The #SweetSixteen is a time of celebration for teams which made the elite group. Similarly, with charitable gift annuities (CGAs), donors can experience the joy of giving to their favorite causes. But, unlike making the Sweet Sixteen, CGAs aren’t hard, they are relatively easy to understand and execute. Also unlike the Sweet Sixteen, CGA donors don’t have to be part of an elite group; all donors, regardless of income, or class, or status, can enjoy the many benefits CGAs offer.

ABCs of CGAs

A CGA is easy to understand, about as easy as a fast break lay-up. A CGA, put simply, is a contract. Specifically, a CGA is a contract in which a charity agrees to pay a fixed amount of money to one or two individuals for their lifetime(s), in return for a transfer of assets (such as, say, cash, stocks, or farmland).

A person who receives payments is called an “annuitant” or “beneficiary.” After the annuitant(s) die(s), or the term of the contract ends, the charity keeps the remainder of the gift.

Sixteen Sweet Benefits of a CGA

Before we go deep into CGAs, I’ve listed 16 key advantages of CGAs.

- CGAs are simple to execute.

- CGAs are (relatively) easy to understand and explain.

- CGAs avoid management responsibilities.

- CGAs may be executed during lifetime (called an inter vivos transfer), or by operation of a will (called a testamentary transfer).

- CGAs allow a donor to provide a consistent stream of income for others.

- CGAs pay lifetime income to one or two individuals, part of which is (most often) a return of principal and free from income tax.

- CGAs provide an immediate income tax charitable deduction for the donor for the gift portion.

- When appreciated property (such as stock or real estate) is provided to fund a CGA, and the donor is an annuitant, some of the capital gain is spread over the donor’s life expectancy, and the rest is never recognized because it is attributed to the gift portion.

- Depending on all the circumstances, CGAs can possibly save a donor taxes on Social Security benefits.

- The income payout from CGAs can begin immediately or can be deferred.

- The income payout from CGAs is guaranteed.

- The income payout from CGAs is fixed (e.g., same amount is paid each payment period).

- The charity’s obligation to make the income payout is backed by the general assets of the charity.

- For some donors, especially in today’s low-interest environment, CGAs may present an attractive alternative to CDs.

- In certain situations, CGAs can supplement retirement income.

- CGAs provide the joy of giving to your favorite causes.

Three More Points on the Scoreboard—Three Types of CGA Agreements

1. Immediate Gift Annuity

Under an immediate gift annuity, the annuitant(s) start(s) receiving payments at the start/end of the payment period immediately following the contribution. Payments can be made monthly, quarterly, semi-annually, or annually.

2. Deferred Gift Annuity

Under a deferred payment gift annuity, the annuitant(s) start(s) receiving payments at a future time, the date chosen by the donor, which must be more than one year after the date of the contribution. As with immediate gift annuities, payments can be made monthly, quarterly, semi-annually, or annually.

3. Flexible Annuity

Under a Flexible Gift Annuity (also known as a Deferred Payment Gift Annuity), the donor need not choose the payment starting date at the time of her contribution. The annuitant (who, remember, may or may not be the donor) can choose the payment starting date based on their retirement date or other considerations.

Jump Ball—Choosing Start Date of Deferred CGA

Under an immediate gift annuity, annuity payments begin no later than one year after the initial contribution.

A deferred gift annuity allows the donor to delay the start date of annuity payments. This delay will increase the annuity amount when payments begin and result in a larger income tax charitable deduction which is available in the year of the contribution (subject, as are all charitable donations, to Adjusted Gross Income (AGI) limits).

A deferred gift annuity can produce current tax savings during high-earning years while creating a supplemental retirement income. Generally, the donor sets a date for the deferred gift annuity to begin. However, the IRS approved a deferred gift annuity which did not specify a fixed starting date for the annuity payments [IRS Ltr. Rul. 9743054].

Don’t Foul Out—Charities Issuing CGAs Must Follow Certain Rules

CGAs are an exception to the general rule that charities cannot issue commercial insurance contracts. As such, charities which issue CGAs must comply with several rules. The basics of the rules may be simplified as follows:

- The present value of the annuity must be less than 90 percent of the total value of the property transferred in exchange for the annuity. In other words, the charitable interest must be at least 10 percent.

- The annuity cannot be payable over more than two lives, and the individual(s) must be alive at the time the gift annuity is set up.

- The gift annuity agreement cannot specify a guaranteed minimum, nor a maximum, number of annuity payments.

- The actual income produced by the property transferred in exchange for the gift annuity cannot affect the amount of the annuity payments.

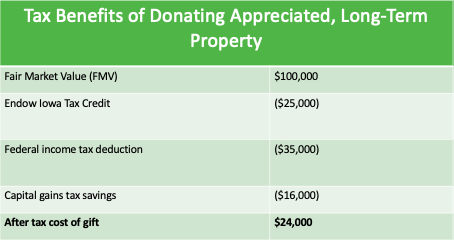

Four Point Play—Tax Advantages

In basketball, a four-point play is a rare occasion when a player makes a three-point shot while being fouled. Similarly, it is rare for a charitable gift to offer four potential tax advantages to donors, as the CGA does. The CGA can have a positive effect on the donor’s charitable deductions, income taxes, capital gains taxes, and gift taxes.

Federal Income Tax Charitable Deduction

Federal Income Tax Charitable Deduction

A CGA is considered part gift and part sale, as the donor contributes property in exchange for annuity payments from the charity. The donor who itemizes deductions on her taxes may take an income tax charitable deduction for the gift portion (i.e., the value of the transferred property minus the present value of the annuity).

This income tax charitable deduction is subject to the same limits as an outright gift of cash or property. For example, if cash is transferred for the CGA, the limitation of the deduction is 50 percent of the donor’s AGI. Or, if long-term capital gain property is transferred the limitation is 30 percent of AGI. Any deduction in excess of the applicable percentage limitation may be carried forward for five years.

Taxation of Payouts

The annuity payments by the charity under a CGA are treated for income tax purposes as follows:

- Tax-free return of principal

- Long-term capital gain

- Ordinary income

Let’s break each of these categories down.

Tax-Free Return of Principal

A portion of each payment received by the donor, or another annuitant, is a tax-free return of principal until the cost of the annuity is fully recovered when the annuitant reaches life expectancy. Put another way, a portion of the payments is considered to be a partial tax-free return of the donor’s gift, which are spread in equal payments over the life expectancy of the annuitant(s).

The assumed cost of the annuity does not include the gift portion of the transaction. The donor’s cost basis must be allocated between the gift and sale portions in accordance with the respective proportions of the value of the property transferred.

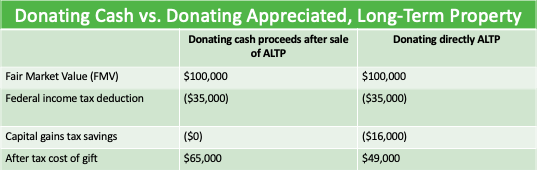

Long-Term Capital Gain

When a taxpayer sells long-term, appreciated property, such as stocks or real estate, she generally pays capital gains on the appreciation. If long-term, appreciated property funds a CGA, a portion of each payment will be taxed as long-term capital gain. This will reduce the income tax-free return of the principal portion of the annuity payments.

Under general tax rules, long-term capital gain is recognized in the year the property is sold. Capital gain is recognized only on the sale portion of the transaction and with the basis allocation previously described. However, with a CGA, the donor may spread the gain over life expectancy, assuming either a sole annuitant or the donor has another individual named as a survivor annuitant. It’s obviously beneficial for a donor to be able to defer capital gains taxes.

Ordinary Income

After the capital gain and tax-free portions of the annuity payment have been determined, the balance of the payment will be taxed as ordinary income.

Gift and Estate Taxation

If the donor is the sole annuitant, there are no gift or estate tax issues because both the annuity is her own and the annuity terminates at death. If the donor names anyone other than herself as an annuitant, gift and estate tax issues may arise.

Regarding the gift tax, if the donor names another person as an annuitant, the gift is the value of the annuity. An exception exists for a spouse under the gift tax marital deduction. Another alternative to avoid gift tax: the donor could retain the right to revoke when the named annuitant has a survivor interest.

Regarding the estate tax, if the donor names another person as an annuitant, the remaining value in the annuity is considered part of the donor’s estate. An exception exists for a joint annuity using only the donor’s life as the measuring life. Of course, there is also an estate tax marital deduction available if surviving annuitant is a spouse.

Low-Interest Rates = Higher Tax-Free Income

The Applicable Federal Rate (AFR) selection decision is more nuanced for gift annuities than for other planned gift tools. A donor who wants to maximize their deduction will select the highest rate available, but this reduces the overall value of the annuity and increases the amount of the charitable gift. Conversely, a donor who wants to maximize the income tax-free portion of the annuity payments will select the lowest available rate.

When the Clock Runs Out—Testamentary CGAs

If carefully planned, it is possible to arrange a CGA through a will. The IRS approved a testamentary gift annuity in Ltr. Rul. 8506089. It is crucial that both the bequest amount and annuity payout are made clear by the terms of the will.

A donor should engage an expert estate planning expert to handle the careful drafting needed for a testamentary CGA. A donor, together with his estate plan professional, should address two issues:

- What if the designated annuitant(s) predecease(s) the testator? (The testator is the person who makes the will).

The donor may want to specify a contingent annuitant or provide for an outright bequest to the charity.

2. What about the payout rate?

The donor could (or should) leave the charity some flexibility in the payout rate, to assure the 10 percent minimum charitable interest requirement can be met in the future.

Winning Point

Donors and nonprofits can both score big with CGAs and this charitable tool can be a slam dunk for all parties!

The mission of Gordon Fischer Law Firm, P.C. is to promote and maximize charitable giving in Iowa. I offer training on complex gifts, like CGAs, for nonprofit boards, staff, and stakeholders. Contact me for a free one-hour consultation; I can always be reached at Gordon@gordonfischerlawfirm.com or at 515-371-6077.

Federal Income Tax Charitable Deduction

Federal Income Tax Charitable Deduction