GoFisch: May Edition

From Gordon's Desk..., NewsletterThis month's issue of GoFisch is out! Give it a read, subscribe, and pass it along to someone you know who could benefit from the information.

Missed past issues? Here are the April and March editions.

Bountiful Harvest: Charitable Giving Using Gifts of Grain

Charitable GivingFor donors who actively engage in farming on a cash basis [1], significant tax savings can be found through donating grain directly to a favorite charity such as a public library, church, or university. Yes, you read that right. Grain. In short,…

What recordkeeping is required for charitable deduction?

Charitable Giving, Taxes & FinanceSave $$$ and help your favorite charities even more.

Some say it's better to give than receive. I say, it’s better to give and receive. You can both give and receive by using the federal income tax charitable deduction.

A gift to a qualified…

Upcoming Event: Professional Advisor Continuing Education Program

Events, From Gordon's Desk...The Community Foundation of Carroll County, along with the Kuemper Catholic School, New Hope Village, and St. Anthony Foundations, teamed up to sponsor the Professional Advisor Continuing Education Program, in Carroll, Iowa. And, I’m excited…

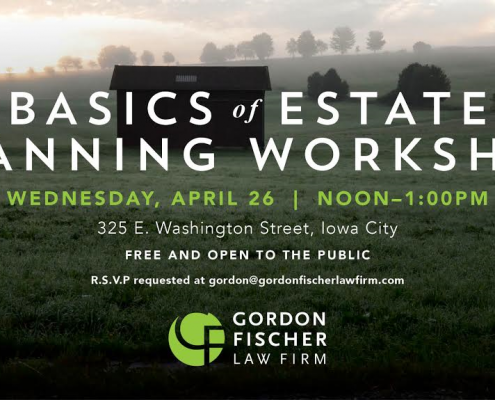

Free Workshop April 26: Basics of Estate Planning

Estates & Estate Planning, EventsLet's be honest, estate planning isn't the most enticing topic to spend your free time on. The last thing you want to do after a long week at work is to dive into the depths of the internet to attempt to understand what an estate plan actually…

GoFisch News: April Edition

From Gordon's Desk...It's hard to believe a month has passed since the first edition of GoFisch was sent out. Click here to read the latest edition of the monthly newsletter. If you like what you read and want GoFisch delivered right to your inbox, be sure to subscribe!

GoFisch is…