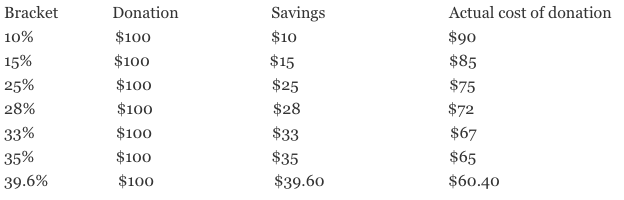

It’s the end of January and that means Tax Day is creeping closer. You tend to hear a lot about what sort activities are tax deductible. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. And, you’ll certainly want to be aware for substantiation purposes what contributions are indeed deductible.

But, in conquering your charitable giving goals, it’s just as important to know which nonprofit organizations are NOT qualified beneficiaries for tax-reducing gifts. Additionally, not all gifts to qualified charities are eligible. Contributions to certain entities may appear to be tax-deductible, but in actuality are not. This is not to say that these contributions are not valuable and helpful to the respective donees, it’s just that the U.S. government isn’t going to give you a tax break.

Knowing what you can and can’t claim helps you maximize the potential tax savings that the charitable tax deduction offers.

Contributions made to the following are NOT considered viable for the charitable deduction:

Promises and Pledges

Let’s say you made a charitable pledge to a local 501(c)(3) for $150, but only paid $50 in donation during the tax year of the respective tax return. You can only deduct the $50 actually donated. Once you make the transfer of the rest of the pledge ($100) then you could deduct that from the appropriate tax year.

Political parties, campaigns, and action committees

It’s important to get involved in the process fo democracy, but joining politic through monetary support does not translate into a charitable donation. Funds given to political candidates, parties, and PACs cannot be claimed. This also includes money spent to host or attend fundraising events or advertising.

Fundraising tickets

I’m sure you cannot count all the times you’ve been asked to purchase raffle tickets, bingo cards, lottery-based drawings and the like. It’s a common fundraising tactic, but such costs are not deductible.

Personal benefit gifts

The IRS considers a charitable contribution to be one-sided. This means if you receive something in reciprocity for a donation—anything from a tote bag, to a plant, to a three-course dinner—only the amount in excess of the fair market value of the item/service received is deductible. Let’s say your little neighbor is selling popcorn to raise money for their scouting troop. You buy some popcorn from the kid for $10 and the retail value of such a popcorn tin is $6. This donation would translate into a $6 charitable deduction. Likewise, you purchase a $75 ticket to an annual event hosted by a qualified charity. The event includes a meal that would have cost you $30 at a restaurant; overall your charitable deduction would be $45. (Read more about quid pro quo donations here.)

Receipt-less donations

You’ve probably given more than you can write off from small cash donations to your church’s collection plate, the Salvation Army holiday bell ringer, and charity bake sales. Why cannot you just guesstimate, add this all up, and deduct the amount off of your taxes? Receipts. The IRS requires proof of all cash donations big and small; a canceled check, statement or receipt from the recipient organization can suffice for cash donations up to a $250 (in total), and then more substantiation is demanded.

Person-to-Person

I’ve seen many successful crowdfunding campaigns for individuals raising money for a multitude of things. Let’s say your cousin is raising money for an expensive medical procedure through an online site and you donate to help them reach their goal. Or, maybe your nephew is raising money to take a mission trip this summer. Unfortunately and contributions earmarked for a certain individual (despite the economic/medical/educational need) are not deductible, according to IRS Publication 526. However, if you were to make a contribution to a qualified organization that in turn helped your cousin or nephew out with a grant or scholarship, for example, the contribution would be deductible. Make note though, even if you were to give a contribution to a charity in order to help a specific individual, you cannot designate the money to one specific individual for the gift to. Basically, the contribution cannot be given directly or indirectly to a specific individual and still be tax deductible.

The list could go on for contributions that are not deductible, but some other notable inclusions to be aware of include:

- For-profit schools (nonprofit schools are good to go so long as donations are not made to benefit a specific individual)

- For-profit hospitals (nonprofit hospitals are A-OK)

- Foreign governments

- Foreign-based nonprofits (with some exclusions for specific nation-states)

- Fines or penalties paid to local or state governments

- Value of your time for services volunteered to a charity

- Value of blood donations (you just need to do that one out of the goodness of your heart…literally)

- Dues, fees, or bills paid to country clubs, lodges, fraternal orders, or similar groups

- College tuition (Even if the school is a nonprofit, tuition to attend the school is NOT tax deductible as a charitable contribution)

- Professional groups/associations (such as civil leagues)

This may make it seem like there are many exceptions to the charitable deduction rule, however there are still an innumerable number of qualified nonprofit organizations that are a good way of reducing taxes (remember, you have to itemize) while also helping others. If you have questions about the charitable contribution tax deduction it’s a good idea to consult with your professional advisors. It’s also a good idea to heed these tips prior to making a charitable donation and double-check the organization’s status on the IRS’ Exempt Organizations Select Check tool, which allows users to search a list of organizations eligible to receive tax-deductible charitable contributions.

I would be happy to have a conversation regarding the tax code, the best time and way to maximize a charitable donation, and help ensure you’re in compliance in compliance with all state and federal laws. Contact me at via email or by cell phone (515-371-6077).