages.

The “charitable gifting through estate planning” webpage should describe what an estate plan is; how charitable giving happens through an estate plan; the benefits of trusts; and ways to use the beneficiary designations. The page can provide the official and full name of the nonprofit; address; and federal tax ID number. Also, providing sample bequest language can be incredibly helpful to both donors and professional advisors in starting to organize and think through a bequest.

“Tools and techniques for charitable gifting” should describe options aside from checks and credit cards. Short, concise paragraphs should highlight gifting retirement benefit plans; real estate; gifts of grain; charitable remainder trusts; and charitable gift annuities, among others.

The page for professional advisors ideally has a two-fold purpose. First, it is to demonstrate the nonprofit wants to work with professional advisors; that the nonprofit should be seen as another “tool in the toolbox” for professional advisors. Specific examples of ways the nonprofit have previously worked with professional advisors should be provided. Second, it could provide a deep-dive into the charitable gifting tools and techniques discussed earlier: really provide the gritty details, so it’s a valuable resource for professional advisors, complete with case studies.

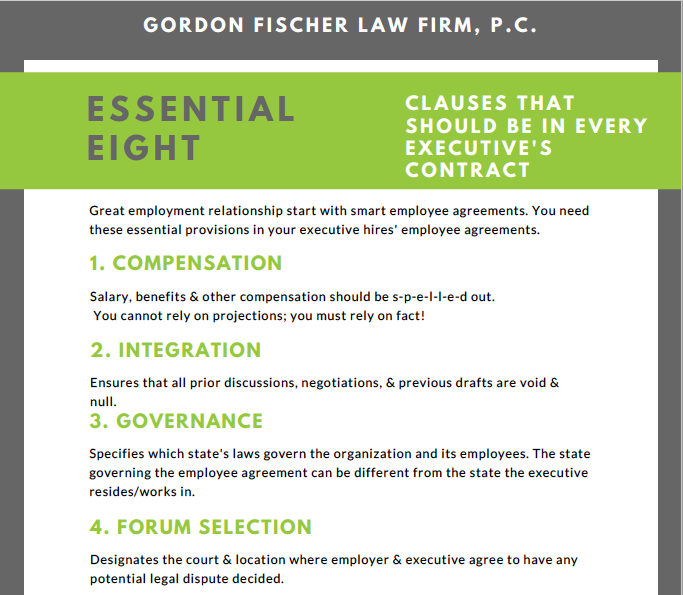

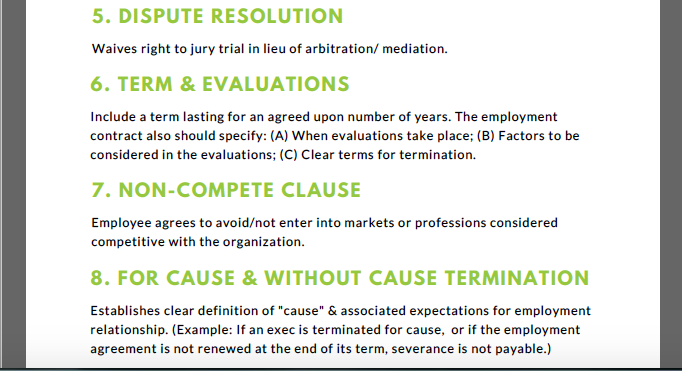

Cautionary Note: Policies & Procedures

Before tackling these marketing ideas, nonprofits should put first things first, and be in optimal compliance with proper, well-drafted, and up-to-date policies and procedures. These should include the 10 major policies and procedures that support the best possible IRS Form 990 practices (such as public disclosure, gift acceptance, and whistleblowing). Nonprofits should also have documents in place covering the topics of employment, grantors and grantees, and endowment management. Further, nonprofits should provide regular training for boards of directors.

Please do not hesitate to contact me via email (gordon@gordonfischerlawfirm.com) or on my cell phone (515-371-6077). I’d be happy to discuss prospective nonprofit marketing strategies through newsletters, seminars, and website content, with you at your convenience.