The latest lawsuit to grip the U.S. news cycle has all the makings of an interesting drama complete with pseudonyms, an agreement to “hush,” a payment for $130,000, and an absent signature. That missing signature is, in part, what brings us to an adult film actress’ lawsuit that a 15-page agreement between “Peggy Peterson” and “David Dennison” concerning an alleged affair with the president is null and void. How? The actress/stripper/director, Stormy Daniels (legal name: Stephanie Clifford), and her attorney, Michael Avenatti, filed their complaint on the bases that that the contract is unconscionable (unreasonably excessive) and invalid since Trump never personally signed. There are also allegations of coercion and physical threats against the actress by the opposing party to stay silent about what she knew about Donald Trump.

Earlier today, we filed this complaint seeking a ct order voiding the alleged “hush” agreement between our client S. Clifford aka Stormy Daniels and Donald Trump. https://t.co/upa9u10MqR

— Michael Avenatti (@MichaelAvenatti) March 7, 2018

If the agreement is found to be invalidated, that would fling open the door for Stormy Daniels to publicly share her story involving Donald Trump without having to pay any damages to Trump’s attorney, Michael Cohen, who brokered the deal.

Daniels requested declaratory relief from the agreement—which Trump’s representatives are intent on enforcing—and even offered to return the $130,000 payment she received.

Many words could be written on the potential legal avenues both sides of this suit could pursue. But, with a CBS “60 Minutes” interview with Daniels slated to air this month, let’s zoom in on one important aspect of the agreement in question: breach of contract.

Even if you’re not suing Trump, we all enter into contracts and agreements, large and small, as a part of living in a modern society. Knowing what breach of contract means could have implications on partnership agreements, residential leases, and employment contracts, among many, many other kinds of agreements.

Legal & Binding

Before we dig into how a party can breach a contract, let’s establish what a contract actually is. A contract simply refers to a promise between two or more parties that establishes binding legal duties on the parties, such that the contract can be enforced in a court if necessary. While there are still major differences between states regarding contract law (i.e. a contract valid in Iowa is not necessarily binding in California), under the legal framework of the Uniform Commercial Code and common law, there are necessary provisions for all legally enforceable contracts in the U.S. The major requirements include (but are not limited to): (1) offer; (2) acceptance; (3) legality of purpose; (4) intent; (5) “competent” parties; and (6) consideration. Let’s look at each of these requirements:

Offer

An offer must be made. Of course, you know what an offer is in general, but in the legal world a contract offer means it must include three parts-

- The offering party must make a statement of intent to enter into a contract.

- Terms must be specified with a specific proposal.

- The offer must identify the party who is receiving the offer. a communication that identifies the person to whom the offer is made.

If any of these elements are not present, an offer has not been made.

There’s no one proper way to make an offer; it could be made via email, letter, text message, telephone call, and even through behavior.

Acceptance

This requirement seems like common sense—the offer must be accepted by the other party. But, like the offer, there are certain aspects that must be present in the acceptance. For instance, an offer must be accepted in the way that the offering party authorizes. (Example: an offer you received by email could specify that acceptance means signing and mailing back to a specific postal address. Another example: a grocery store coupon in the newspaper must be used, or accepted, by a date certain or it expires.)

Plus, an offer can only be accepted by the party to whom the offer was made, unless there’s a power of attorney or other authorization of another agent to accept on the party’s behalf.

Let’s say you receive a job offer with a new employer. That’s exciting, but you’re going to want to give the offer in the form of an employment agreement a thorough review. If you review (and consult with your attorney) and decide there are terms you don’t agree with, you may suggest changes and send your counteroffer back to the prospective employer. The edited, updated version of the contract you suggested could be accepted or rejected by the employer. Without acceptance of the agreement from all parties, there is no agreement.

This is one of the elements Daniels is asserting in her lawsuit against Trump—that the existing agreement is not valid and enforceable since one of the parties, David Dennison (AKA Donald Trump), never signed the written contract.

Legality

For an agreement to be enforceable, it must be made for a legal purpose. In other words, a contract’s subject matter cannot violate public policy or be deemed illegal. For example, a “contract” involving the sale of heroin would not be enforceable. If some parts of a contract violated either a state or federal statute, while the other parts were legal, and the two could be reasonably separated, only the aspects of the contract that were lawful could be enforced.

Intent

Sometimes referred to as “mutuality of obligation,” this necessary provision means that both parties to a contract must have a similar intent for the contract. So, if one party to a contract had been shown to purposefully misled or defraud the other party on the terms of the contract, then the contract could be nullified. Basically, everyone involved needs to enter into the contract honestly.

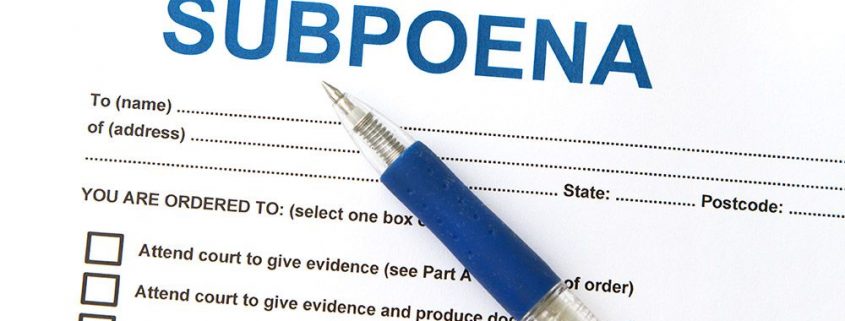

If you were to take a contract to court with the allegation that there was a lack of mutuality of obligation, the court would likely review records and communications that were used in creating the contract. This would provide evidence and a basis for the court to determine if an agreement on intent was actually absent at the time of drafting and execution. For that reason, I typically recommended my clients keep records of communications regarding contracts for a reasonable amount of time.

To go back to our Trump lawsuit example, intent also comes into play. Daniels has asserted that she was coerced into signing the agreement, and therefore there’s a lack of intent since, if this was the case, she wouldn’t have entered into the contract entirely freely. If proof can be found of blackmail or other types of intimidation, a court will rule the contract lacking in validity and thus unenforceable.

Competency

Parties that enter into a legal contract must have the competency and capacity to do so. People who are limited in their ability to enter into a contract include persons who have been deemed mentally incompetent, or temporarily incapacitated in the case of being under the influence of drugs or alcohol, and minors (unless they have been legally emancipated). This requirement ultimately provides protection for both parties.

Consideration

This essential part to a valid, enforceable contract is actually quite different than it sounds. Instead of simply “considering” the agreement, this means that both parties need to provide something of value. Consideration could be a good, service, money, or even benefits. What if there isn’t consideration on both sides? Then the agreement creates the situation for a gift instead of a contract.

To use our previous employment example, the consideration in most employment contracts is the exchange of a service (the work) for money (such as a salary or wage).

All or Nothing

It’s not good enough if just two or three of the elements are present—all aforementioned requirements must be met if a court is to find a contract legally enforceable and binding.

Does a Contract Have to be in Writing?

A question I receive often is if every contract must be in writing. The short answer is no, but it’s a good idea whenever possible, especially in any business contract. Plus, under the intimidating-sounding Statute of Frauds, written contracts can be necessary for certain agreements to be enforceable like those involving real estate transactions, marriage, and long-term contracts (where duties cannot or will not be performed with one year of execution). That being said, if all the required elements are present in an oral agreement (and could be backed-up if necessary) a valid, enforceable exists.

Breach of Contract

Now that we’ve established what a contract is, what’s a violation or breach of a contract mean? A breach of contract occurs when either party in the legal, enforceable agreement fails to perform their duties as outlined in the contract. When a breach of contract occurs, the other (injured) party can be entitled to a remedy, typically monetary damages. In theory the monetary remedy is to be an adequate substitute for the contracted duty and that it will set-up the injured party to be in the same position had the contract never been breached.

This makes a lot of sense when you consider real-world scenarios where the monetary remedy could be used to enlist a substitute. Let’s say you’re remodeling your house and you contracted with ABC Construction to redo your kitchen. You contracted with ABC Construction based on the fact they quoted you a lower cost for the remodeling services than XYZ Construction, the only other company that performs similar services in the local area. For whatever reason, the company refuses to complete their end of the contract; they fail to show-up multiple times and you can’t get in contact with them. If the contract were legal, you could sue ABC Construction for breach of contract, and ask for monetary damages (likely equal to the higher cost of services from XYZ Construction), since ABC failed to complete their end of contracted duties. As you can see, the money remedy “restores” your economic position to that as if ABC never breached.

In almost all cases money damages are the go-to remedy for contractual performance, but there are few exceptions. Specific performance of the contracted duties can be required in unique situations where cash is not sufficient to adequately compensate the non-breaching party. Real estate offers a common example where specific performance is often required. Let’s say a valid, enforceable written contract is executed for Alan to sell Bert his house at a certain rate, but then Alan later decides he doesn’t want to sell at all. Because there is no property just like Alan’s house, Bert may be entitled to specific performance of Alan going through with the sale.

The injured party can also be entitled to contractual performance if a total value of damages cannot be calculated.

Other remedies an aggrieved party can pursue in a breach of contract include recession from the contract (terminating the contract); quantum meruit (a fancy latin way of saying “what one has earned” meaning in contract law a recovery of the value of labor and materials); and injunction (a court order for a party to do, or cease, specific acts).

Let’s take it back to the 2016 nondisclosure agreement between Daniels and Trump (or, rather, Trump’s attorney Michael Cohen). The agreement asserts that if Daniels breaches the contract (meaning she discusses information about Trump in relation to the alleged affair) the remedy will be $1 million for each violation on top of any compensation Daniels earns from disclosing information about Trump. At this time, Cohen filed papers in a federal court reportedly seeking $20 million in damages from Daniels for 20 supposed breaches of the agreement. Which circles back to Daniels’ legal argument that she is not required to pay any damages; no breach of contract occurred as there was no valid contract to begin with.

On top of all this, the clause for $1 million in liquidated damages per breach is debatably a penalty clause. “Because penalty clauses are generally not enforceable under contract law, a court will construe an excessive liquidated damages clause as a penalty clause and will simply not enforce it.” (Note that liquidated damages are defined as specific sum of money parties agreed to and wrote into the contract. This is the amount the injured party should be paid if the other party breaches certain aspects of the contract.) Then, there is the question if the agreement and payment of $130,000 violated campaign finance laws.

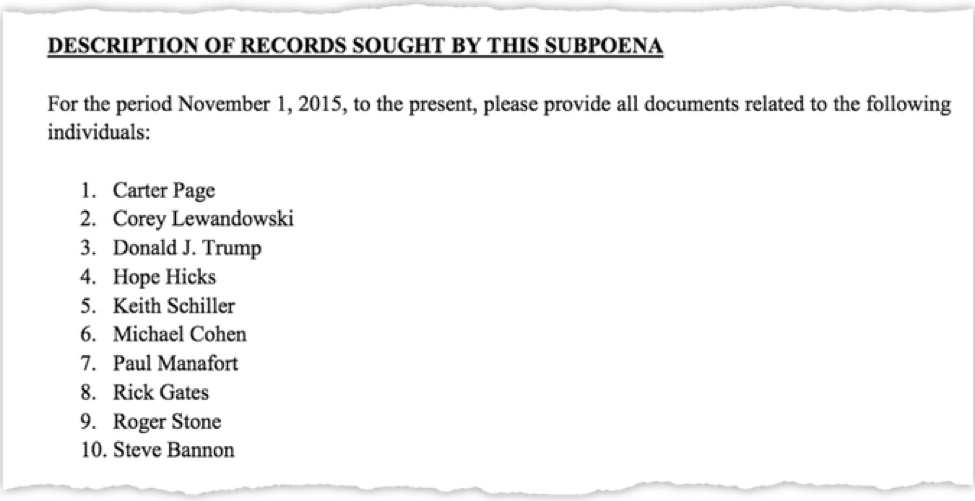

So, needless to say, the Stephanie Clifford a.k.a. Stormy Daniels a.k.a. Peggy Peterson vs. Donald J. Trump a.k.a David Dennison and Essential Consultants, LLC. lawsuit seems to be getting increasingly complex with news of Cohen’s lawsuit against Buzzfeed. It’s also likely that we’re going to see other conversations surrounding Trump and breach of contracts considering the nondisclosure agreements he had White House staffers sign. The agreements supposedly have economic penalties for “unauthorized disclosures” not just during Trump’s term in the White House, but even after he’s out of office.

All of this is to say before you sign a contract, be it for some aspect of nonprofit operations, a personal property transaction, or employment agreement, you’ll need to spend ample time reviewing all the fine print. If at all possible you will also want to run the agreement by a skilled attorney, so they can help catch any obscure legalese or one-sided loopholes.

Questions about “breach of contract?” Need advice on a pending agreement? Want to know if a contract has all the required elements? Don’t hesitate to contact me via email or by phone (515-371-6077).