Happy Father's Day: Give Dad the Gift of Estate Planning

Estates & Estate PlanningHappy Father's Day to all the dads, grandpas, uncles, and father figures out there! There are many kinds of fathers, from the beer-drinking to the book-reading, from the golf-loving to the car-fixing, to all of the above. And, just like there's…

Estate Planning with Cryptocurrency

Estates & Estate Planning, Taxes & Finance, Wills, Trusts & EstatesA cutting edge issue in traditional estate planning is cryptocurrency. “Cryptocurrency” (as defined by Investopedia) is “a digital or virtual currency that uses cryptography for security. A cryptocurrency is difficult to counterfeit because…

Estate Planning Basics: What You Need to Know, but Were too Bored to Ask

Charitable Giving, Estates & Estate Planning, Powers of Attorney, Trusts, Wills, Wills, Trusts & EstatesI KEEP six honest serving-men

(They taught me all I knew);

Their names are What and Why and When

And How and Where and Who.– Rudyard Kipling

I’ll use all six “serving men”—what, why, when, how, where, and who, albeit sometimes…

In Honor and Remembrance: Memorial Day Estate Plan Discount

Estates & Estate Planning, Events, Wills, Trusts & EstatesI want to take this moment on Memorial Day to express my deep gratitude for the fallen heroes and military veterans who have served America. Indeed, we can enjoy the land of free only because of these brave individuals.

While Memorial Day…

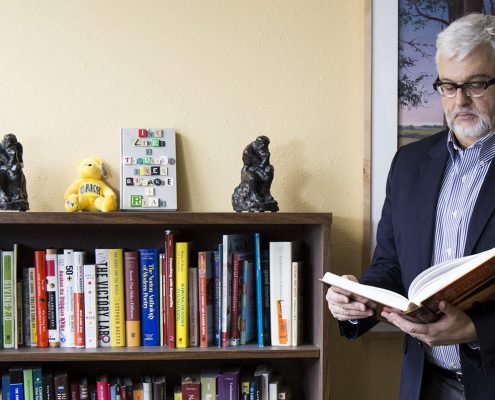

GoFisch Book Club: May 2019

Book ClubThis year marks the 70th iteration of recognizing May as Mental Health Awareness Month. Started in 1949 by Mental Health America, the month marks an opportunity for education, outreach and for us to have honest conversations about something…

Think Estate Planning is Just for the Wealthy? Think Again!

Charitable Giving, Estates & Estate Planning, Trusts, Wills, Wills, Trusts & EstatesThere is a rumor that has been floating around that only the rich need estate planning. That is extremely false. Everyone needs an estate plan, but the wealthy don’t need estate planning as much as the middle-class and working-class folks.…