You need an estate plan. You need an estate plan.

If I haven’t yet fully convinced you that you need an estate plan, consider many other reputable sources. Following the brutal infighting over his estate, Prince would probably tell you to make an estate plan. So would these other celebrities who died without a plan. Fox Business emphasizes the critical importance of an estate plan, adding, “[y]ou don’t have to be rich to plan for your death.” U.S. News & World Report notes both the financial and emotional pain inflicted on loved ones when folks fail to plan. Fidelity cautions that too often estate planning is a neglected, but important, part of overall financial planning. Forbes reminds us that, “Plain and simple, estate planning helps protect your family in the event that something bad happens to you.”

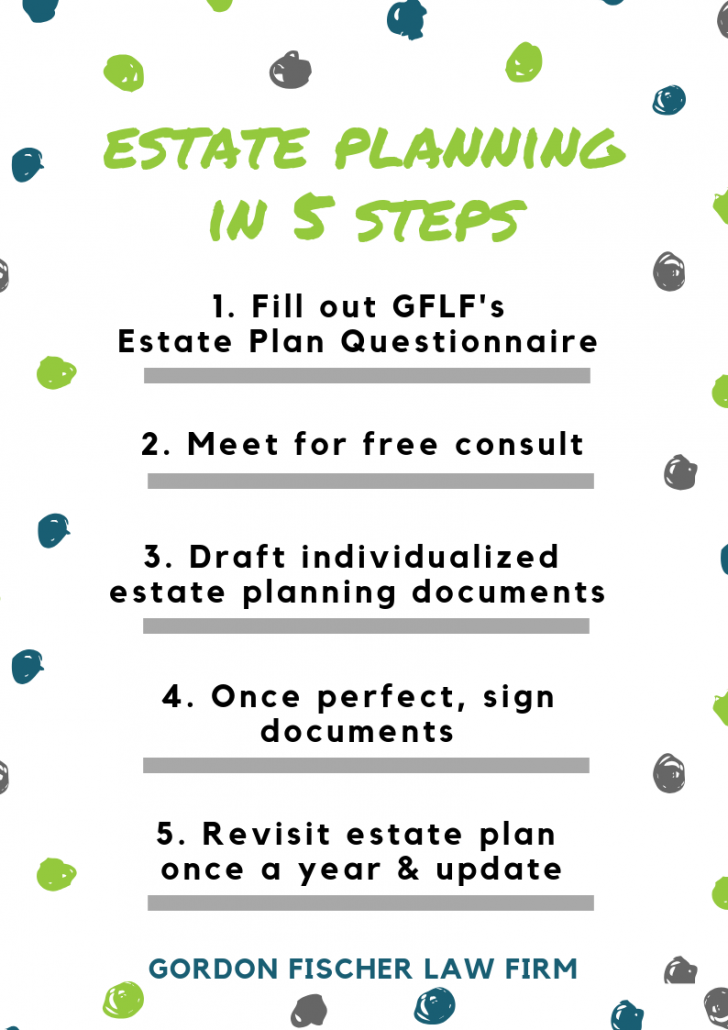

So, an estate plan is clearly critically important, but where to start? Keep reading for an easy five-step guide to get you where you need to go.

Estate Plan, Not Just a Will

Before I discuss the five easy steps, let’s get our terminology straight. Remember a will is NOT the same as an estate plan. While these two terms are (mistakenly) used interchangeably all the time, they are quite different.

An estate plan consists of several legal documents to prepare for your death or disability. Your will is just one of those documents, albeit a very important one. You need more than a will; you need an estate plan. With that settled, let’s discuss the five-step process of how I can craft your very own, individualized estate plan.

Honesty and Transparency

I work with my clients from a place of complete honesty and transparency. I’m upfront and open about my process of developing clients’ estate plans.

I’m always sure to inform potential clients of my five-step process:

- You download and fill out my free estate plan questionnaire.

- We meet for a free one-hour consultation and discuss your completed estate plan questionnaire.

- Based on the information you provided me, and our discussion, I draw up drafts of your estate planning documents.

- Once you are sure the estate planning documents are perfect, we sign the documents.

- About once a year we revisit your estate plan to ensure it’s aligned with your life changes.

That’s it. That’s really all there is to it.

STEP ONE: Estate Plan Questionnaire

A great place for you to start is by filling out my free estate plan questionnaire. It’s completely free, with no obligation.

You can print off my estate plan questionnaire and either fill it out by hand, or type in your information digitally. If filling it out on a computer, tablet, or smartphone, remember to “save” often and regularly. The estate plan questionnaire collects essential information needed to craft a quality estate plan. This information includes contact information about your family and your professional advisors, assets, family, and specific property items.

Cost of an Estate Plan

People thinking about completing an estate plan are often, quite understandably, concerned about its cost. No matter who you hire to draft or update your estate plan, make sure they’re completely up front with you about what it will cost. My own fees couldn’t be more obvious, as seen here from this rate sheet.

Looking at the different options, you may be confused as to which estate plan package is right for you. “Do you need a revocable living trust? Or would a simple will package be enough?” To which I say, relax. We’ll figure it out together.

There is no such thing as a “one-size-fits-all” estate plan. Estate plans – their terms, coverages, ins and outs – depend on a myriad of individual circumstances and indeed preferences.

This is why filling out my estate plan questionnaire is such a great first step. You can gather your own individual important and relevant information, all in one place, and think through decisions you’ll need to make when building your estate plan. Then, I can see from your responses what you might want and need. Once your estate plan questionnaire is complete, we’ll meet for a free one-hour consultation.

STEP TWO: Free, One-Hour Consultation

In the free, one-hour consultation, we’ll talk about your estate plan questionnaire you completed. I usually meet clients in my office, but I’ve also met folks at coffee shops, restaurants, hospitals, and their houses. (I do make house calls!) I’ll listen carefully as you describe your intentions. I’ll answer all your questions. I’ll address all your concerns. Once we are both satisfied we understand each other, I’ll give you my recommendations. I’ll tell you in plain language what I think you need and why I think you need it. I’ll also tell you the exact cost. As you can see from my fee schedule above, I use a flat fee approach. So, you’ll get a 100% reliable figure.

STEP THREE: First Drafts of Estate Plan Documents

Once you and I agree about what documents and what terms in those documents should be included in your estate plan, I get to work. I draft a set of documents, unique to you and your needs. Once completed, I share this first draft with you.

How I share the draft with you depends entirely on your preference, which I ask about in the estate plan questionnaire. Most folks are good with email. Some clients don’t have email, or don’t want these sorts documents sent through email. In such cases I would either snail mail the documents, or have the client could pick them up at my office.

However you receive the documents, you’ll spend time reviewing the first draft of your estate plan. You’ll make changes, ask questions, and raise concerns. This is all on your time frame. You take as much, or as little time, as you feel you need. I will move at the speed you want. We can go through one draft or we can go through twenty. The important thing is we won’t continue to the next step until you are completely satisfied with your estate plan in all aspects. Only when you are completely, totally, and 100 percent satisfied do we execute the documents.

STEP FOUR: Executing Your Estate Plan

We’ll set up an appointment to meet (again, usually my office, but could be another place you choose). We’ll need two witnesses. I’m a notary. We’ll go through and properly sign and notarize all the documents.

Only Then, My Bill

I talked about the cost of an estate plan, but I haven’t yet mentioned a bill. That’s because I don’t present you with a bill until the end of the process. Only once you have a fully executed (i.e., signed, notarized, and witnessed) estate plan, then and only then do I provide you my bill for legal services. The bill total will exactly match the figure I provided you earlier, during our free consultation. If it doesn’t match, frankly, you could simply not pay the bill. (I might keep the estate planning documents, though). Some clients write a check right on the spot. Other clients want to pay along with all their other bills, so they remit payment later. Yes, you may take the estate plan documents without paying—I trust you’ll pay me.

Yes, YOU Get the Original Documents

Some lawyers keep the original, signed documents. I don’t. I give you the original documents to keep safely. I can make copies (electronic, paper, or both) for you if you’d like. I do keep both a paper and electronic copy of the signed version of your estate plan. Copies of estate plans are great, just in case, but it’s the original that counts.

Short Client Satisfaction Survey

I may send you an online client satisfaction survey via email. The survey is super short, optional, confidential, and anonymous. The questions center on your satisfaction with me, the process, and the product. The survey allows you to voice your opinion on working with me and helps me improve and maintain a high-quality level of service.

STEP FIVE: Annual Follow-Up

The only constant in life? Change. As your life inevitably changes, your estate plan must adapt.

How often should you revisit your estate plan? I like to check in with my clients on an annual basis.

Some clients like revisiting their estate plan at the start of the year. Others prefer to review on a significant date, like a birthday or wedding anniversary. Some pick a random date we agree upon. The “default” date would be the annual anniversary of executing the estate planning documents.

At our decided-upon date, I’ll just do a quick check-in; typically, this is just a quick series of short emails. Only if there’s been a major life event, death of an heir or fiduciary; drastic change in health; significant change in assets; or the like, will we need to have a longer discussion. Of course, you don’t have to change anything you don’t want. I’ll simply provide advice.

You know you need an estate plan, and as you can see above, this five-step process isn’t so bad! So, cast those excuses aside and get started on checking off step one of your checklist.

If you have any questions or concerns about estate planning in your situation, please contact me any time. I can always be reached via email, gordon@gordonfischerlawfirm.com, or my cell phone, 515-371-6077.