Serena-ity Now!

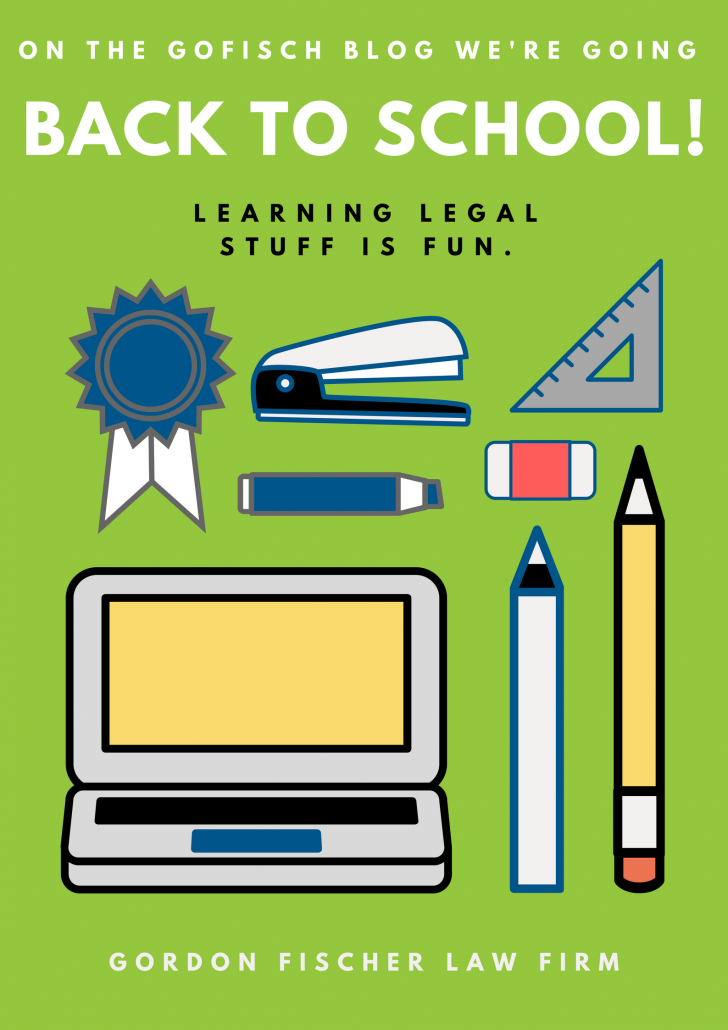

On the blog we’ve been going “back to school,” and our lessons wouldn’t be complete without a mandatory gym class. Which brings us to the question: is there gender bias in sports? Duh, yes. Mos def. It’s been especially newsworthy in tennis too.

There was nothing wrong with Serena Williams’ catsuit. Please, if a guy wore that, it would be noticed for sure, but certainly not banned.

Even worse: France’s Alizé Cornet received a code violation at the U.S. Open on Tuesday for removing her shirt on the court sidelines (she had a sports bra underneath). This is something men do all the time, and even while on the court.

The conversation continues in the aftermath of the US Open Finals last night between Serena Williams and Naomi Osaka. Were the umpire’s penalties in U.S. Open Final match the result of sexism? I certainly think so. I mean, I’ve seen male players such as, say, Rafael Nadal or John McEnroe, go absolutely bananas on the court and not receive a penalty to the tune of $17k.

Three Truth Bombs

Here are three truths that aren’t changed by any contretemps at Arthur Ashe Stadium:

First, Serena Williams is the greatest tennis player in history.

Second, at least on this day, Naomi Osaka outplayed Williams thoroughly for an amazing upset win.

Third, America, I love you like crazy, the crazy way that only an immigrants’ kid could love America. But, you have serious problems with sexism and misogyny.

From the Tennis Court to Law Court

Here’s yet another truth bomb: nonprofits, already under terrific scrutiny by board members, donors, stakeholders, and government agencies, can’t afford even a whiff of a controversy like the tennis examples above. Even allegations of scandal can destroy previously successful nonprofits. And, just like the game of tennis, both need to consistently be working toward implementing rules and standards that ensure equity.

Such situations can split Boards, cause stakeholders to resign or pull back, snap shut donors’ wallets, and even result in expensive litigation. Fortunately, there are policies and procedures that can prevent your hardworking organization from ever having to deal with controversy (particularly those relating to discrimination, gender bias, and the like), by deterring such actions from every occurring. Let’s first discuss the IRS Form 990 and then the policies that relate to this annual information return.

IRS Form 990

IRS Form 990. This is the form that (most) nonprofits have to annually file some version of. Say what you will about the IRS – but in Form 990, the IRS provides nonprofits a path to prosperity. On Form 990, the IRS asks about several major policies and procedures that actually help nonprofits govern smarter. Any and every nonprofit should have all of these policies and procedures in place, with regular updates as appropriate. But, in our context, three policies are particularly relevant here.

At this point in the blog post, I feel as though I can actually hear you: “I don’t think we could ever afford that in our budget…we don’t know where to start!”

Before I delve into specific policies that will help your fave nonprofit combat discrimination and bias, let me repeat a special offer. I offer all nonprofits 10 major policies and procedures on IRS Form 990, drafted specifically and individually to each organization. for a flat fee of $990. No jokes, tricks, or hidden fees. Interested in learning more? Give this post a read, and don’t hesitate to contact me to take advantage of this solid, straight-up deal.

Compensation Policy

Data related to compensation is reported in three different sections on Form 990: “Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees;” “Statement of Functional Expenses,” lines 5, 7, 8, and 9; and Schedule J;” and “Compensation Information for Certain Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees.”

Having a set policy in place that objectively establishes salary ranges for positions, updated job descriptions, relevant salary administration, and performance management, is used to establish equality and equity in compensation practices. A statement of compensation philosophy and strategy, which explains to current and potential employees and board members how compensation supports the organization’s mission, can be included in the compensation policy.

Generally, this policy provides the benefits of:

- Enhanced confidence of donors and supporters

- Consistent framework for decision making on compensation

- Increased compliance with federal and state employment laws

- Reduced risk to the organization and its management and governing board

This policy can state clearly an organization’s intention to abide by federal and state law under which it is illegal to have pay differentiate based on gender.

Document Retention and Destruction Policy

This policy should clarify what types of documents should be retained, how they should be filed, and for what duration. It should also outline proper deletion and or destruction techniques.

The document retention and destruction (DRD) policy is useful for a number of reasons. The principle rational as to why any organization would want to adopt such a policy is that it ensures important documents—financial information, employment records, contracts, information relating to asset ownership, etc.—are stored for a period of time for tax, business, and other regulatory purposes. No doubt document retention could be important for proof in litigation or a governmental investigation.

When I was a litigator, I represented employers who could not find a key document–a personnel file; written warning; performance review, and the like. Needless to say, in all these situations, the missing documents were a huge disadvantage to the employer in defending itself. Make sure that doesn’t happen to you by setting down rules as to what documents to keep and how long to keep them.

You know, there’s even a question of federal code. You may have heard of the federal law, the Sarbanes-Oxley Act of 2002. It reaffirms the importance of a DRD policy. Sarbanes-Oxley reads:

“Whoever knowingly alters, destroys, mutilates, conceals, covers up, falsifies, or makes a false entry in any record, document, or tangible object with the intent to impede, obstruct, or influence the investigation or proper administration of any matter within the jurisdiction of any department or agency of the United States or any case filed under title 11, or in relation to or contemplation of any such matter or case, shall be fined under this title, imprisoned not more than 20 years, or both.”

While the Sarbanes-Oxley legislation generally does not pertain to tax-exempt organizations, it does impose criminal liability on tax-exempt organizations for the destruction of records with the intent to obstruct a federal investigation.

Yet another reason a DRD policy is an excellent idea, is it forces an organization to save space and money associated with both hard copy and digital file storage, by determining what is no longer needed and when…it’s like sanctioned spring cleaning!

Whistleblower Policy

Nonprofits, along with all corporations, are prohibited from retaliating against employees who call out, draw attention to, or “blow the whistle” against employer practices. A whistleblower policy should set a process for complaints, including gender bias or harassment, to be addressed and include protection for whistleblowers.

Ultimately this policy can help insulate your organization from the risk of state and federal law violation and encourage sound, swift responses of investigation and solutions to complaints.

A whistleblower policy encourages staff and volunteers to come forward with credible information on illegal practices or violations of adopted policies of the organization, specifies that the organization will protect the individual from retaliation, and identifies those staff or board members or outside parties to whom such information can be reported. (Instructions to Form 990)

The Sarbanes-Oxley Act (referenced under the document retention and destruction policy above) also applies here. If found in violation of Sarbanes-Oxley, both an organization and any individuals responsible for the retaliatory action could face civil and criminal sanctions and repercussions including prison time.

Employee Handbook

On top of the super important policies he first line of defense for nonprofits is a well drafted, individualized employee handbook. Really, how can you NOT have an employee handbook? An employee handbook even if you have but a single employee makes clear the rights and responsibilities of both the employer and employee. So many disputes can be avoided by a clear, easy-to-read, and direct employee handbook.

In terms of gender discrimination, there are several provisions that should help insulate your favorite nonprofit. Your employee handbook would have an equal opportunity statement; anti-harassment policy; complaint procedure; and rules about compensation, document retention, and whistleblowing.

I offer a free “starter” employee handbook that can get you thinking about the types of provisions you should/could include in your employee handbook.

Update As Needed

If you already have some (or all) of the above policies or employee handbook in place, seriously consider the last time they were updated. How has the organization changed since they were written? Have changes to state and federal laws impacted these policies at all? It may be high time for a new set of policies that fits your organization.

Playing tennis Without a Net?

Robert Frost famously opined that writing free verse is like playing tennis without a net. Well, I don’t know about that, but any nonprofit without the 10 major polices asked about on IRS Form 990, or without an employee handbook, is definitely like playing tennis without a net, ball, lines, umpires, or rules! And, the best way to play the “game” while assuring equity and fairness for all the players involves preventing bias and discrimination from ever holding a place on the court.

Schedule your free one-hour consultation and let’s talk about your organization’s needs!