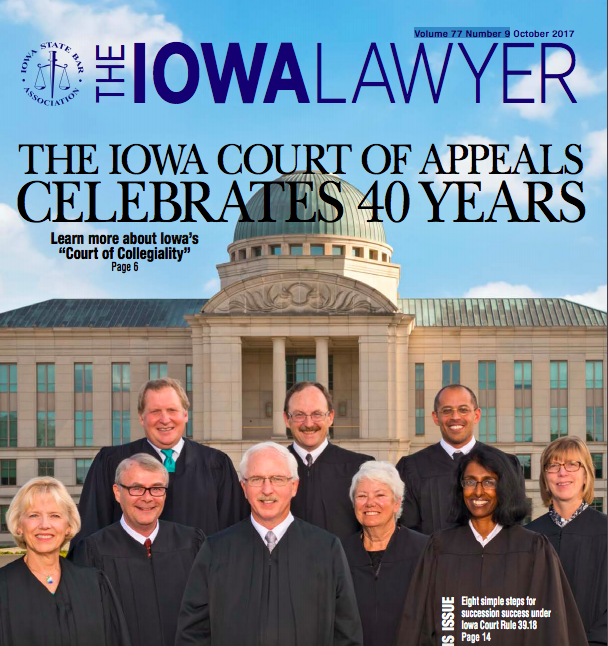

I regularly help and encourage my clients to complete business succession planning. So, I was immensely interested in fully understanding and helping to explain the Iowa Court Rule 39.18 which mandates some aspects of practice succession planning for active Iowa lawyers. I wrote extensively on the subject in a four-part series for The Iowa Lawyer (you can find links to all the articles here). But, with the deadline for compliance fast approaching, it is useful to have just the basic. The ISBA recently published my rundown of nothing but the essentials in The Iowa Lawyer Weekly, and for convenience I’m publishing it here as well.

This short article directly informs every Iowa private practitioner precisely what s/he needs to know about new Iowa Court Rule 39.18. Under the Iowa Court Rule 39.18, Iowa-licensed lawyers must take steps to prepare for their own disability or death. New questions that are related to Rule 39.18 compliance will be included on the Iowa Client Security Commission 2018 Client Security Reports to be filed via the Iowa Office of Professional Regulation between Dec. 26, 2018 and March 10, 2018 without penalty.

Two Tiers

Iowa Court Rule 39.18 is divided into two tiers; the first tier is mandatory; the second tier is optional. The second, optional tier is very helpful, and I’d urge every Iowa layer to seriously look at implementing it. Considering that I write this in mid-December, however, it may be wise for Iowa lawyers to make certain they are in full compliance with the mandatory provisions, and give the optional provisions more full and careful consideration in 2018. Since this article is about just the basics, I’m just going to discuss only the mandatory provisions of Iowa Court Rule 39.18.

Choose Designee and Custodian

Every Iowa attorney in private practice must choose and identify both a designated representative and a custodian. The term designee representative(s) is defined, while the term custodian is not. The designated representative (hereinafter “designee”) must be either an:

- active Iowa attorney in good standing;

- Iowa law firm that includes Iowa attorneys in good standing (including the attorney’s own firm); or

- qualified attorney-servicing association.

A “qualified attorney-servicing association” is a bar association, all or part of whose members are admitted to practice law in the state of Iowa; a company authorized to sell attorneys professional liability insurance in Iowa; or an Iowa bank with trust powers issued by the Iowa Division of Banking.

(Important note: Earlier this month The Iowa State Bar Association Board of Governors authorized The ISBA to serve as a qualified attorney servicing association.) Again, the term “custodian” in not defined. The custodian can be anyone – a fellow lawyer, friend, spouse, administrative assistant, whomever.

Clients Lists and Client Files

Additionally, every Iowa attorney in private practice is responsible for the following: (1) maintaining a current list of active clients in a location accessible by the designee; (2) identifying the custodian to the designee; and (3) identifying the locations of the client list, electronic and paper files, records, passwords, and any other security protocols required to access the electronic files and records for the custodian and, ultimately, for the designee.

Death or Disability

Iowa Court Rule 39.18 kicks into action only in two extreme circumstances: your death or your disability (a disability so severe you can no longer practice law, whether temporarily or permanently). Upon your death or disability, your designee is given broad authority, including the right to review client files (whether paper or electronic or both), notify each client of your death or disability, serve as a successor signatory for any client trust accounts, prepare final trust accountings for clients, make trust account disbursements, properly dispose of inactive files, and arrange for storage of files and trust account records. Also, the designee is authorized to access passwords and other security protocols required to access electronic files and records. Finally, as a “catch all” provision, the designee may determine whether there is need for other immediate action to protect the interests of clients.

Read More About Iowa Court Rule 39.18

If you would like to read deeper beyond these basics, click to the September through December 2017 issues of The Iowa Lawyer from the online archives to read our four-part series. In the series, all the elements (mandatory and supplementary) of Iowa Court Rule 39.18 are reviewed and explained in detail.

There is also a list of additional resources that can be found here. If you’re an active lawyer in Iowa help your fellow counselors out and share this piece with them so they will be prepared not only for the Iowa Client Security Commission 2018 Client Security Reports, but in the off chance of unexpected death or a disability. If you have any questions as you set your plans in place contact me by email or phone (515-371-6077).