I. INTRODUCTION

Happy New Year! A great way to start 2024 for Iowa nonprofits? Adopt the ten (10) policies referenced on IRS Form 990, as discussed fully below.

II. IRS FORM 990

Every nonprofit, every year, must complete and file a version of Form 990, which the IRS calls its “Return of Organization Exempt From Income Tax.” The “long” version of Form 990 asks about many financial matters – donations, money on hand, non-cash assets, breakdown of expenses, and so on.

Form 990 goes even further however, and asks nonprofits if they have certain policies in place. In fact, there are ten (10) specific policies that the IRS asks about on Form 990.

To be clear, the IRS does not mandate adopting these ten (10) policies. But the IRS, at least to me, is signaling what policies nonprofits should have in place. Again, my read of Form 990 is that the IRS is showing nonprofits what it considers to be “best practices.”

III. REASONS FOR THESE TEN (10) POLICIES AND THEIR BENEFITS

One might ask, if these policies are not absolutely required, why have them?

Generally, these ten (10) policies provide substantial benefits, including, but hardly limited to:

- Enhanced confidence of donors and other stakeholders

- Consistent framework for decision making

- Increased compliance with federal, state, and local laws

- Reduced risk to the nonprofit and its management and governing board

The existence of policies doesn’t mean compliance is always assured of course, but having policies in place provides a framework and sets expectations for a nonprofit’s board members, employees, donors, volunteers, and other stakeholders. Such policies can be referenced if (when) issues arise.

Another major reason to invest in adopting these policies is because the IRS audits tax-exempt nonprofits, just as it audits companies and individuals. Having certain policies in place will only serve to benefit the nonprofit should it happen to be audited. Also, proper policies provide a foundation for soliciting, accepting, and facilitating charitable donations.

Last, but not least, Form 990 is made accessible to the public, meaning it can be used as a public relations tool if filled out diligently. Major donors can and often do review a nonprofit’s Form 990 to ensure the nonprofit is compliant, putting charitable donations to good use, and continuing to operate in alignment with its overall mission.

IV. WHAT POLICIES ARE WE TALKING ABOUT?

The IRS made a major revision to Form 990 in 2008. The old version focused largely on financial data. Now, Form 990 reports extensive information on operations such as board governance, fundraising, non-cash assets, and more. Let’s cover all ten (10) policies the IRS asks nonprofits to report on in its Form 990. I’ll discuss each policy in alphabetical order.

1. COMPENSATION

Data related to compensation is reported in multiple sections on Form 990: Part I, Part VI, Part VII, Part IX, and Schedule J.

Competitive compensation is just as important for employees of nonprofits as it is for for-profit employees. Having a policy that objectively establishes salary ranges for positions, updated job descriptions, relevant salary administration, and performance management establishes equality and equity in compensation practices. A statement of compensation philosophy and strategy, which explains to current and potential employees and board members how compensation supports the nonprofit’s mission, should be included in the compensation policy.

2. CONFLICT OF INTEREST

Found on Form 990 Part VI, Section B, Line 12 a-c.

A conflict of interest policy should do two important things. First, it should require board members with a conflict (or a potential conflict) to disclose said conflict. Second, it should exclude individual board members from voting on matters in which there is a conflict.

The Form 990 glossary defines a “conflict of interest policy” as follows:

A conflict of interest policy defines conflicts of interest, identifies the classes of individuals within the organization covered by the policy, facilitates disclosure of information that can help identify conflicts of interest, and specifies procedures to be followed in managing conflicts of interest. A conflict of interest arises when a person in a position of authority over an organization, such as an officer, director, manager, or key employee can benefit financially from a decision he or she could make in such capacity, including indirect benefits such as to family members or businesses with which the person is closely associated. For this purpose, a conflict of interest doesn’t include questions involving a person’s competing or respective duties to the organization and to another organization, such as by serving on the boards of both organizations, that don’t involve a material financial interest of, or benefit to, such person.

Form 990 asks whether the nonprofit has a conflict of interest policy, as well as how the nonprofit determines and manages board members who have an actual or perceived conflict of interest. This policy is hugely important, as conflicts of interest that are not successfully and ethically managed can result in sanctions against both the nonprofit and the individual with the conflict(s).

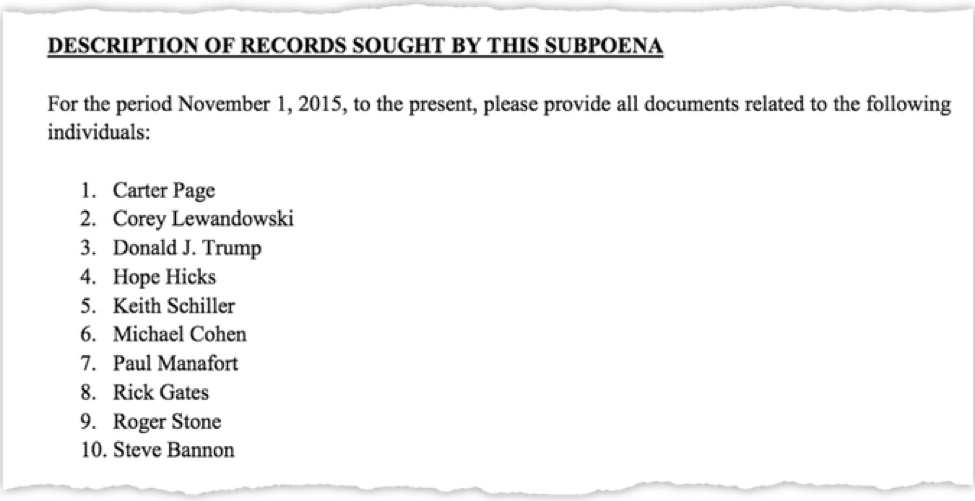

3. DOCUMENT RETENTION AND DESTRUCTION

Found on Form 990 Part VI, Section B, Line 14.

This policy should clarify what types of documents should be retained, how they should be filed, and for what duration. It should also outline proper deletion and or destruction techniques. The document retention and destruction policy (sometimes called, sometimes simply called a “DRD policy”) is useful for a number of reasons. The principal rationale as to why any nonprofit would want to adopt such a policy is that it ensures important documents—financial information, employment records, contracts, information relating to asset ownership, etc.—are stored for a standard period of time for tax, business, and other regulatory purposes. No doubt document retention is incredibly important should litigation or governmental investigation arise.

A strong, clear DRD policy also allows nonprofits to save time, space, and money associated with both hard copy and digital file storage, by determining what is no longer needed and when…it’s like sanctioned spring cleaning!

4. FINANCIAL POLICIES AND PROCEDURES

Different than the investment policy (as discussed below), financial policies specifically address guidelines for making financial decisions, reporting the financial status of the nonprofit, managing funds, and developing financial goals. The financial management policies and procedures should also outline the budgeting process, investment reporting, what accounts may be maintained by the nonprofit, and when scheduled auditing will take place. Form 990 does not make a specific ask about a nonprofit’s financial policies, but this type of policy will serve as an indispensable guide to organizing, collecting, and reporting financial data.

5. FORM 990 REVIEW

Found on Form 990 Part VI, Section B, Line 11.

Form 990 asks the following questions:

Has the organization provided a complete copy of this Form 990 to all members of its governing body before filing the form? Describe in Schedule O the process, if any, used by the organization to review this Form 990.

In asking these questions, the IRS is indicating that careful distributing and reviewing Form 990 prior to filing is optimal. This policy is extremely useful in clarifying the specific process for distribution and procedure review by the governing body (such as the board of directors). It also acts as a reminder to nonprofit leaders that Form 990 is coming due!

6. FUNDRAISING

The topic of fundraising gets substantial attention on Form 990; fundraising income and expenses are asked about in Part I, Part IV, Part VIII, Part IX, and Schedules G and M.

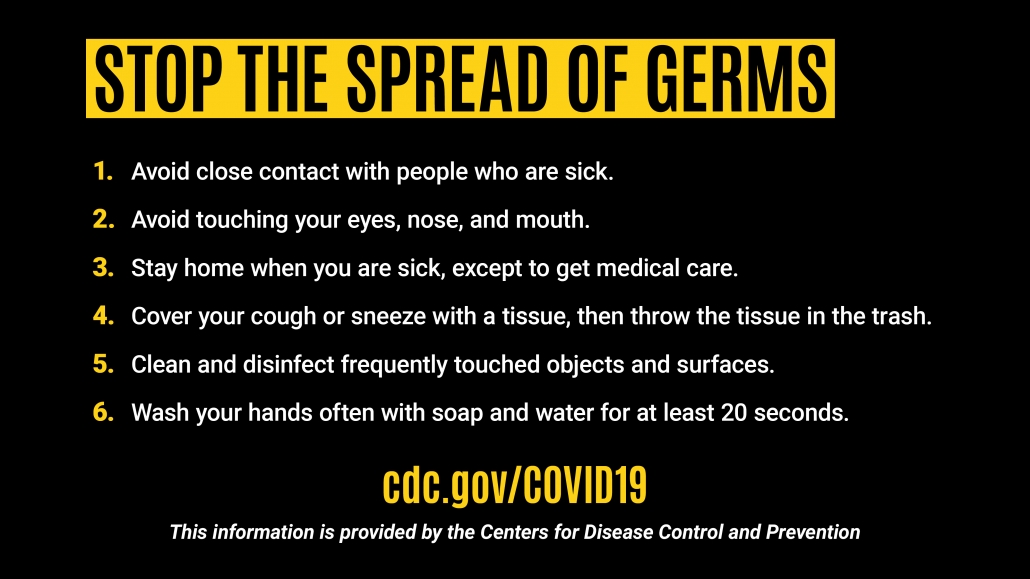

Almost every nonprofit needs a fundraising policy, as so many nonprofits engage in some sort of charitable fundraising. This policy should include provisions for compliance with local, state, and federal laws, as well as the ethical norms the nonprofit chooses to abide by in fundraising efforts. Remember that fundraising doesn’t just include solicitation of donations, but also receipt of donations.

7. GIFT ACCEPTANCE

Gifts and contributions are referenced many times on Form 990: Part I, Part IV, Part V, Part VIII, Part IX, and Schedule M.

While related to the fundraising policy, the gift acceptance policy is different, as it establishes how nonprofits will handle certain types of assets. This policy provides written protocols for nonprofit board members and staff to evaluate proposed non-cash donations. The policy can also grant some much-needed guidance in how to kindly reject donations that can carry extraneous liabilities and obligations the nonprofit is not readily able to manage.

8. INVESTMENT

One way a board of directors can fulfill their fiduciary responsibility to the nonprofit is through investing assets to further the nonprofit’s goals. But, before investment vehicles are used, the nonprofit should have an investment policy in place to define who is accountable for the investment decisions. The policy should also offer guidance on activities of growing/protecting the investments, earning interest, and maintaining access to cash if necessary.

The policy should be written to give the nonprofit’s management personnel the authority to make investment decisions, as well as preserve the board’s oversight ability. Beyond the specifics of investments, this policy can also govern financial management decisions regarding situations like accepting charitable gifts of securities.

Many nonprofits hire a professional financial advisor or investment manager to implement investments and offer advice. This person’s role can be accounted for in the investment policy. Form 990 does not ask if a nonprofit has a specific investment policy, but it does refer to investments in multiple places throughout the form, and there is an obvious need.

9. PUBLIC DISCLOSURE

Found on Form 990 Part VI, Section C, Lines 18-20.

Speaking broadly, nonprofits exist to serve the public in some way or another, and some nonprofit documents must be made available to the public upon request. Other documents can be kept entirely internal. This policy should overview (1) what documents the nonprofit must disclose, and (2) to what extent does it want to make other non-required documents and information available to the public.

Form 990 specifically asks the filing nonprofit to report if certain documents are made available to the public, such as governing documents (like the bylaws), financial statements, and the conflict of interest policy. Additionally, Form 990 asks for the name, address, and phone number of the individual(s) who possesses the financial “books” and records of the nonprofit.

10. WHISTLEBLOWER

Found on Form 990 Part VI, Section B, Line 13.

Nonprofits, along with all organizations, are prohibited from retaliating against employees who call out, draw attention to, or “blow the whistle” against employer practices. A whistleblower policy should set a process for complaints to be addressed and include protection for whistleblowers. Ultimately this policy can help insulate your nonprofit from the risk of state and federal law violation and encourage sound, swift responses of investigation and solutions to complaints.

A whistleblower policy encourages staff and volunteers to come forward with credible information on illegal practices or violations of adopted policies of the nonprofit, specifies that the nonprofit will protect the individual from retaliation, and identifies those staff or board members or outside parties to whom such information can be reported.

V. CONCLUSION

Iowa nonprofits make such a huge difference all across our state. Nonprofits can make an even larger impact by adopting the ten (10) policies referenced on IRS Form 990.

Questions about the ten (10) policies referenced on IRS Form 990? My email is:

gordon@gordonfischerlawfirm.com