Estate planning is one of those pesky things you know you absolutely should do, but it tends to get pushed to the bottom of your continuous to-do list. Even the best plans to make this the year of finally getting your estate plan in order, life happens and things can get hectic. Unfortunately, when you or your loved one needs an estate plan the most, such as in the tragic situation of unexpected disability or death, it’s not readily available.

Together, we’re going to make this year your most prepared one yet! In the spirit of a fresh start, a new year and a new decade, here are six resolutions to set you up for estate plan super success.

Overcome Your Excuses.

It’s understandable why I often hear the same excuses from folks who should have an estate plan (aka everyone older than 18, regardless of age, debts, assets, and marital status), but don’t. Procrastination is a natural part of human nature, especially when you’re putting off perceived conversations on uncomfortable topics like money, death, and taxes. Yet, most people, once they learn the benefits which accrue to a completed estate plan, initial discomfort fades. So, let’s eliminate the three most common excuses:

Not enough time or too busy.

Let’s be honest, there’s never enough time. There never will be. The (sometimes cruel) irony of estate planning is that it’s there for you and your family when you’ve literally run out of time. You’ll be happy to know the bulk of time needed for an estate plan (if you work with a professional…and you should) is thinking about and communicating, what you want to happen with your assets upon passing. Who do you want to be your named as beneficiaries? Who do you want to serve as guardians to your kids? Also, you’ll need to consider carefully who you want to be your financial and health care agents in the case of disability.

(Note that such communicating can be easily done through a tool like my estate plan questionnaire.)

I don’t know where to start.

As excuses go, this has some validity but is easily quashed with a few tools that are available to everyone for free. First, read my post on all the basics of estate planning to get familiar with the six key documents. Second, fill out my free, no-obligation estate plan questionnaire. Truly, estate planning (at least my process), is just five easy steps from start to finish.

It’s too expensive to make an estate plan.

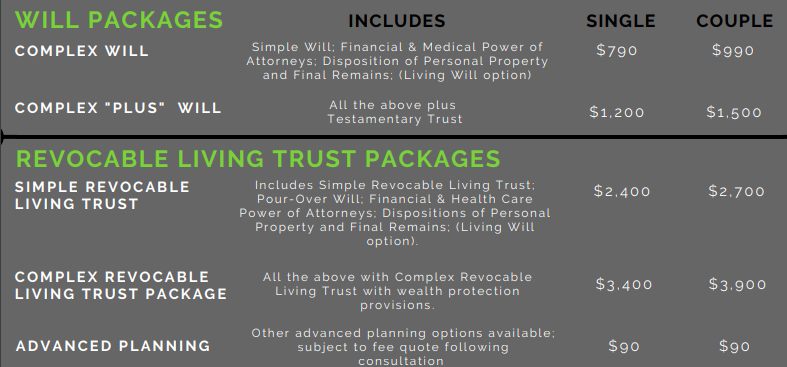

There’s no one-size-fits-all for estate plans. Therefore, costs will depend on your estate’s size, complexity, and your goals. I’ll be completely clear on the exact costs upfront, and that’s a guarantee. This is a major reason why filling out the estate plan questionnaire is such an important first step. Through your completed questionnaire, I can tell what you need, make a recommendation, and give you an exact price.

Keep in mind that it will almost certainly be more expensive for your family and loved ones if you die intestate (without a will). It will not only cost them monetarily, but also, much worse, emotionally as well, the process can be shockingly slow, tedious, and create unnecessary conflict.

Organize your digital asset information.

Think of all the information pertinent to your personal and professional life and the finances that you have on your computer. Think of all the important data that’s held entirely in online accounts. Often things like your email accounts, online banking, and storage accounts, for example, are referred to as digital assets. Access to these digital assets will be important for your chosen executor or trustee to handle and settle your estate. A solid estate plan will account for these digital assets and specify who you want to have access to all this data information in order to transfer/settle/close accounts appropriately. Additionally, you’ll want to have a separate, secure document or account (like LastPass, for instance) that lists your all accounts and their login information.

Be Resolute with Revisions

If you already have an estate plan, do a happy dance! You are way ahead of about 60% of the population, which doesn’t even have a basic will (or trust) in place.

While estate plans never expire, they do need to be updated and kept current. If you have a major life event, it may well warrant revisiting your estate plan. Such life events include marriage or divorce if you establish residency in a new state, the birth of a child, the loss of one of your beneficiaries/executors, or if your financial situation changes significantly.

Speaking of change, remember too that state and federal laws are perpetually changing and when certain rules change, so too must your estate plan. For instance, under the new tax law passed in 2017, the changes to the federal transfer tax exemptions could impact decisions as to if a certain type of trust is applicable. Again, this is where an experienced professional estate planner, whose job it is to stay up on these policy changes so you don’t have to, is beneficial.

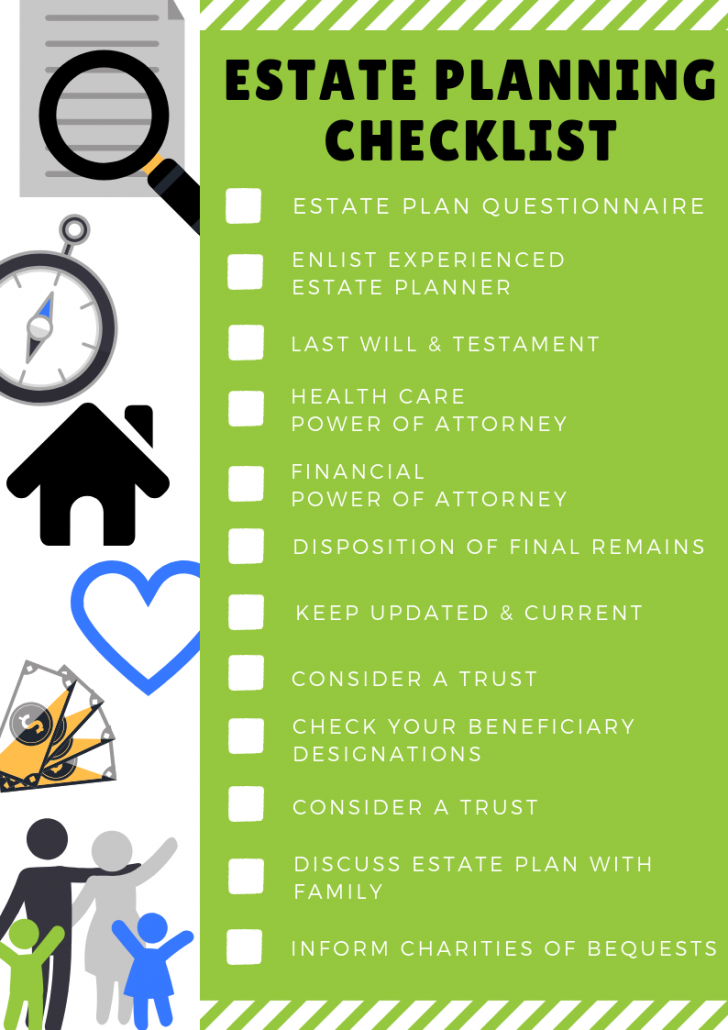

Check your Marks

The Gordon Fischer Law Firm Ultimate Estate Planning Checklist makes it easy to visualize your completion rate of all the important documents and related tasks. It’s easy to read, a handy dandy cheat sheet of items to accomplish to get you from zero to superhero in no time.

Plan for an Impact

There is a multitude of ways to practice impactful charitable giving. One incredibly easy way is to name charities near and dear to your heart as beneficiaries in your estate plan. The resolution here? Think about what charities you would like to give to, how much (a figure or percentage), and, if you already have an estate plan, review it. If it doesn’t include your chosen charities, it’s time for an update!

Transform Talk into Trust

When making estate planning decisions it’s important to discuss said decisions with your family (and others included in the plan). Communicating in advance and ensuring your loved ones fully understand the “what” and “why” means there’s a significantly better chance your wishes will be respected and executed fully as you intended. The worst-case scenario in estate planning is litigation over what the deceased (or critically disabled) individual wanted. For instance, if you have an end-stage medical condition, the last thing you want is family fighting over your health care power of attorney or living will. These conversations can be challenging, but ultimately should be conducive to a peaceful transition of assets, reduction of tension between beneficiaries, and a clear understanding of what was communicated and recorded.

Creating an estate plan that achieves your goals is a resolution you can DEFINITELY keep this year (even if that low-carb diet resolution doesn’t quite make it past January). The time it takes is nothing in comparison to the time it will save your loved ones in time, money, and stress! Plus, the peace of mind that comes with knowing your affairs are in order if something were to happen is invaluable. This is your year to be prepared. Let’s get started. Contact me at any time via email (gordon@gordonfischerlawfirm.com) or phone (515-371-6077) and in the meantime fill out the estate plan questionnaire.