You’ve been perpetually reminded by commercials, Facebook ads, and the candy aisle at the store that everyone’s favorite pink, red, and chocolate-dipped holiday is coming up quick. In this #PlanningForLove series through February 14, I’m featuring different aspects of how estate planning oddly but perfectly fits in with a day all about love. For this post, I’m going to focus on married couples because, despite the commercialization and overpriced flowers, Valentine’s Day seems as good as time as any to celebrate your spouse!

Let’s face it, it’s a miracle any of us find a soul mate, a best friend, a partner in crime…whatever you call them…that not only tolerates all your weirdness on the daily, but also still loves you “for richer or poorer” and “through sickness and in health.” I can think of no better way to honor that kind of long-term commitment than to take the appropriate estate planning steps with your sweetheart in mind. I realize it may not be the most romantic gesture, but it’s WAY more valuable than stale chocolates or a heart-holding teddy bear. And, like your love, there is no expiration date on an estate plan.

For richer or poorer makes a lot of sense when put in the context that someday you are going to pass away and you probably want to pass your assets to your spouse (and heirs at law) while also minimizing the burdens. If you die without a will it will cost your beloved a lot of time and money, on top of anxiety and even heartache.

In sickness and health also directly relates to one of the main estate planning documents. For instance, say you were in an accident and were severely incapacitated. You would want to have your health care power of attorney established and kept updated (many spouses choose one another as the designated representative), so that important medical decisions could be made by someone you trust to do what’s in your best interest. The same goes for a financial power of attorney. There are many aspects of your separate finances you may want to designate to your spouse so they could settle or manage specific assets in the case that something happened to you.

Beyond the numerous benefits that come with the six main estate planning documents that all Iowans need (yes, all Iowans, young and old; rich and not wealthy!), what are the other considerations of spouses should have in regard to estate planning?

What’s Mine is Yours: Common Law Property

The majority of states, including Iowa, are called “common law property” states. (As opposed to the alternative—community property states—which applies to eight states.)

In this case, “common law” is simply a term used to determine the ownership of property acquired during the marriage. As in, the common law system provides that property acquired by one member of a married couple is owned completely and solely by that person. Of course, if the title or deed to a piece of property is put in the names of both spouses, then that property would belong to both spouses. If both spouses’ names are on the title, each owns a one-half interest.

If your spouse were to pass away in a common law state, his or her separate property is distributed according to his or her will, or according to intestacy laws without a will. The distribution of marital property depends on how the spouse’s share ownership—the type of ownership.

If spouses own property in “joint tenancy with the right of survivorship” or “tenancy by the entirety,” the property goes to the surviving spouse. This right is actually independent of what the deceased spouse’s will says. However, if the property was owned as “tenancy in common,” then the property can go to someone other than the surviving spouse, per the deceased spouse’s will. Of course, not all property has a title or deed. In such cases, generally, whoever paid for the property or received it as a gift owns it.

‘Til Death do us Part: Forced Share Law

If married, technically your spouse cannot disinherit you. An Iowa statute allows spouses to take a “forced share” against the will. In short, the surviving spouse has a choice; the spouse can inherit any property bequeathed to him/her under the will, OR the spouse can take a forced share. So, even if a will leaves nothing for the surviving spouse, the surviving spouse can take a forced share against the will.

Under Iowa law (specifically, Iowa Code § 633.238), a surviving spouse that elects against the will is entitled to:

- One-third of the decedent’s real property;

- All exempt personal property that the decedent held; and,

- One-third other personal property of the decedent that is not necessary for payment of debts and other charges.

In other words, a surviving spouse can choose (elect) after your death to basically ignore your will or trust that doesn’t provide for said surviving spouse, and take approximately one-third of your estate.

For example, if you left your entire estate to your children and not your spouse, your spouse can say, “You know, I don’t like this at all. I’ll take one-third of my dead spouse’s estate. Thank you!” And, pretty much just like that, boom, the surviving spouse can do so.

Preferred Portability: Unlimited Marital Deduction

The unlimited marital deduction is a money-saving must for married couples. The unlimited marital deduction is an essential estate preservation tool because it means an unrestricted amount of assets can be transferred (at any time, including at death) from one spouse to the other spouse, free from taxes (including the estate tax and gift tax). Note that the marital deduction is available only to surviving spouses who are U.S. citizens. If your spouse is not a U.S. citizen, look at other tools, such as a qualified domestic trust (QDOT), which may act to minimize or eliminate taxes.

Property Passage

If you acquired property (like a house or other significant asset) before getting married, take a look at re-titling property (such as a home) from sole ownership to joint tenancy. This means that if one spouse were to pass, the other would get the property without it passing through probate. (Depending on your situation, you could also consider “tenancy in common” as another option for holding property titles under multiple names.)

Joint Representation is Optional

Married couples often seek joint representation in estate planning, meaning they both utilize the same estate planning lawyer. (And, yes, you most definitely want to hire a qualified, experienced estate planner.) The benefits are obvious; joint representation can be cost-effective and can be more efficient since you can work together on a single Estate Plan Questionnaire in preparation to meet with the estate planning lawyer. Another advantage is that the joint representation somewhat forces open and honest communication between you as a couple as you make decisions on beneficiaries (such as children and grandchildren), executors, and disposition of property.

However, individual representation is, of course, an option and can help couples avoid conflicts of interest.) There are times when it is best for each spouse to seek separate legal counsel. One such time is when there are different interests that are at odds with each other. For example, if one or both people have children from a previous marriage/relationship that will be named as beneficiaries. There can be conflicting interests between stepparents and stepchildren when it comes to the estate. Additionally, if you both have your own individual estate planning lawyer, you may have more freedom to voice individual concerns, without having to audit your opinions in accordance with your partner’s desires.

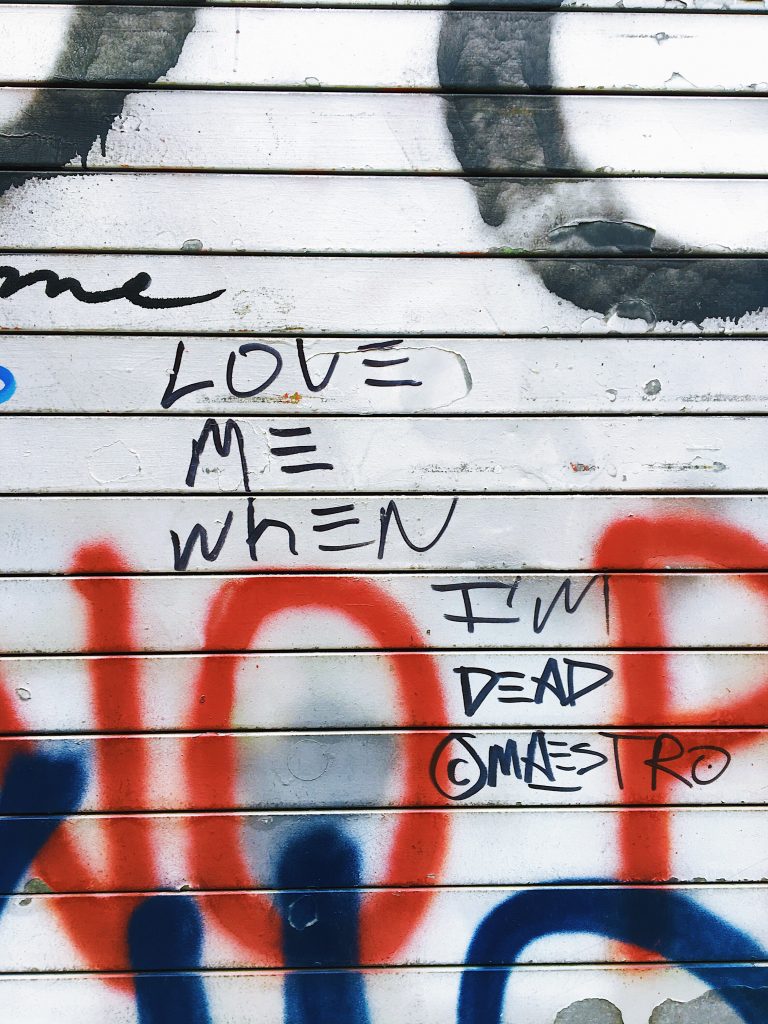

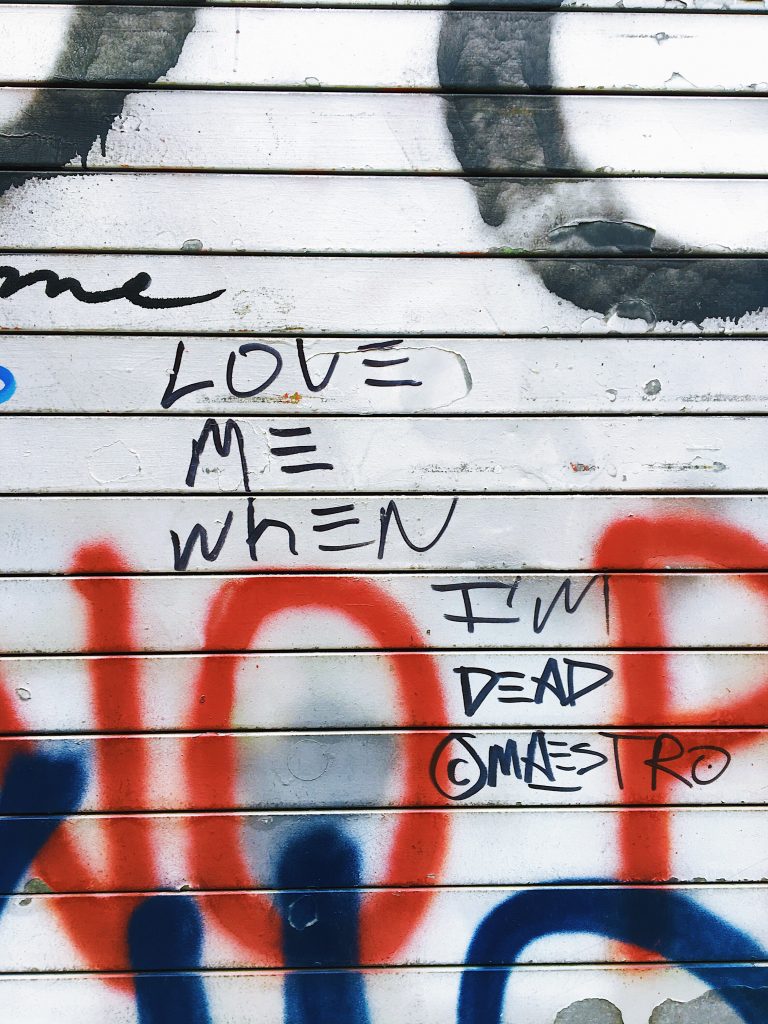

All You Need is Love…and an Estate Plan

You’ve worked hard for the life you’ve built together with your spouse. This Valentine’s Day, give a gift that ensures your commitment will carry on even after one of you passes on. The best way to get started is with my free, no-obligation Estate Plan Questionnaire. You can also email or call (515-371-6077) me at any time. I’d love to explain more how an estate plan says, “I love you,” way better than a card ever could!