DON’T DARE READ THIS ALONE!

Count Dracula needed a new estate plan. After all, the Count hadn’t updated his last will in 1,400 years. After he got over a few eerie common estate planning excuses, he went to his Iowa estate planner.

The Iowa estate planner dutifully gathered information about all of Count Dracula’s many assets. While discussing real estate holdings, however, the Iowa estate planner inexplicably failed to inquire as to whether Dracula owned real estate with his wife, in any other states.

[Blood-curdling screams]

Yes, that’s right: the Iowa estate planner simply forgot to ask about other States, including community property states. This could, unfortunately, impact the effectiveness of the Drac’s will and the dispersion of Drac’s property.

[Angry mob shouts in disbelief]

Iowa is NOT a Community Property State

What are Community Property Laws?

Given our limited space I will only provide the most basic of oversimplifications. Simply put, states with community property follow a rule that all assets acquired during marriage are considered “community property.” While each community property state has its own unique and precise set of characterization rules, they all share the general rule that an asset acquired or given during marriage is presumed to be community property, until it is proven to be separate.

Marital property in community property states is owned by both spouses equally (50/50). Marital property includes earnings, all property bought with those earnings, and all debts accrued during the marriage. Community property begins as soon as the couple is married and ends when the couple physically separates with the intention of not continuing the marriage.

Spouses may not transfer, alter, or eliminate any whole piece of community property without the other spouse’s permission. A spouse can manage his or her own half the way he or she wishes, but the whole piece includes the other spouse’s one-half interest. In other words, a spouse cannot be alienated from his or her one half.

Death or Divorce in Community Property States

When one spouse passes away, half of the community property passes to the surviving spouse. Their separate property can be devised to whomever they wish according to their will, or via intestacy statutes without a will. Many community property states offer an interest called “community property with the right of survivorship.” Under this doctrine, if a couple holds title or deed to a piece of property (usually a home), then upon a spouse’s death the title passes automatically to the surviving spouse and avoids probate court proceedings.

If the couple divorces or obtains a legal separation, all of the community property is divided evenly (50/50). The separate property of each spouse is distributed to the spouse who owns it and is not divided according to the 50/50 rule (but, again, there is a presumption that all property is community property, not separate property).

Sometimes, economic circumstances warrant awarding certain assets wholly to one spouse, but each spouse still ends up with 50 percent of all community property in terms of total economic value. This is most common regarding marital homes. Since it is not a practical idea to try to divide a house in half, often the court will award one spouse the house, while the other spouse receives other assets with a value equal to half the value of the home.

There are exceptions to the equal division rule. The most common and well-known, thanks to popular culture, is a prenuptial agreement. Before the marriage, the couple may enter into such an agreement that lays out how the marital property shall be divided upon divorce.

Which States Have Community Property Laws?

Eight states are considered to be the “traditional community property” states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Washington. Wisconsin is the functional equivalent of a community property state when it adopted the Uniform Marital Property Act in the 1980s. Alaska and Tennessee are elective community property states, meaning spouses may create community property by entering into a community property trust or agreement.

What About all the Other States?

The other states, the clear majority of states, are called “common law property” states. “ In this case, “common law” is simply a term used to determine the ownership of property acquired during the marriage. The common law system provides that property acquired by one member of a married couple is owned completely and solely by that person. Of course, if the title or deed to a piece of property is put in the names of both spouses, then that property would belong to both spouses. If both spouses’ names are on the title, each owns a one-half interest.

Death or Divorce in Common Law Property States

When one spouse passes away, his or her separate property is distributed according to his or her will, or according to intestacy laws without a will. The distribution of marital property depends on how the spouse’s share ownership—the type of ownership.

If spouses own property in “joint tenancy with the right of survivorship” or “tenancy by the entirety,” the property goes to the surviving spouse. This right is actually independent of what the deceased spouse’s will says. However, if the property was owned as “tenancy in common,” then the property can go to someone other than the surviving spouse, per the deceased spouse’s will. Of course, not all property has a title or deed. In such cases, generally, whoever paid for the property or received it as a gift owns it.

If the couple divorces or obtains a legal separation, the court will decide how the marital property will be divided. Of course, just as in community property states, the prenuptial agreement is an option. The couple can enter into agreement before marriage, providing how to divide marital property upon divorce.

Why did the Iowa Estate Planner Forget to Inquire About Real Estate Located in Other States?

Some say evil men were born that way, while others say monsters learn evil. We can only guess. All we can know for sure is that the Iowa estate planner didn’t ask about real estate in other states. And that was terrible.

You Said Iowa Wasn’t a Community Property State. So, Why Does it Even Matter?

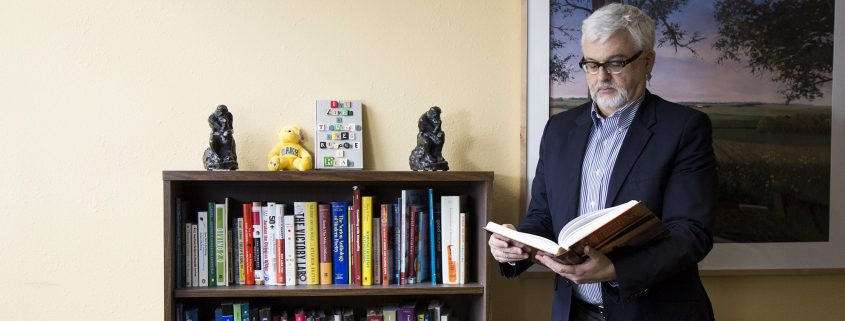

For at least three reasons a lawyer in a common-law state like Iowa needs to have a basic understanding of community property principles.

- A client may move to a community property state. Or perhaps there’s a divorce, one party stays in Iowa, the other moves to Washington).

- A client may buy property in a community property state. Perhaps the client buys a vacation home in Texas.

- The client’s beneficiaries (adult children, for example) may move to a community property state. For example, your daughter marries an Arizonian and they both move to Phoenix.

In all three cases, the distinction between community property and common law states needs to be carefully explained to the client. The estate plan may well need revisions, or even just an extra document or two.

Mob With Pitchforks Goes After Iowa Estate Planner

Ugly! Don’t let this happen to you. Seek an experienced estate planner, who knows the right questions to ask, and be sure to offer them as much information as you possibly can.

Questions or Concerns About Community Property?

Do you have a vacation home in California? Did your son recently elope and the happy couple moved to New Mexico? It may be time to talk about community property and how it impacts YOUR estate plan. Always feel free to email me anytime at gordon@gordonfischerlawfirm.com. Or call my cell at 515-371-6077. I’d be happy to offer you a free one-hour consultation.