Before I explain the concept of “heirs at law,” you might be thinking, why even bring this up? Of what relevance is this “Ye Olde Sounding Phraise” in today’s modern world?

It’s important for me to share the concept of “heirs at law” with you, dear GoFisch blog Reader, for three reasons.

- It helps explain why I, and other estate planners, ask so many darn questions. We need lots of info.

- The concept of “heirs at law” shows that you need to be open and honest and forthcoming with me, or any estate planner. Without complete transparency and truth, the estate plan runs the risk of being useless (the idea of “garbage in, garbage out” applies here).

- “Heirs at law” is yet another reason that a DIY will, or using an online service to produce your will, is just a terrible idea. You need an estate plan crafted by a trusted professional, unique to your special needs. Every family is different, so there can be no “one-size-fits-all” estate plan, and there are many moving parts to a comprehensive estate plan.

With that established, what does the term “heirs at law” actually mean?

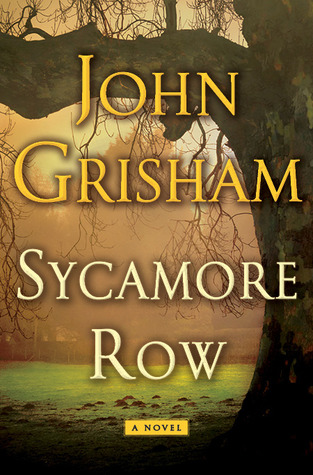

Heirs at law are those folks who would inherit your property in the event you died without a will, which is called intestacy.1 It is critically important to determine who the heirs at law are, even for people not subject to the laws of intestacy (i.e., folks who have a will) for two big reasons.

- Heirs at law must be notified of the probate process.

- Heirs at law are allowed to challenge the will in probate court.

All in the (sometimes complicated) family

As I already stated, it’s a wise idea to work with your estate planner and provide all the information requested. As a practical matter, the extent of information you’ll need to provide your estate planner regarding heirs at law depends of the nature of your family and relatives. For instance, in the case of two people, married only to each other, with children only from that one marriage—then the spouse and children (and perhaps grandchildren) will be the obvious heirs at law.

In another example, a family could also constitute a remarriage with each spouse having children from previous relationships. In this case, the stepchildren would need to be adopted by the applicable stepparent to be considered an heir at law.

In other situations, the client relatives may be much more distant, requiring more fact investigation. For example, take the case of a client who is unmarried and without children. In such a situation, the estate planner will need to pay close attention to identifying other relatives.

Of course, with an estate plan you can bequeath your estate to whomever you choose. You don’t have to give anything to any of your obvious or non-obvious heirs at law or any other relative for that matter. (In colloquial terms we could call this “stiffing your relatives.”) Although with that said, you cannot choose to disinherit a spouse.

This point reiterates why the estate planner should know and have updated contact information of who are the heirs at law. Again, it’s required that heirs at law be notified of probate process and these heirs (unlike a non-relative work colleague or neighbor) also have the legal standing to contest the will in court.

Another reason the estate planner must have knowledge of the heirs at law is to ward off fraudulent claims if need be. This reason is particularly important if the heirs at law are distant relatives. (An unfortunate real-world example of this involves Prince and the complicated intestate process following the singer’s passing without an estate plan.)

Bottom line: heirs at law are important when it comes to the distribution of your estate (with or without a will). Of course, dying intestate is NOT optimal and you DO need a will for a number of important reasons. I’d love to discuss the topic over the phone (515-371-6077) or via email. Don’t hesitate to contact me at any time!

[1] Bonus word! If an Iowan dies without a valid will, they die “intestate” and the laws of “intestate” succession are used to determine who will inherit the estate.