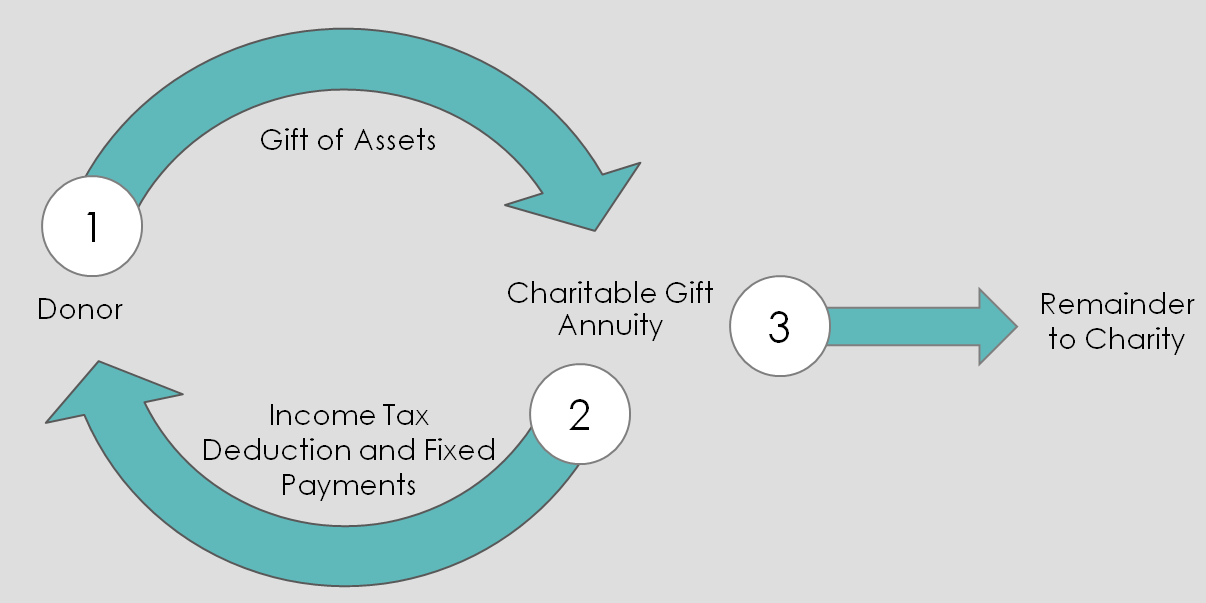

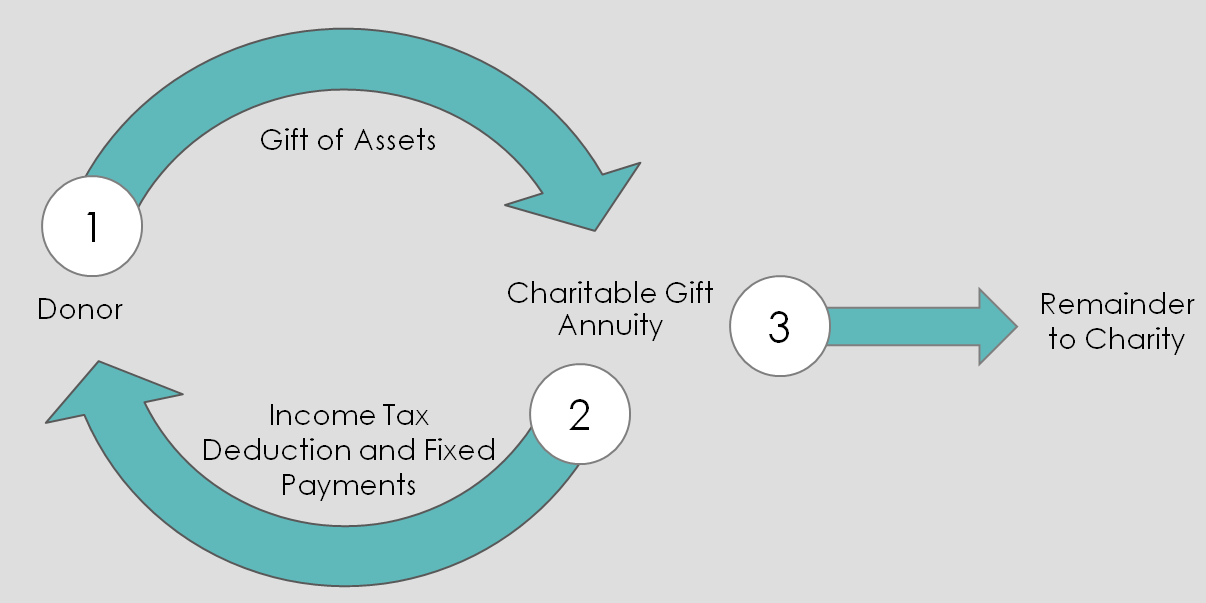

The Basics

A charitable gift annuity (CGA) is a contract in which a charity, in return for a transfer of assets, such as say, stocks or farmland, agrees to pay a fixed amount of money to one or two individuals, for their lifetime. A person who receives payments is called an “annuitant” or “beneficiary.”

For the entire term of the contract, the payments are fixed. A portion of the payments are considered to be a partial tax-free return of the donor’s gift, which are spread in equal payments over the life expectancy of the annuitant(s).

Benefits of a CGA

There are at least six key benefits to a CGA:

- A CGA provides an immediate income tax charitable deduction to a donor for the gift portion.

- A CGA pays a lifetime income to one or two individuals, part of which is (most often) a return of principal and free from income tax.

- The income payout from the gift annuity can begin immediately or can be deferred.

- The charity’s obligation to pay the annuity is backed by the general assets of charity.

- When appreciated property is provided, and the donor is an annuitant, some of the capital gain is spread over donor’s life expectancy, and the rest is never recognized because it is attributed to the gift portion.

- A CGA is (relatively) simple to execute.

3 versions of CGA agreements

There are three versions of different CGA agreements depending on to whom the annuity is to be paid to:

- A “single life” agreement (annuity paid to only one person for his/her lifetime)

- A “two lives in succession” agreement (annuity paid to A, and then if B survives A, paid to B)

- A “joint and survivor” agreement (pay annuity paid to two persons simultaneously, and at death of first annuitant, the survivor is paid full annuity amount). This is most commonly used for married couples who file joint tax returns and/or who live in community property states.

Types of CGA agreements

In addition to the three versions there are three main types of CGA agreements that determine when the payments are issued to the annuitants: immediate, deferred, and flexible.

- Immediate Gift Annuity

Under an Immediate Gift Annuity, the annuitant(s) start(s) receiving payments at the start/end of the payment period immediately following the contribution. Payments can be made monthly, quarterly, semi-annually, or annually.

- Deferred Gift Annuity

Under a Deferred Payment Gift Annuity, the annuitant(s) start(s) receiving payments at a future time, the date chosen by the donor, which must be more than one year after the date of the contribution. As with immediate gift annuities, payments can be made monthly, quarterly, semi-annually, or annually.

- Flexible Annuity

Under a Flexible Gift Annuity (also known as a Deferred Payment Gift Annuity), Donor need not choose the payment starting date at the time of her contribution. The annuitant (who may or may not be the donor) can choose the payment starting date based on her retirement date or other considerations.

Charities That Issue CGAs: The Rules

NOTE: Gift annuities are an exception to the general rule that charities cannot issue commercial insurance contracts. As such, charities which issue gift annuities must comply with several rules, which may be simplified as follows:

- The present value of the annuity must be less than 90% of the total value of the property transferred in exchange for the annuity. In other words, the charitable interest must be at least 10%.

- The annuity cannot be payable over more than two lives, and the individual(s) must be alive at the time the gift annuity is set up.

- The gift annuity agreement cannot specify a guaranteed minimum, nor a maximum, number of annuity payments.

- The actual income produced by the property transferred in exchange for the gift annuity cannot affect the amount of the annuity payments.

CGAs and Tax Considerations

Federal income tax charitable deduction

A charitable gift annuity is considered part gift and part sale, as the donor contributes the property in exchange for annuity payments from the charity. The donor who itemizes may take an income tax charitable deduction for the gift portion (i.e., the value of the transferred property less the present value of the annuity).

This income tax charitable deduction is subject to the same limits as an outright gift of cash or property. For example, if cash is transferred for the CGA, the limitation of the deduction is 50% of the donor’s AGI; if long-term capital gain property is transferred, the limitation is generally 30% of AGI.

Any deduction in excess of the applicable percentage limitation may be carried forward for five years.

Taxation of payouts

The annuity payments by the charity under a gift annuity are treated for income tax purposes as follows:

- Tax-free return of principal

- Long-term capital gain

- Ordinary income

Let’s break each of these categories down.

Tax-free return of principal

A portion of each payment received by Donor, or another annuitant, is a tax-free return of principal until the cost of the annuity is fully recovered when the annuitant reaches life expectancy.

The assumed cost of the annuity does not include the gift portion of the transaction. The donor’s cost basis must be allocated between the gift and sale portions in accordance with the respective proportions of the value of the property transferred.

Long-term capital gain

If property held for more than one year is transferred for a gift annuity, a portion of each payment will be taxed as LTCG. This will reduce the income tax-free return of principal portion of the annuity payments.

Capital gain is recognized only on the sale portion of the transaction and with the basis allocation previously described. Under general tax rules, long-term capital gain is recognized in the year the property is sold. However, with a charitable gift annuity, the donor may spread the gain over life expectancy provided the donor is the sole annuitant, or the donor and another individual named as a survivor annuitant.

Ordinary income

After the capital gain and tax-free portions of the annuity payment have been determined, the balance of the payment will be taxed as ordinary income.

Gift and estate taxation

If the donor is the sole annuitant, there are no gift or estate tax issues because both the annuity is her own and the annuity terminates at death.

If the donor names anyone other than herself as an annuitant, gift and estate tax issues may arise.

Regarding gift tax, if the donor names another person as an annuitant, the gift is the value of the annuity. An exception exists for a spouse under the gift tax marital deduction.

Another alternative to avoid gift tax: the donor could retain the right to revoke when the named annuitant has a survivor interest.

Regarding estate tax, if the donor names another person as an annuitant, the remaining value in the annuity is considered part of the donor’s estate. An exception exists for a joint annuity using only the donor’s life as the measuring life. Of course, there is also an estate tax marital deduction available if the surviving annuitant is a spouse.

Low-interest rates = higher tax-free income

The applicable federal rate (AFR) selection decision is more nuanced for gift annuities than for other split-interest gift tools.

A donor who wants to maximize their deduction will select the highest rate available, but this reduces the overall value of the annuity and increases the amount of the charitable gift.

Conversely, a donor who wants to maximize the income tax-free portion of the annuity payments will select the lowest available rate.

Choosing start date of deferred CGA

Under an immediate charitable gift annuity, annuity payments begin no later than one year after the initial contribution.

A deferred gift annuity allows the donor to delay the start date of annuity payments. This delay will both increase the annuity amount when payments begin and result in a larger income tax charitable deduction which is available in the year of the contribution (subject, as always, to AGI limits).

A deferred gift annuity can, therefore, produce current tax savings during high-earning years while creating a supplemental retirement income. Generally, Donor sets a date for the deferred gift annuity to begin. However, the IRS approved a deferred gift annuity which did not specify a fixed starting date for the annuity payments [Ltr. Rul. 9743054].

Testamentary Gift Annuity

If carefully planned, it is possible to arrange a charitable gift annuity through a will. It is, of course, crucial that both the bequest amount and annuity payout are made clear by the terms of the will.

A donor considering a testamentary gift annuity should directly address three important questions:

- What if the designated annuitant(s) predecease the testator? Donor may want to specify a contingent annuitant or provide for an outright bequest to Charity.

- What if the charity no longer exists at death? Or, what if the charity is either unable or unwilling to accept the gift? The donor may want to name a contingent charitable beneficiary.

- What about the payout rate? The donor should leave the charity some degree of flexibility in the payout rate, to assure the 10% minimum charitable interest requirement can be met in the future.

You may have many more questions regarding charitable gift annuities and your personal situation. Feel free to contact me any time to discuss how to maximize your gift. I offer a one-hour free consultation, without any obligation. I can be reached any time at my email, gordon@gordonfischerlawfirm.com, or on my cell, 515-371-6077.