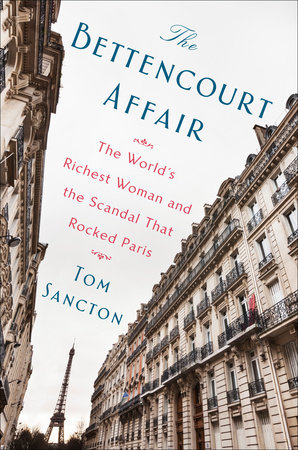

Spread out your beach towel (even if it’s just in your own backyard) and crack open this month’s GoFisch Book Club pick: The Bettencourt Affair, by Tom Sancton.

The book takes its readers on twists and turns through an all too real French soap opera of the rich, powerful, and famous. Its characters including Liliane Bettencourt, one of the richest women in the world and heiress to the L’Oreal cosmetics fortune; former President of France, Nicolas Sarkozy; an intriguing (or scam) artist; a worried (or jealous) daughter; and a whole slew of lawyers, judges, and other professionals wrapped into the web this story weaves. There’s also some interesting WWII back story that comes into play as well as political payoffs and quid pro quo. It’s a quick read and sumptuous in the surrounding luxury of private jets, islands, and Swiss bank accounts. Yet, entirely sobering when remembering that all this wealth caused the emotional heartache, numerous lawsuits, and ruined careers in its wake.

Why is this the GoFisch book club pick of the month? Despite its tabloid-esque plot, legal aspects of estate planning are plentiful throughout the life and times of the players with multiple types of trusts, a will that’s being constantly updated, transfer of long-term capital assets, questions of testator incapacitation, multiple conflicts of interest, and impressive charitable giving tools and tactics.

One of the central questions asked throughout the legal battle that ensues throughout the latter half of the 416 pages is: did one man (François-Marie Banier) take advantage of a wealthy old woman or was he simply the supportive friend and recipient of numerous unsolicited gifts. In this course of all of this, multiple other advisors, employees, and politicians get implicated in “l’affaire Bettencourt” as the courts question who did and did not unduly benefit from Bettencourt’s supposed generosity, and who may or may not have had unethical influence over her decisions. The answers to these are answered in part from the decisions of the courts, but

Also, for anyone interested in the legal systems of other countries The Bettencourt Affair offers a sort of crash course on explaining how France’s judiciary operates and how it.

As you’re reading this book consider the estate planning-related questions:

- What role did estate planning play in the Bettencourt Affair?

- Do you think Liliane Bettencourt;s estate was taken advantage of and if so, by whom?

- Do you believe Liliane Bettencourt was of sound mind and body in order to make the financial decisions and gifts she did? What characteristics come into play when proving incapacitation and need for guardianship or conservatorship?

- Just for fun…if you had the kind of wealth that the Bettencourts did, what kind of trusts would form and who would the trusts benefit? What organizations would you like to benefit from your tax-wise philanthropic efforts?

- What are your thoughts on the French judicial system as exemplified through this book? How does it compare to the U.S. for both the better and the worse?

It’s worth noting here that there almost an endless number of different types of trusts and an adept estate planning attorney can help their clients form a trust that fits with their estate planning, financial, and charitable giving goals.

![]()

It’s also important to remember that trusts are certainly not just for the wealthy. Indeed many regular folks like you and I can stand to benefit from creating different types of trusts. After (or before) you dive into this GoFisch Book Club pick for the month, don’t hesitate to contact Gordon Fischer Law Firm with your trust-related questions or for a consultation if a trust fits your individual needs.

Leave your thoughts on the book in the comments below and let us know if you have any estate planning or nonprofit-related book picks for the upcoming months!