In the days since the horrific school shooting in Parkland, Florida on February 14, many of the surviving students of Marjory Stoneman Douglas High School, along with students across the country and their supporters, have banded together to demand “never again.” Their battle cry is built on the disappointment and frustration with elected policymakers at the state and federal levels that fail to change the current status quo. They are calling out the politicians’ collective “there’s nothing we can do about it” shrug and the cumulative sag of the democratic system weighted by prescribed partisanship, undeniable deadlock, and constricting lobby money.

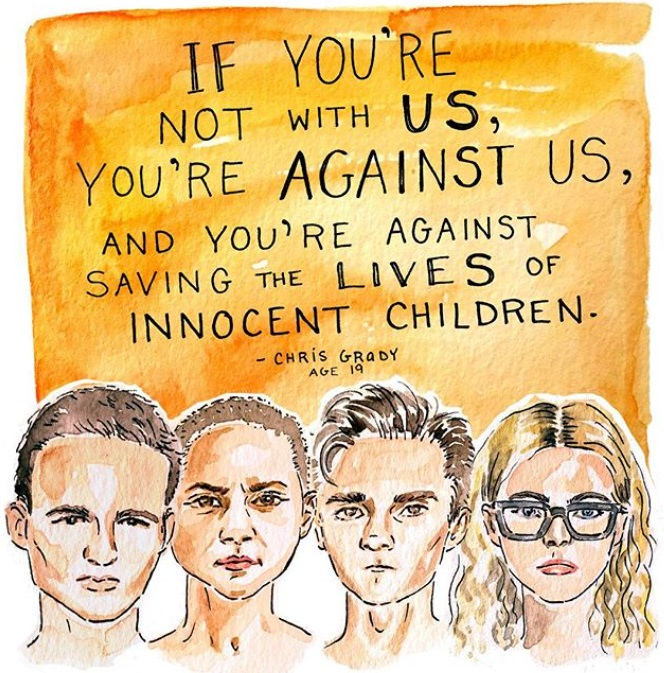

Cameron Kasky, Emma Gonzalez, David Hogg, and Delaney Tarr (art by Kimothy Joy) via Vince Reinhart, Flickr

In the wake of yet another senseless mass shooting, these students are calling for actionable policy changes that will serve to protect other youth from having to face the same horrific scenario of murdered friends, teachers, and administrators that they did. Without a doubt, these teens have shown an impressive level of organization that has already resulted in some changes and important conversations on the issue. The Stoneman Douglas students have inspired school walkouts across America, published impassioned articles and op-eds, given interviews on national news, led televised press conferences, influenced a lie-in in front of the White House, took center stage at a CNN town hall, have advocated for gun control at their state Capitol, are creating “wining” social media content to spread their message to legislators and the general public, and so much more. The March For Our Lives is planned for March 24 in Washington D.C. (and in more than 460 sister sites/events around the world) as activists will “demand that their lives and safety become a priority and that we end this epidemic of mass school shootings.”

As time goes on, the #NeverAgain movement may take on different forms, pursue various routes, and try different tactics. Given the life cycle of major protests, it can be difficult to sustain the momentum of continued interest and activism so imperative for driving change. Because of this I want to offer up some legal strategies the Parkland activists and others could employ.

https://twitter.com/neveragainmsd

Form a 501(c)3

One legal strategy the Parkland youth (and other groups interested in pursuing progressive gun policies with a structured platform) could take is forming a 501(c)(3) organization. But, as we mentioned, the Never Again activists are making waves and changes without an official nonprofit platform to stand on, so why would they bother? It’s a good question, and the answer is a multitude of benefits including the following:

Tax exemption/deduction: Organizations that qualify as public charities under Internal Revenue Code 501(c)(3) are eligible for federal exemption from payment of corporate income tax. Once exempt from this tax, the nonprofit will usually be exempt from similar state and local taxes.

Tax-deductible contributions: Even better—if an organization has obtained 501(c)(3) tax exempt status, an individual’s or company’s charitable contributions to this entity are tax-deductible. (It’s true that charitable deductions are generally not as “valuable” since the changes made by the 2017 tax bill, but that’s a topic for another post entirely).

Eligibility for public and private grants: Nonprofit organizations can not only seek charitable donations from the public, they can also seek funding from grant making organizations, like foundations and government entities.

Formal structure: A nonprofit organization exists as a legal entity and separately from its founder(s). Incorporation puts the nonprofit’s mission and structure above the personal interests of individuals associated with it.

Limited liability: Under the law, creditors and courts are limited to the assets of the nonprofit organization. The founders, directors, members, and employees are not personally liable for the nonprofit’s debts. Also these folks have no personal liability for the actions and obligations of the nonprofit. Of course, there are exceptions. A person obviously cannot use the corporation to shield illegal or irresponsible acts on his/her part. Also, directors have a fiduciary responsibility; if they do not perform their jobs in the nonprofit’s best interests, and the nonprofit is harmed, they can be held liable.

Focus your giving: With charitable giving flowing through a central nonprofit organization, it’s easier for donors and the organizers alike to focus the giving on a singular mission (such as advocating for progressive gun control and reform at both the state and federal policy levels). An organized nonprofit can be much less susceptible to varied causes and cases of the different donors, volunteers, and employees, because a platform can be clarified.

With all of these benefits in mind, the present-day Women’s March is great example of a movement that has spawned dynamic nonprofits including March On, Women’s March LA Foundation, Women’s March Alliance, and Women’s March Canada. Women’s March leaders also launched a super PAC in 2017, March On’s Fight Back PAC. (Note: The 501(c)(3) organization Gathering for Justice served as the presenting partner for the Women’s March on Washington, meaning the organization lent their 501(c)(3) status to the grassroots movement, so that all donations could be tax-deductible.)

Wait, Can Teens Even Form a Nonprofit?

Some of the criticism the Parkland students have weathered in the recent weeks has been based on their age. Without a doubt, these students have the right and have demonstrated a clear, mature ability to speak up for their cause even if some cannot legally vote in an election yet. Additionally, being a minor doesn’t prohibit them from founding a nonprofit organization. There are countless success stories of inspiring youth who haven’t let age hold them back from pursuing an amazing missions such as those behind The Ladybug Foundation, We Movement (which began as Free the Children), Kids Saving the Rainforest, Alex’s Lemonade Stand, and FUNDaFIELD (among many others).

The one things teens need to be aware of is that minors are typically not permitted to enter into legal contract unless they are emancipated. So, a teen could form a nonprofit, but then they may need to hand over control to a legal adult executive director in order for the nonprofit to pursue certain agreements and the like that would be beneficial.

How to Form a Nonprofit

Previously on this blog I wrote about how to form a nonprofit organization, but let’s review the basics; forming a 501(c)(3) involves four main steps:

- drafting, editing, and filing articles of incorporation;

- drafting and editing bylaws, with new board members then voting in favor of the bylaws in a duly authorized meeting;

- applying for an Employer Identification Number (EIN); and

- drafting, reviewing, and editing the IRS non-exempt status application, known as IRS Form 1023, as well as all the supporting materials IRS Form 1023 requires.

Note that each state can have different requirements for initial registration and filing, annual and employment filing, charitable fundraising compliance, and governance structure requirements. For example, in Iowa, there needs to be a minimum of one director (directors comprise the governing body of the nonprofit and serve as stakeholders in its mission and success) and an annual meeting is required.

So, if high school students in Florida form a nonprofit it would differ in process and compliance than if high school students in Iowa did the same.

What About Political Activity?

The limits on political activity is something that the Parkland students would have to adhere to if they formed a 501(c)3 organization. To maintain tax-exempt status, nonprofit organizations cannot participate with political campaigns on the behalf (or in opposition) of a candidate running for elected public office. So, this includes campaigns for U.S. president, senate, house of representatives, governor, state legislators, and even local offices like the county trustee. The IRS takes this rule super seriously and violations can result in a range of penalties from corrective actions to ensure the violation won’t reoccur, to excise taxes, to the revocation of tax-exempt status.

If the students did form a 501(c)(3), what could they do in terms of political-related activities?

The rule of thumb here is nothing partisan. So, nonprofits can certainly engage in non-partisan activities like voter education and registration drives, as well as non-partisan political debates. (Nonprofits just need to be prepared to demonstrate that their activities don’t help or harm any particular candidate, and how the activities fit in with the organization’s exempt purposes.)

Up until now the Parkland students have been advocating largely for a specific stance (legislation that favors gun control) and not specific political campaigns. They could continue to do this issue-related advocacy work, so long as boundaries are not overstepped and the lobbying turns into political campaigning.

Remember that individuals associated with a nonprofit (say a founder or director of fundraising, for example) retain their right to participate in the democratic process by campaigning for specific candidates and vocalizing opinions; individuals just cannot do so as a representative of a nonprofit organization.

Other Options for Organization

501(c)(4)

If the Parkland students and their supporters want more of an active role in directly supporting candidates that agree and support gun control, they may want to pursue forming a 501(c)(4) instead of or in addition to the 501(c)(3).

A 501(c)(4) IRS designation indicates a “social welfare” organization, which the IRS defines as, “Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare.” (Note: A 501(c)(4) can also include local associations of employees.) Some commonly recognized examples of this type of organization are volunteer fire departments, homeowners associations, Disabled American Veterans chapters, and community service groups like the Rotary Club. Even Miss America Organization is a 501(c)(4)! You may also know 501(c)(4)s that are openly connected with a specific political party or ideology, like Organizing for Action and Crossroads GPS.

What differentiates the 501(c)(4) from it’s (c)(3) cousin is this type of organization is allowed to participate directly and indirectly in politics…so long as it is not the organization’s primary focus. Under this type of designation, organization representatives can conduct unlimited lobbying efforts and engage in partisan campaign activity…but only as a secondary activity. In practice, this means the organization must spend less than half of their funds on political campaigns, candidates, and the like. (Most counsel would recommend 30 to 40 percent of funds to be on the safe side).

Super PAC

Another option would be for the students to form a super political-action committee (PAC). Super PACs are not a category of nonprofit, but rather their own beast. I could (and will!) write a full post on this type of entity’s history, fundraising abilities, and limitations. What’s important for you (and the Parkland students) to know is that that super PACS have no limitations on who (be it unions, corporations, associations, or individuals) can contribute and how much they spend on elections, specific candidates, and in opposition of other candidates. This is why the 2016 presidential election saw super PACs donate massive amounts like Priorities USA Action spent more than $133 million supporting Hillary Clinton’s campaign, and Right to Rise gave $86 million to Jeb Bush’s candidacy.

When it comes to political activity, the main restriction is that a super PAC cannot spend funds “in concert or cooperation with, or at the request or suggestion of, a candidate, the candidate’s campaign or a political party,” according to the Federal Election Commission. It’s also important to note that donors can give to a nonprofit anonymously, but cannot make anonymous contributions to PACs.

Tax-exempt organizations interested in direct political work can form a PAC as a separate legal and funded entity in addition to their normal mission oriented work.

This is all to say that the Parkland students (and their supporters) have a multitude of options if they wanted to harness the benefits a nonprofit organization and/or an entity like a super PAC allows.

For anyone looking to form a nonprofit (regardless of age!) I recommend you meet with an attorney experienced in nonprofit formation and compliance to ensure you’re meeting all requirements, as well as drafting the important policies and procedures.

I would be happy to offer you a free consultation, address any questions, or help you get started on pursuing your mission-oriented organization. You can contact me via email or by phone (515-371-6077).