Your most valuable asset? Most would say their home.

Could your home benefit your favorite charity? Yes, and with a retained life estate, you can give away your house, keep the keys, and get a current tax deduction.

Under a retained life estate, the donor irrevocably deeds a personal residence or farm to charity, but retains the right to live in it for the rest of his/her life, a term of years, or a combination of the two. The term is most commonly measured by the life of the donor, or of the donor and the donor’s spouse.

When the term ends, typically when the last of one or more tenants dies, the charity can either keep the property for its own use, or sell the property and use the proceeds as designated by the donor.

Keep in mind that donating a personal residence doesn’t mean it has to be the donor’s primary residence. It can be a vacation home or any other structure the donor uses as a residence. A farm can include raw farm land, as well as farmland with buildings on it.

The blog post dives in deep to the details of what makes the retained life estate a viable and valuable charitable giving tool. If you’re a donor exploring this option, or a nonprofit leader looking for more information on how to facilitate this type of gift, read on and then contact me to discuss your individual situation.

Definitions

Again, the donor irrevocably deeds a personal residence or farm to charity, but retains the right to live in it for a certain term, such as the life or lives of individuals, term of years, or a combination of the two. At the end of the measuring term, all rights to the real estate are transferred to the charity. In this scenario, the donor is called the “life tenant,” who has a “life use” of the real estate, and is transferring a “remainder interest” to the charity. The charity is called the “charitable remainderman.”

Necessary: Detailed Gift Agreement

When a retained life estate is used for charitable purposes, for protection of both the donor and the charity, a detailed gift agreement should be worked out. Lots of legal issues should be resolved, regarding a wide variety of responsibilities, including [but hardly limited to]:

- real estate taxes;

- liability and casualty insurance;

- utilities;

- maintenance and minor repairs;

- remodeling and major repairs;

- process for evaluating leases and lessees, should life tenant rent farmland;

- rights of charitable remainderman to enter and inspect farmland with proper notice given;

- procedures for removal of the personal property of the life tenant upon the end of the tenancy; and

- a comprehensive dispute resolution process.

Let’s address several of these items further.

Liability and casualty insurance

Presumably, a donor would want to maintain insurance. The charity may want to consider adding life estate properties to its master insurance list. Also, the charity may want the life tenant to provide the charity an annual certification that appropriate insurance is in place and that premiums have been paid.

Maintenance and repairs

The life tenant is generally responsible for expenses customarily borne by the donor of real property, such as routine maintenance. However, expenses for improvements which benefit, or even might benefit, the charitable remainderman, can and should be addressed in the gift agreement. For example, capital improvements which will last beyond the life tenant’s use of the property, such as a new barn, will benefit both the life tenant and the charitable remainderman. Again, this needs to be handled by agreement between the parties.

Process for evaluating leases and lessees

The life tenant retains all “beneficial lifetime rights” in the property, which includes, for example, the ability to rent the property and receive rental income. The well-drafted gift agreement should establish responsibilities for property management and maintenance by lessees. The charity, as remainder interest owner, has a huge interest in making certain the real estate is appropriately maintained. It is therefore not uncommon in gift agreements for the charity to have a right of approval over parties who would lease the real estate, and by what terms.

Comprehensive dispute resolution process

The relationship between the donor and the charity can change over time for any number of reasons. Having an agreed-upon and formal process for resolving disputes in place from the outset, should help if issues arise. All parties should consider adding in the agreement a mandatory mediation or arbitration clause.

Options for flexibility

Should there be a change, such as the life tenant no longer wanting to live in the residence, a life estate provides several options for flexibility. Let’s discuss the most common alternatives.

Joint sale

The donor and the charity can enter into a joint sale. Under a retained life estate, the real estate is owned in part by the donor and in part by the charity. Just as with any other type of joint ownership, the parties can agree together to sell and divide the proceeds.

Gift of life estate

The donor could decide to donate the life estate to the charity. In such an event, the charity would then own both the remainder value and the life estate and could sell the farmland (if applicable). The donor would receive a charitable deduction for the gift of the remainder interest.

Charitable remainder unitrust

Another alternative: the donor could contribute his/her life interest to a charitable remainder unitrust [CRUT]. Since a life interest is a valid property interest, if the donor transfers his/her entire retained ownership into the CRUT, they’ll receive a charitable deduction for a gift of appreciated property.

No pre-arranged obligations

Under these alternatives, there can be no pre-arranged binding obligation to select any one of possible options. If a binding obligation exists, the charitable deduction will be denied.

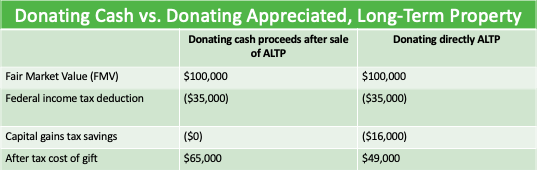

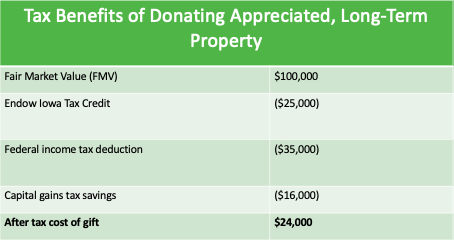

Federal income tax charitable deduction

A federal income tax deduction is permitted for the present value of the remainder interest. As with all charitable contributions, the tax deduction for gifts involving appreciated property is limited to 30 percent of the donor’s adjusted gross income [AGI]. However, any unused portion can be carried over for up to five additional years.

For gifts of a remainder interest in real estate, the donor is entitled to a charitable deduction in an amount equal to the net present value of the charitable remainder interest. The computation is performed under guidelines described in Treas. Reg. § 1.170A-12 and is based on the following factors:

- the fair market value of the property [including improvements] on the date of transfer;

- the fair market value of depreciable improvements attached to, or depletable resources associated with the property on the date of transfer;

- the estimated useful life of the depreciable improvements;

- the salvage value of the depreciable improvements at the conclusion of their useful life;

- measuring term of the agreement [if measured by the life of one or more individuals, the date of birth of the individuals]; and

- the Applicable Federal Midterm Rate [in effect for the month of transfer or during either of the two preceding months].

Let’s look at two additional factors:

Measuring terms

As discussed earlier, retained life estates are most commonly measured by the lifetime of one or more individuals; however, life estates can also be measured by a term of years, or by the longer of the life or lives of individuals and a term of years, etc.

If the life estate is measured by one or more lives, the individuals must be in being at the time the life estate is created. If the life estate is measured by a fixed term of years, there is no minimum or maximum term for federal tax purposes.

Applicable Federal Midterm Rate

The Applicable Federal Midterm Rate [AFR] in effect for the month of the life estate gift is used as the interest component for present value computation purposes. At the donor’s election, the AFR in effect for either of the two months preceding the life estate gift can be substituted. This is an obvious opportunity for good planning.

In short, the lower the AFR, the higher the charitable deduction. Historically speaking, then, this is a very positive time for life estates.

Cautionary note

This article is presented for informational purposes only, not as tax advice or legal advice.

All individuals, families, businesses, and farms are unique and have unique legal and tax issues. If you are considering a retained life estate you certainly should speak with a trusted legal professional. Same goes if you’re a nonprofit leader looking facilitate the gift of a retained life estate. I’m happy to help; reach out to me at any time via email (gordon@gordonfischerlawfirm.com) or by cellphone at 515-371-6077.