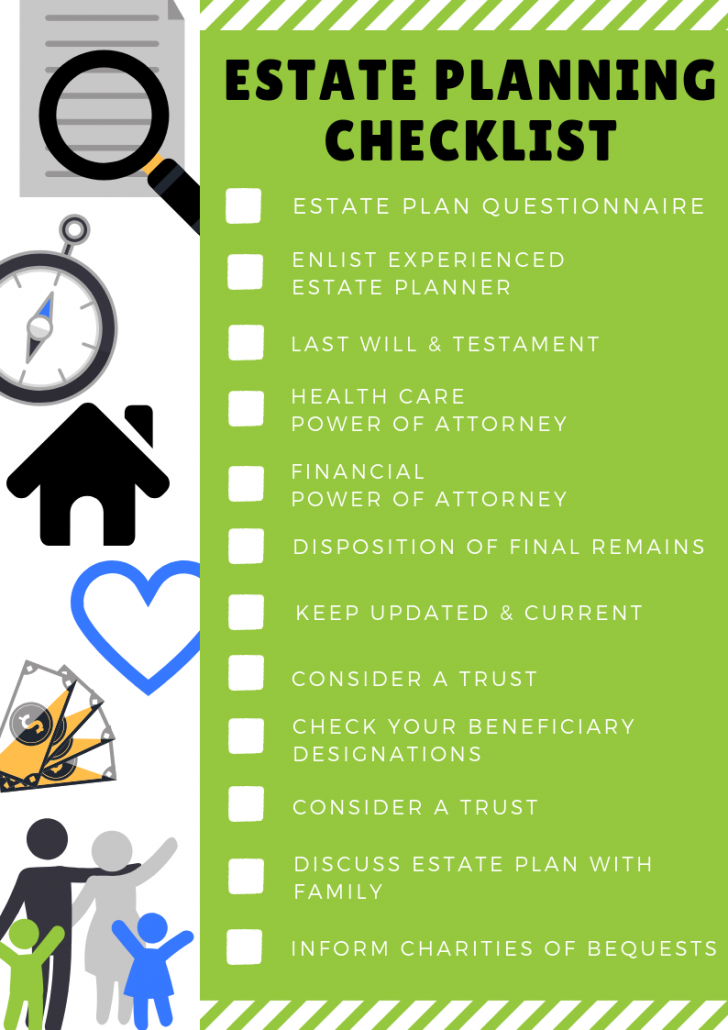

If you’ve visited my blog before you know I can talk often and always about the importance for all Iowans to make a will as a part of a complete estate plan. I highly recommend enlisting an estate planner with good recommendations to draft your individualized estate plan. But even the best estate planner cannot write another type of will you should deeply consider—an ethical will. This is a document that’s best written by the person who knows you the best . . . you.

What is an Ethical Will?

An ethical will isn’t a legal document like a last will and testament or a living trust. An ethical will won’t transfer assets won’t be admitted to a probate court to evidence testator intent. But an ethical will can be extremely meaningful and useful to the loved ones you leave behind. It’s a document where you can transfer immaterial assets—think words of wisdom, lessons learned, stories, documentation of heritage, and values.

Let me be clear, an ethical will certainly does not replace the need for a legal will, but it serves as a compliment or an addition. Rather, an ethical will is the place you can provide explanations for what decisions you make in your estate plan if you so choose. For instance, if you think there will hurt feelings or confusion if a certain family member is selected as the executor of your will, you could articulate your reasoning in an ethical will.

There’s no hard and fast definition for what should go in your ethical will. Unlike a last will and testament, there are no specific formalities. You may consider your ethical will as a collection of documents like journal entries, letters to loved ones, or even just your favorite quotes you live by. Curious about how to get started compiling an ethical will? I would recommend thinking about last words and a lasting legacy. What do you want to make sure gets said, even after you’re gone? For my own ethical will, I would start by just writing a letter to my wife.

One question I often get is where to store estate planning documents? For your ethical will, I recommend storing a physical and digital copy with your other estate planning documents or letter of instruction (if the estate planning documents are only accessible by certain executors). The most important thing will be that the people you want to have access to the ethical will do indeed have access to it.

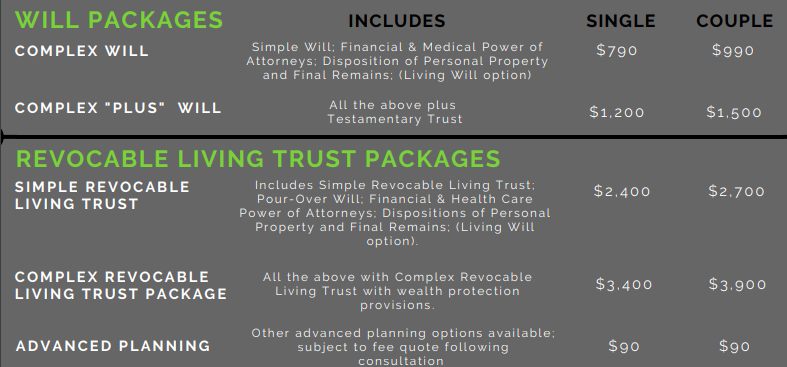

Need an estate plan? There’s no day like the day for investing a roadmap for your loved ones after you pass. An estate plan can save money, time, bureaucratic red tape, and a whole lot of heartache for your beneficiaries. Don’t hesitate to contact me with any questions about estate planning via email (gordon@gordonfischerlawfirm.com) or by phone (515-371-6077).