It’s not hard to find books about estate planning, but if I’m being honest most are nonfiction guides and most are kind of dry and dull. Sure, they can act as a solid primer for what you may want to know about estate planning, but they do not make for cozy, wintery weekend reads. But it’s much easier, less complicated, and concise to work with an estate planning attorney who can tailor information to your needs.

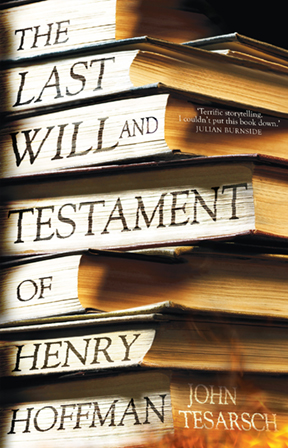

To spare you from books you’ll hate, I try to recommend reads for the GoFisch Book Club that touch on my practice areas—estate planning, charitable giving, and nonprofits—that are also engaging. Kicking off 2020, I’m adding “The Last Will and Testament of Henry Hoffman” by John Tesarsch to the GoFisch bookshelf.

After their eccentric (or reclusive, depending on how you see it) father commits suicide, three adult siblings are left to reckon with the father’s will that leaves his full estate to an unknown woman. Secrets unravel and the strings of grievances and grief intertwine as the siblings come apart fighting over their inheritance. Without disclosing any spoilers, this is more of a family drama than a legal one, but the bits and pieces of will contests serve as a warning sign that should hopefully inspire all readers to get their ducks in a row. Indeed, while largely set in Australia, this familial breakdown and conflict over competing legal documents could happen almost anywhere.

Having practiced as a barrister in Australia, Tesarsch knows a thing or two about how estate planning can leave a lasting legacy. . . and a contested will can cause immense familial conflict.

What titles would you like to see me add to the GoFisch Book Club? I would love to hear what you’re reading. Shoot me an email, Facebook message, tweet, or Instagram DM to let me know.