For the majority of the 25 Days of Giving series, I’m going to focus on charitable gifts made to nonprofit organizations. But, investing in a student’s future and helping to make higher education more affordable and accessible is certainly a valid cause…and has tax benefits of its own. This brings to mind a different type of gift you can give to a loved one who is currently or planning on attending college: the 529 Plan.

The 411 on the 529

Gordon Fischer Law Firm is dedicated to Iowans, so I’ll focus on the College Savings Iowa 529 plan, but know that all 50 states and D.C. sponsor at least one type of 529 plan. There are two types of 529 plans—prepaid tuition plans and college savings plans. The College Savings Iowa plan is a tax-advantaged program sponsored and administered by the Treasurer of the State of Iowa. The purpose? Just as the name “college savings” says, it is intended to “help an individual or a family pay for higher-education costs.”

The account funds can be used by the beneficiary for any purpose, but for the withdrawals to be considered tax-free, the money must be used for qualified higher-education expenses at an eligible educational institution by the student. Eligible expenses include elements associated with higher education such as: tuition, mandatory fees, books, required supplies, computers (including related hardware and software), internet access, equipment required for enrollment/attendance, and even room and board during any academic period where the student is enrolled at least half-time.

If withdrawals are made and not used for a qualified expense, the deductions must be added back to Iowa taxable income and adjusted annually for inflation. Additionally, the earnings part of the non-qualified withdrawal may be subject to a 10% federal penalty tax on top of federal income tax. A great alternative to non-qualified withdrawals if the student doesn’t end up going to or paying for school is transferring the money to another eligible beneficiary’s 529 account.

Who Can be a 529 Plan Beneficiary?

Your school years may be far behind you, but you can set up a 529 for any beneficiary. The only requirements are that the prospective or current student must be a U.S. citizen or resident alien with a valid Social Security number or other taxpayer ID number. The student doesn’t have to reside in Iowa or be related to you in any way. So, you could set-up a 529 for your niece, but also your friend’s son whom you’ve known since he was little…even if he lives in another state!

Federal, State, & Estate Tax Benefits

The most obvious benefit of College Savings Iowa 529 accounts is that contributed assets grow deferred from federal and state income taxes. Plus, Iowa taxpayers can deduct up to $3,387 in contributions per beneficiary (student) account from adjusted gross income for 2019. These contributions can usually be made up through the tax-filing deadline. (For example, you could make a tax-deductible contribution for the 2017 tax year up until the end of April 2018.)

Beyond the $3,387 state tax deduction, you can contribute up to $75,000 in a single tax year for each beneficiary (or $150,000 as a married couple filing jointly) without incurring federal gift tax. This is provided you don’t make any other gifts to that student beneficiary over the course of five years. For the purpose of the contribution, it’s as if you made the $75,000 gift over the course of five years. Any additional gifts made to the beneficiary during that five-year period will incur a gift tax.

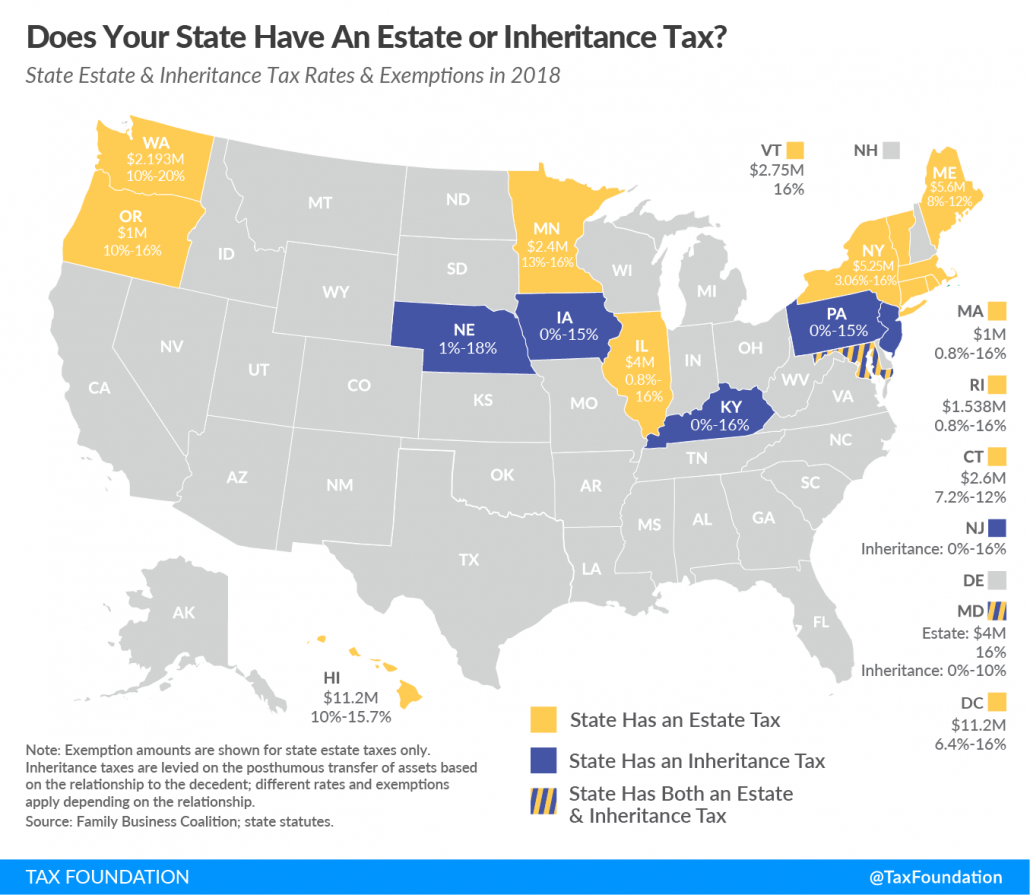

There’s another major benefit when it comes to the 529 and estate taxes. Money contributed to a 529 account is generally treated as a “completed gift” to the student beneficiary, but as the contributor/participant, you still have control over the money. If you were to die with money remaining in your account, it will not be included in your estate for federal estate tax purposes. In short, the 529 is a valid tool if your goal is to reduce the total of your estate to avoid the estate tax, but still, help a student you care about.

In terms of the estate tax, if you took the option for the $75,000 contribution ($150,000 for married couples) to a 529 plan account as if it was made over five years and then you die within the five-year window, a prorated portion of the contribution will be subject to estate tax. This can get a bit confusing, so please speak with your trusted estate planning attorney or tax advisor for more personalized information.

What’s your experience with 529 plans? Any questions in regards to how contributing to a 529 plan could impact your tax savings? Don’t hesitate to contact me by email (gordon@gordonfischerlawfirm.com) or phone (515-371-6077).