Iowans’ retirement benefit plans hold tremendous wealth. Your IRAs, 401(k)s, 403(b)s, and so on, could have a huge impact on the charities you care about most.

Nonprofits should be aware that retirement benefit plans are incredibly underutilized for charitable giving. It’s in nonprofit stakeholders’ best interest to educate themselves and potential donors about the benefits of charitable giving of retirement benefit plans.

Categories of Charitable Giving

There are several ways to categorize charitable giving. For example:

- Cash versus non-cash gifts

- Planned giving versus “unplanned” giving

- Income producing charitable gifts (such as charitable gift annuities and charitable remainder trusts) versus non income producing gifts

- Gifts of different types or classes of assets

When discussing gifts of retirement assets, perhaps the most helpful categorization is lifetime gifts versus gifts at death. Lawyers sometimes call charitable gifts made during lifetime as inter vivos gifts and gifts at death as testamentary gifts.

Let’s start with testamentary gifts of retirement plan assets. This can be an easy and convenient way for your clients to support their favorite causes.

Testamentary Gifts of Retirement Plan Assets

Name charity as beneficiary

You can make a very meaningful gift simply by naming your favorite charity or charities as beneficiary of an IRA, 401(k), 403(b), or other retirement plan. Giving retirement assets in this way is quite easy. Just contact the institution holding your retirement plan, request a change of beneficiary form, fill the form out completely and correctly, and return the form. Typically naming a beneficiary in this way does not require drafting or amending a will or trust.

Keep in mind, however, that if the account holder is married, the spouse should be informed. Depending on the type and terms of the plan, the spouse may have to consent to the gift.

Tax rules may make testamentary gifts of retirement plan assets more favorable

Retirement plan assets are a good choice for testamentary gifts for tax reasons, too. In fact, the interplay of a few tax rules may make charitable gifts of retirement plan assets more attractive to you than charitable gifts of other kind of assets.

To understand why this might be so, we need to look at three important concepts:

- Inheritance generally is not income.

- Income in respect of a decedent (IRD)

- Step-up in basis (also called, stepped up basis)

Inheritance is not income

Generally speaking, inheritance is not income, for federal tax purposes. Most inherited property passes tax-free.

(It’s true there is an Iowa inheritance tax. To keep this simple, I’ll focus on federal tax.)

Income in respect of a decedent (IRD)

Most inherited property passes tax-free, but not all. IRD is income that the deceased was entitled to, but had not yet received, at the time of death. IRD can come from various sources, including:

- Unpaid salary, fees, commissions, and/or bonuses;

- Deferred compensation benefits;

- Accrued but unpaid interest, dividends, and rent; and

- Distributions from retirement benefit plans

That’s right—retirement benefit plans are IRD.

Federal tax law provides for IRD to be taxed when it’s distributed to the deceased’s beneficiaries. IRD retains the character it would have had in the deceased’s hands.

Step-up in basis

Step-up in basis refers to the readjustment of the value of an appreciated asset for tax purposes upon inheritance. With a step-up in basis, the value of the asset is determined to be the higher market value of the asset at the time of inheritance, not the value at which the original party purchased the asset.

Interplay Between Tax-Free Inheritance, IRD, and Step-Up in Basis

There can be interesting interplay between tax-free inheritance, IRD, and step-up in basis, which may make testamentary gifts of retirement benefit plans very attractive. Here’s a simple example:

Alex dies, with three surviving children, Brett, Casey, and Dana. At her death, Alex owned three major assets: a house, stock, and an IRA. She bequests each child one asset. What result?

Assume:

- Alex’s house is worth $100,000. She purchased it for only $20,000.

- Alex owns shares of stock in Acme Company, worth $170,000. She purchased the stock for just $50,000.

- Alex’s IRA is worth $200,000.

Alex’s house is inherited by Brett. There’s no federal tax on this transfer. Brett sells the house shortly thereafter. Still no federal tax. Although Alex purchased the house for only $20,000, Brett receives a step up in basis. Brett’s basis is $100,000, the value of the house. Since she sells it for $100,000, there’s nothing to tax.

When Casey inherits the stock, no tax—as there’s no taxable event. Later, Casey sells the stock. Although Alex purchased the stock for only $50,000, Casey receives a step up in basis. Casey’s basis is $170,000, the value of the stock. Since Casey sells the stock for $170,000, there’s nothing to tax.

How about Dana and the IRA? The IRA was registered with Dana as beneficiary, but no money is taken out of it immediately, so no taxes. When Dana withdraws money from the IRA, however, Dana must pay federal income tax of up to 39.6 percent. (It is true that Dana could defer withdrawals from the IRA for a long time, and of course such deferral reduces the impact of taxes.)

To sum up, in this hypothetical, the house and stock passed to the beneficiaries without any taxable event. The IRA passed to the beneficiary, but the beneficiary will have to pay taxes when she withdraws funds.

As can be seen, testamentary gifts of retirement benefits to a worthy charity can be tax-savvy. Let’s move on to inter vivos gifts of retirement benefits to charity.

Inter Vivos Gifts of Retirement to Charity

A helpful way to discuss charitable gifts of retirement plan assets during lifetime is to break them down into three categories:

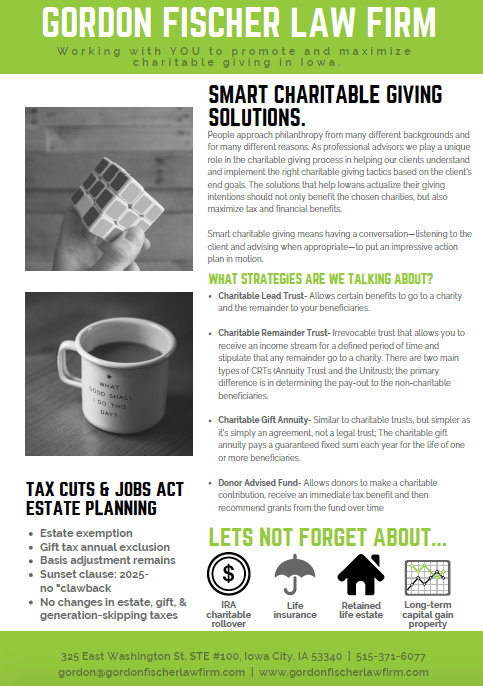

- IRA Charitable Rollover;

- Required Minimum Distributions (RMDs), and

- Non–RMDs

IRA Charitable Rollover

The federal law known as the IRA Charitable Rollover allows individuals aged 70½ and older to donate up to $100,000 from their IRAs directly to charities without having to count the distributions as taxable income. This gift transfer is called a “qualified charitable distribution” or “QCD.”

To be a valid QCD, there are two threshold requirements. First, you must be age 70½ or older. Second, the retirement plan account must be an IRA.

Age requirement of 70½

Taxpayers who are 70½ and older are required to make annual distributions from IRAs which are then included in the taxpayers’ adjusted gross income (AGI) and subject to taxes. The IRA Charitable Rollover permits those taxpayers to make donations directly to charitable organizations from their IRAs without counting them as part of their AGI and, consequently, without paying taxes on them. You can be either an IRA participant donating from your own IRA, or a beneficiary donating from an inherited IRA.

Again, the IRA Charitable Rollover requires you (whether owner or beneficiary) to be age 70½ or older. This is based on the year you reach age 70½, not the day you reach that age.

IRA Charitable Rollover is for IRAs only

QCD can only be made from traditional IRAs or Roth IRAs. Charitable donations from 403(b) plans, 401(k) plans, pension plans, and other retirement plans are not eligible for the IRA Charitable Rollover law.

Annual cap of $100,000

Your total combined IRA Charitable Rollover contributions cannot exceed $100,000 in any one year. The limit is per IRA owner, not per IRA. Also, this amount is not portable between spouses.

Eligible charities

Under the IRA Charitable Rollover, charitable contributions from an IRA must go directly to a public charity that is not a supporting organization. Contributions to client-advised funds and private foundations, except in narrow circumstances, do not qualify for tax-free IRA rollover contributions.

I must emphasize that QCD must go directly to charity. You can’t withdraw the money, and then give it to charity – rather, the IRA administrator must send QCD straight to the charity.

IRA Charitable Rollover & quid pro quo

What about gifts to your client from a charity, in return for QCD? You cannot receive any goods or services in return for QCD to qualify for tax-free treatment.

IRA Charitable Rollover and IRS substantiation

The IRA Charitable Rollover requires substantiation for the IRS. You must obtain written receipt of each IRA rollover contribution from each recipient charity.

Specific tax advantages of QCD

Keep in mind the specific tax advantages of QCD under the IRA Charitable Rollover. For Iowans who don’t itemize deductions, and so thereby don’t get to deduct their charitable contribution, the IRA Charitable Rollover obviously helps. This is even more applicable after the passing of the new tax law.

For Iowans who are “itemizers,” it may also be tax-advantaged, particularly for those who practice strategies like “bunching” donations.

IRA Charitable Rollover and QCD can’t fund split interest gifts

QCD must be a contribution that would be 100 percent deductible if paid from the owner’s non-IRA assets, so a split-interest gift will not qualify. Therefore, IRA Charitable Rollover funds generally cannot be made to a charitable remainder trust, charitable gift annuity, or pooled income fund.

No federal income tax charitable deduction with IRA Charitable Rollover

QCD, from the IRA Charitable Rollover, are excluded from your gross income for all purposes. Of course, there is no charitable deduction for any IRA Charitable Rollover funds.

IRA Charitable Rollover helps with three notable challenges to lifetime giving

Speaking very generally, there are three notable challenges to lifetime giving:

First, consider taxpayers who don’t itemize. Most fundamentally, a taxpayer has to itemize to take advantage of the charitable deduction. A taxpayer who uses the “standard deduction,” rather than itemized deductions, of course wouldn’t see any tax benefit from the charitable deduction.

Second, look at AGI percentage limits on charitable deductions. The federal income tax charitable deduction is limited to a certain percentage of adjusted gross income. The percentage is either 30% or 50%, depending on the type of property given and the type of donee charity.

Third, remember the Pease limitation. The “Limitation on Itemized Deductions” (known as the “Pease limitation,” after Donald Pease, the Ohio congressman who helped create the law), reduces most itemized deductions by 3 percent of the amount by which AGI exceeds a specified threshold, up to a maximum reduction of 80 percent of itemized deductions. The income thresholds for Pease vary by filing status.

You can readily see these three potential obstacles are just not at issue at all with the IRA Charitable Rollover. Again, simply put, QCD does not increase AGI.

IRA Charitable Rollover can fulfill RMDs

QCD, from the IRA Charitable Rollover, can fulfill RMDs. So, it’s an excellent way for Iowans over 70½ to both fulfill RMDs and help favorite causes.

Don’t confuse RMDs and QCDs

QCD and RMDs are actually completely different. It’s true that QCD counts toward RMDs, to the extent RMDs have not already been taken. But QCD can be taken, regardless of whether RMD for the year is more or less than $100,000; regardless of whether the plan participant has already taken RMD; and regardless of any other distributions from the IRA.

Charitable Giving and RMDS

The IRA Charitable Rollover applies only to IRAs. Generally, a retirement plan participant, aged 70½ or older, must take annual RMDs – whether the plan is an IRA, or a 401(k), another type of plan.

These RMDs would seem to be an ideal charitable gift. After all, if a plan participant must take an RMD anyway, why not use it to support her favorite causes?

A beneficiary who inherits a retirement benefit plan is also generally required to take annual RMDs. The same analysis would presumably apply.

Charitable Giving and Non-RMDs

Depending on individual circumstances, taxpayers may also choose to make lifetime charitable gifts using funds withdrawn from retirement benefit plans. Individuals over age 59½ may generally withdraw funds from retirement plans without penalty, make a gift with these funds, and then claim an offsetting charitable deduction. In most cases, charitable gifts made in this manner will be a “wash” for tax purposes.

Let’s Talk About Retirement

Whether you are a donor or a donee charity, I would be happy to visit with you about increasing your charitable giving. Please feel free to contact me any time for a free one-hour consultation. I am always available at gordon@gordonfischerlawfirm.com or 515-371-6077.