Thanks for reading the 25 Days of Giving series; this is the “gift” for day 17! Plan on coming back to the blog every day from now through Christmas Day.

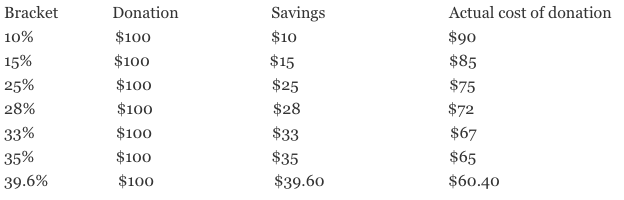

Might this be a good season to consider being more generous to your place of worship? Generally, churches are considered to be public charities. This means they are typically exempt from local, state, federal, and property taxes. This also means donations can be deducted if you itemize your federal income taxes.

Allow me to offer up four tips which could allow you to give more to your church and pay less in taxes. It’s a win-win situation: make a financially wise contribution AND a difference in an organization you care about.

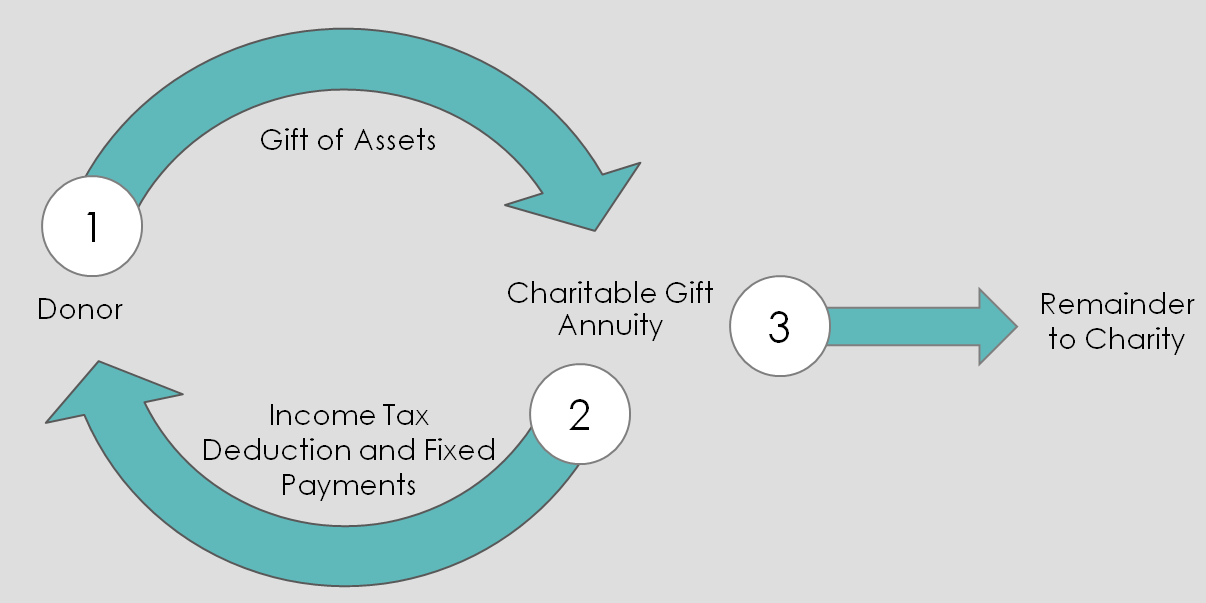

Tip 1: Consider All Your Assets

You need to consider ALL your assets for smart giving. Don’t just consider cash, but look at your entire basket. Here are three real-world examples:

- I know a farmer who doesn’t have a lot of cash on hand—we’ve all heard the phrase, “land rich, cash poor.” But, farmland itself can be a very tax-savvy gift. So are gifts of grain.

- I know a young person who’s self-employed. Again, not lots of cash on hand. But, this person inherited an IRA from a relative, and must make annual required minimum distributions [RMDs]. IRA RMDs can be a tax-wise gift.

- I also know a couple who recently retired. The couple has three life insurance policies, which made lots of sense when their kids were younger. Their kids are now grown and independently successful. A paid-up life insurance policy could be signed over to their favorite charity.

Your individual facts and circumstances are unique. Consider seeking a qualified attorney or financial advisor to look at your whole basket of assets.

Tip 2: Consider Long-Term Capital Gains Property

Gifts of long-term capital assets, such as publicly-traded stock and real estate, may receive a double federal tax benefit. Donors can receive an immediate charitable deduction off federal income tax, equal to the fair market value of the stock or real estate.

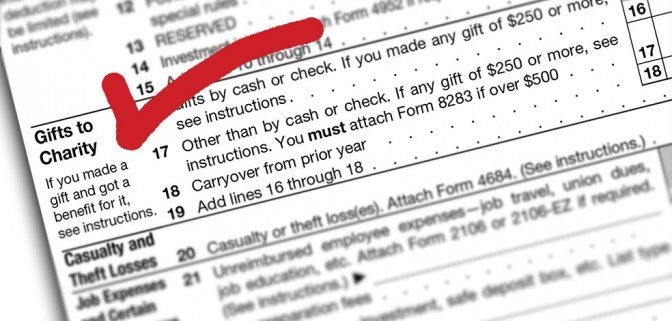

Records are required to obtain a federal income tax charitable deduction. The more the charitable deduction, the more detailed the recording requirements. For example, to receive a charitable deduction for gifts of more than $5,000, you need a “qualified appraisal” by a “qualified appraiser,” two terms with very specific meanings to the IRS. You need to engage the right professionals to be sure all requirements are met.

Second, assuming the donor owned the asset for more than one year, when the asset is donated, the donor can avoid long-term capital gain taxes which would have been owed if the asset was sold.

Let’s look at an example to make this clearer. Sara Donor owns stock with a fair market value of $1,000. Donor wants to use the farmland to help her favorite causes. Which would be better for Sara? To sell the stock and donate the cash? Or, gift the stock directly to her church? Assume the stock was originally purchased at $200 (basis), Sara’s income tax rate is 37%, and her capital gains tax rate is 20%.

| Donating cash versus donating long-term capital gain assets, such as publicly-traded stock | Donating cash proceeds after sale of stock | Donating stock directly |

| Value of gift | $1,000 | $1,000 |

| Federal income tax charitable deduction | ($370) | ($370) |

| Federal capital gains tax savings | $0 | ($160) |

| Out-of-pocket cost of gift | $630 | $470 |

NOTE: ABOVE TABLE IS FOR ILLUSTRATIVE PURPOSES ONLY. ONLY YOUR OWN FINANCIAL OR TAX ADVISOR CAN ADVISE IN THESE MATTERS.

Again, a gift of long-term capital assets made during lifetime, such as stocks or real estate, can be doubly beneficial. The donor can receive a federal income tax charitable deduction equal to the fair market value of the asset. The donor can also avoid capital gains tax.

Tip 3: Consider Endow Iowa Tax Credit Program

Under the Endow Iowa Tax Credit program, gifts made during lifetime can be eligible for a 25% tax credit. There are three requirements to qualify:

- The gift must be given to, or receipted by, a qualified Iowa community foundation (there’s a local community foundation near you).

- The gift must be made to an Iowa charity.

- The gift must be endowed (i.e., a permanent gift). Under Endow Iowa, no more than 5% of the gift can be granted each year – the rest is held by, and invested by, your local community foundation. This final requirement is a restriction, but still, in exchange for a 25% state tax credit, it must be seriously considered by Iowa lawyers and donors.

Tip 4: Combine the First Three Tips!

Let’s look again at the case of Sarah, who is donating stock per the table above. If Sarah makes an Endow Iowa qualifying gift, the tax savings are dramatic:

| Tax benefits of donating long-term capital gain asset with Endow Iowa | |

| Value of gift | $1,000 |

| Federal income tax charitable deduction | ($370) |

| Federal capital gains tax savings | ($160) |

| Endow Iowa Tax Credit | ($250) |

| Out-of-pocket cost of gift | $220 |

NOTE: ABOVE TABLE IS FOR ILLUSTRATIVE PURPOSES ONLY. ONLY YOUR OWN FINANCIAL OR TAX ADVISOR CAN ADVISE IN THESE MATTERS.

Note Sara’s significant tax savings! In this scenario, Sara receives $370 as a federal charitable deduction, avoids $160 of capital gains taxes, and gains a state tax credit for $250, for a total tax savings of $780. Put another way, Sara made a gift of $1,000 to her favorite charity, but the out of pocket cost of the gift to her was less than than a quarter of it.

Each donor’s financial situation and tax scenario is unique; consult your own professional advisor for personal advice. I’m happy to offer you a free consult to discuss your charitable giving options. I can be reached by phone at 515-371-6077 or by email.