According to the Centers for Disease Control and Prevention, 24,000 babies in America are lost every year to stillbirth. Emily Price learned about this and an inspiring Iowa-based organization, Healthy Birth Day, working to reduce the number of stillbirths in America, for a story she did as a reporter at KCCI-TV. In a recent Des Moines Register article, Price credited the organization with giving her with the knowledge to recognize something wasn’t right with her pregnancy. She brought the concern to her doctor, and ultimately saved the life of her son.

Emily Price

Price (who currently is the Board President, but will assume the role of Executive Director of Healthy Birth Day, Inc. on May 8), said, “Aside from raising our family, it’s the most fulfilling thing I’ve ever done in my life. To hear about a baby saved is the most impactful thing—it stops us in our tracks and we cry tears of joy.”

She was happy to share more about how Healthy Birth Day began, the significant impact the organization has made so far, and details on some exciting developments coming up in the future.

How did Healthy Birth Day come to be?

EP: Healthy Birth Day was created by five Iowa moms (Kate Safris, Kerry Biondi-Morlan, Janet Petersen, Tiffan Yamen, Jan Caruthers) who all lost daughters to stillbirth or infant death in the early 2000s. They took their grief, researched stillbirth prevention methods and discovered that by encouraging moms to track fetal movement in the third trimester that some stillbirths and premature births could be prevented.

(Side note: Since its founding, one of the major accomplishments for the organization was getting the Stillbirth Registry law enacted in Iowa, which has brought over $2 million in to the state for prevention research.)

Scientific studies indicate kick counting, a daily record of a baby’s movements (kicks, rolls, punches, jabs) during the third trimester, is an easy, free and reliable way to monitor a baby’s well-being in addition to regular prenatal visits.

Can you shed some light on Count the Kicks? What’s the campaign about and how has it helped mothers in Iowa?

EP: In Iowa we’ve watched our stillbirth rate drop by 26 percent as the rest of the country’s stillbirth rate has remained stagnant. Some states, like Tennessee, are even seeing stillbirth numbers increase. We have received quite a few stories from moms in Iowa where they’ve been monitoring their baby’s movements, notice a change in how long it’s taking them to get to 10 kicks, call their provider, provider runs tests, tests show a baby in distress, doctor decides to deliver baby via emergency C-section, mom wakes up to doctor telling her, “Congratulations, you saved your baby!” It is incredible to hear and we are so grateful when moms feel empowered to not only count their baby’s kicks, but to also speak up when they notice a change. Sometimes it makes all the difference.

In the five short years after Count the Kicks launched in Iowa, our state went from 33rd worst stillbirth rate to third lowest in the country.

Are there any specific resources related to the organization that people may not know about, but should?

EP: We have a free Count the Kicks! app in Google Play and iTunes online stores that allows expectant moms to monitor their baby’s movement, record the history, set a daily reminder, count for twins, and is available in English and Spanish. We have Count the Kicks Ambassadors in 18 states, a national PSA that’s generated more than 300 million viewer impressions, and a monthly Huffington Post blog that reaches moms across the globe. We also have a growing network of supportive doctors, nurses, hospitals, and clinics that give Count the Kicks materials to their patients. (Count the Kicks materials are free to ALL providers in Iowa, Illinois, and Nebraska!)

We also offer resources on our website and we are on Facebook, Twitter, and Instagram.

Does the organization have specific needs from volunteers or donors at this time?

EP: Yes! We have volunteer needs in graphic design, data collection, research, and clerical work, as well as donations to our Save 6,000 Babies campaign. Just being an advocate for kick counting means the world to us. When you know someone who is pregnant, tell them to download our Count the Kicks! app; tell them about the importance of tracking their baby’s movement in the third trimester. We also love when you spread the word about our organization on social media. Share, retweet, like—it all helps spread the word about our campaign. You never know who you might save.

What’s ahead for Healthy Birth Day?

EP: Oh lots of incredible things are happening in 2017! In February we launched the Save 6,000 Babies campaign (the same month our Founders were featured in O Magazine!).

We have a bold vision to save 6,000 babies each year in the U.S. If we can decrease the entire country’s stillbirth rate by 26 percent, we will save more than 6,000 babies every year.

We have a plan in place that will replicate exactly what we have done in Iowa in all 50 states. We are ready to implement this plan just as soon as we have enough funding. To us, this is urgent as we hear far too often from expectant moms who did not know the importance of tracking fetal movement in the third trimester and find us only after losing their precious son or daughter.

In order to go after our goal of saving 6,000 babies every year in the U.S., we need to raise $2 million for increased staffing and programming. This will completely cover our plan to replicate what we have done in Iowa in all 50 states and set us on a true path to success. Success to us equals saving babies.

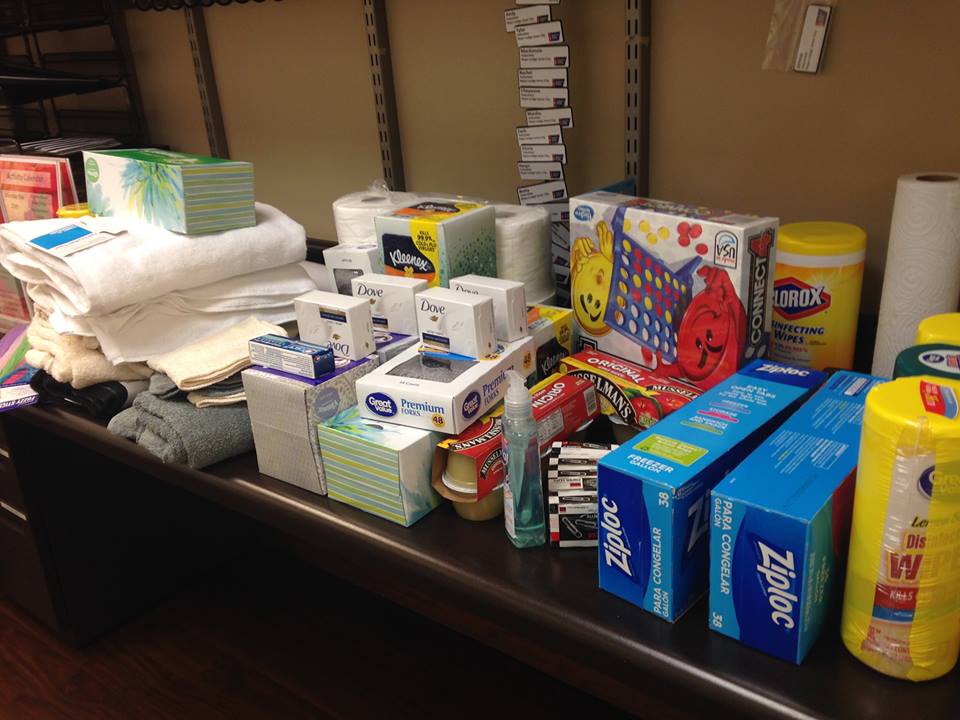

We are also about to move into our very first office space thanks to the generosity of Telligen Community Initiative. It will be located in a non-profit incubator space near Gray’s Lake and we are thrilled to move in!

If someone wanted to get involved with Healthy Birth Day, how would they go about doing so?

EP: Please send us an email at info@healthybirthday.org! Thank you so much.

Gordon Fischer works with nonprofits and the donors who support them in a number of different ways including coordinating complex gifts. If you’re a nonprofit or looking to maximize the benefits of your charitable gift contact Gordon at any time by email, Gordon@gordonfisherlawfirm.com or by phone at 515-371-6077.