Over the past few years Giving Tuesday has claimed its rightful place in the post-Thanksgiving “days” that kick-off the holiday shopping season as well as the end-of-year giving push. Billed as a “global giving movement,” the tag #GivingTuesday encourages people to donate your time, monetary donations, or even just your voice and ideas to a charity/cause that you care for.

Yet, with the threat and immense need caused by COVID-19, waiting until Giving Tuesday for a global, unified call for charitable giving isn’t sufficient. #GivingTuesdayNow (on May 5, 2020) was organized as an international day “designed to drive an influx of generosity, citizen engagement, business and philanthropy activation, and support for communities and nonprofits around the world. It’s a day when we can all come together and give back in all ways, no matter who or where we are.”

Use this day a chance to celebrate the power of giving by supporting the nonprofit organizations you care deeply about—particularly those providing social services and essentials to beneficiary populations in need.

Of course, with unemployment at a record high, donors can also celebrate and support the COVID-19 efforts through donating time or blood/plasma.

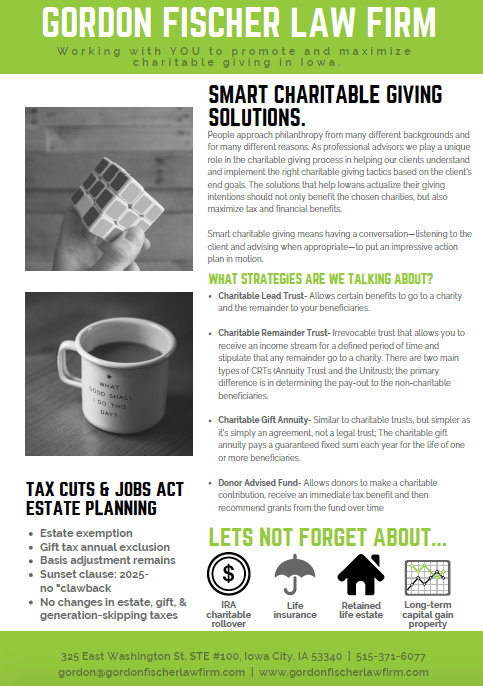

Want to discuss how to be strategic with your charitable giving during this difficult time? Don’t hesitate to shoot me an email or give me a call at 515-371-6077.