I love getting to collaborate with wonderful professional advisors (like financial advisors and insurance agents, among many others) to promote and maximize charitable giving in Iowa. Together we get to help their clients best incorporate strategic charitable giving in to their financial and estate planning goals and plans.

People come to philanthropy from many different places and for many different reasons. Beyond the obvious tax benefits of donating to a charitable organization, there’s always that admirable intention of wanting to make a difference, of aspiring to help the organizations and causes they care about progress.

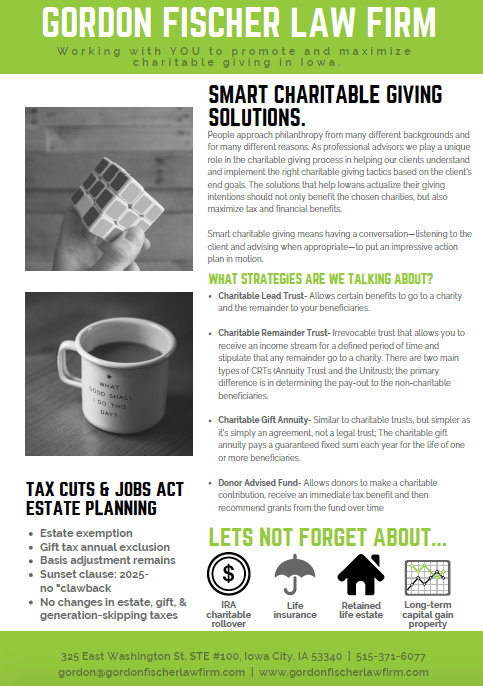

As a starting point for discussing smart charitable giving solutions, I’ve created this handy one-pager. It gives an overview of strategies like the popular donor advised fund and different types of charitable trusts, and reminds of other options like an IRA charitable rollover and retained life estate. The pdf also hits on aspects of the Tax Cuts and Jobs Act that prospective donors and professional advisors should be aware of.

Click here to view the free guide to smart charitable giving solutions and then let’s continue the conversation. Additionally, you can learn more about how Gordon Fischer Law Firm works with the professional advisors here. Together I’m certain we can craft the best, legal giving solutions that align with your clients’ giving goals.