It’s been said, “You should be giving while you are living, so you’re knowing where it’s going.” Giving now allows you more say over how your gifts are handled, and you’ll get to experience the joy that comes with helping the causes you care for most. Gifts to charities made during your lifetime also provide significant tax advantages. Here are five pro tips to stretch your charitable dollar.

Pro tip #1: Don’t give cash.

Sure, it’s easiest to give by cash or check. But, cash gifts are not tax-wise gifts…almost any other asset is a smarter, tax-wise gift than cash! As you’ll see throughout this short article, it makes much more tax sense to give other, less obvious assets.

Pro tip #2: Use the federal income tax charitable deduction.

I once read a Forbes article where the journalist said she cringes at church, when the collection plate goes around. The reason? The columnist worries churchgoers who toss in cash aren’t keeping records, and so are losing money by not claiming the federal income tax charitable deduction.

I don’t go that far, I don’t cringe in church, but I do think we should all keep records of our charitable gifts. What information you have to keep, and may need to provide to the IRS, depends on the size of your gift.

Pro tip #3: Use appreciated assets.

Gifts of long-term capital assets can receive a double federal tax benefit. Long-term capital assets may include items such as stock, real estate, and farmland, or even artwork, or collections like stamps or coins. The first tax benefit was just discussed; donors can receive an immediate federal income tax charitable deduction, equal to the fair market value of the long-term capital asset. Second, assuming the donor owned the asset for more than one year, the donor can avoid long-term capital gain taxes which would have otherwise been owed if the asset was sold instead of donated.

https://www.gordonfischerlawfirm.com/gifts-of-long-term-versus-short-term-capital-gain-property/

Pop quiz!

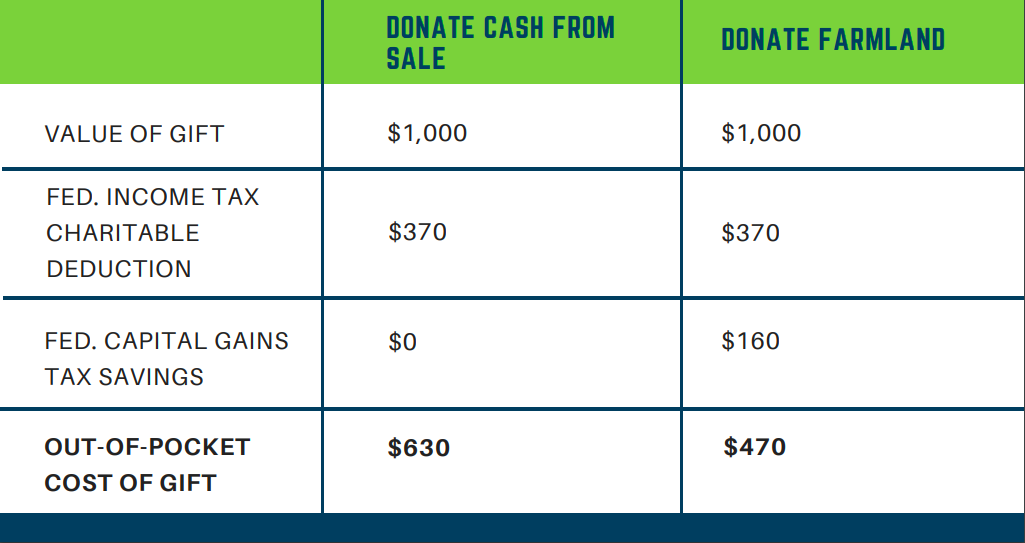

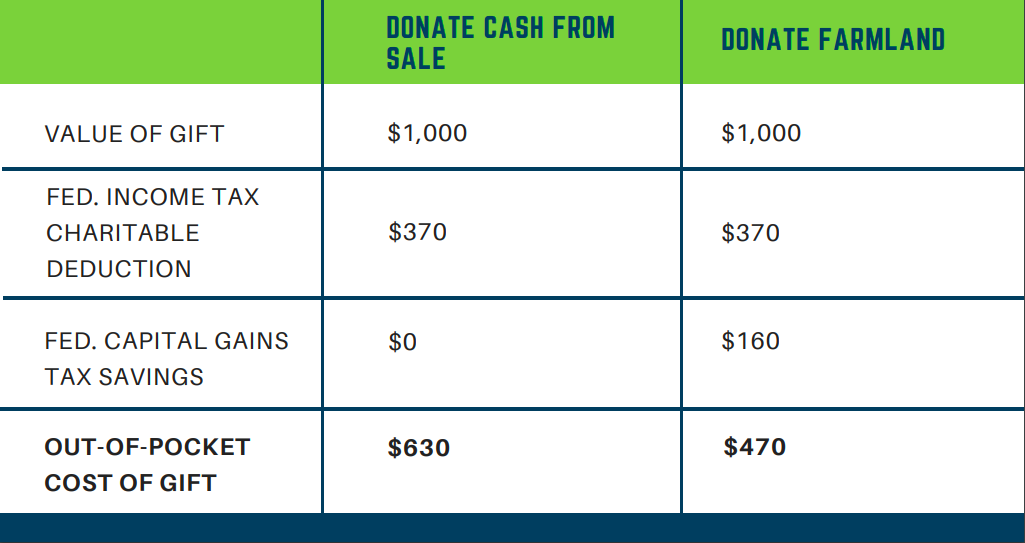

Let’s look at a concrete example to make sure the first three pro tips are clear. Pat owns farmland and she want to give one acre. Let’s assume one acre has a fair market value of $1,000. She wants to use the farmland to help her favorite causes. Which would be better for Pat — to sell the farmland and donate the cash, or give the farmland directly to her favorite charities? Assume the farmland was originally purchased at $200 (basis), Pat’s income tax rate is 37%, and her capital gains tax rate is 20%.

NOTE: Above table is for illustrative purposes only. Only your own financial or tax advisor can advise in these matters.

Pat receives a double benefit; she gets a federal income tax charitable deduction equal to the fair market value of the asset, AND avoids paying capital gains tax.

Pro tip #4: Make gifts which are eligible for the Endow Iowa Tax Credit

Through the Endow Iowa Tax Credit Program, donors can receive a 25% state tax credit for gifts made during lifetime. Endow Iowa has three requirements to qualify. The first two requirements are simple, but the third requirement can be tougher to meet.

- The gift must be given to, and receipted by, a community foundation. Opening a fund at your local community foundation is easy.

- The gift must be made to an Iowa charity. If it’s a national charity, and not a statewide or local organization, you simply need to check if they have an Iowa arm, and many do. In other words, to get the Endow Iowa tax credit, you couldn’t give to Girl Scouts of America, while you could give to Girl Scouts of Greater Iowa. To get the Endow Iowa tax credit, you couldn’t give to National Public Radio, but you could give to Iowa Public Radio.

- This third requirement is a bit more difficult than the first two. The Endow Iowa Tax Credit Program was designed to encourage endowments. Endowment means a permanent fund—something that will go on forever. So, to get the Endow Iowa tax credit, there is a limit on spending; you can only give out a maximum of 5% per year. This may, or may not, square with your charitable goals. Yet, for a tax credit of 25% off your gift, it’s something to seriously consider.

Endow Iowa Tax Credits are capped. The Iowa Legislature sets aside a pool of money for Endow Iowa, and it’s available on a first-come, first-served basis. Submitting an application at the beginning of the tax year is advised, as tax credits often run out toward year’s end. However, you can submit your application to be placed on the wait list for the next year’s tax credits.

Endow Iowa also has a cap for individuals and couples. Tax credits of 25% of the gifted amount are limited to $300,000 in tax credits per individual for a gift of $1.2 million, or $600,000 in tax credits per couple for a gift of $2.4 million (if both are Iowa taxpayers).

Pro tip #5: Combine Pro Tips #1-4 for dramatic tax savings.

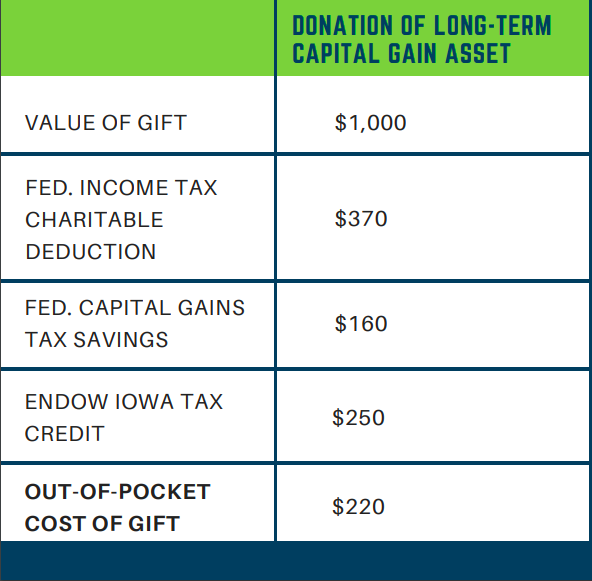

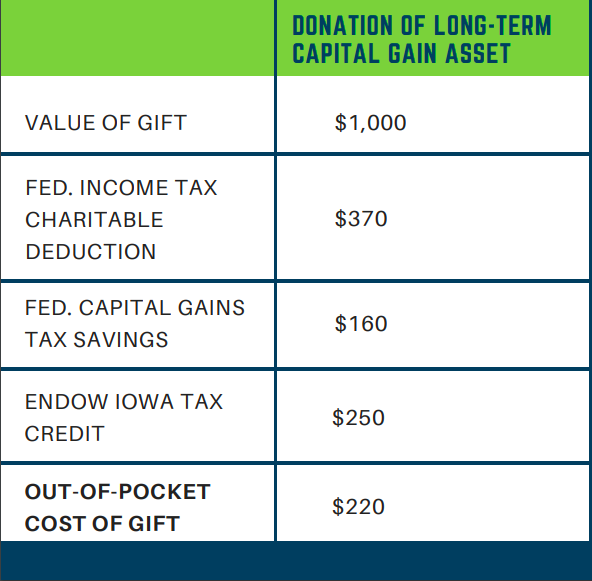

Combine the first four pro tips! If you combine the first four pro tips, you can achieve dramatic tax savings. Let’s look again at the case of Pat and her donation of a long-term capital gain asset (her farmland) with the addition of the Endow Iowa Tax Credit. Check out Pat’s tax savings:

NOTE: Above table is for illustrative purposes only. Only your own financial or tax advisor can advise in these matters.

Pat gave her favorite charity $1,000 in the form of a long-term capital gain asset. After Pat combines the federal income tax charitable deduction, the capital gains tax savings, and the Endow Iowa Tax Credit, the out-of-pocket cost of that gift of $1,000 is less than $250. Because her gift was endowed, it will be invested by the local community foundation and presumably will grow. It will continue benefiting the charities Pat cares about, forever…talk about a legacy!

Let’s Talk

Remember, all individuals, families, businesses, and farms are unique and therefore have unique tax and legal issues. This article is presented for informational purposes only, not as tax advice or legal advice for an individual’s situation. If you would like to discuss how you can help the causes you’re passionate about, while also making smart tax decisions, don’t hesitate to reach out via email or phone (515-371-6077).