Did anyone sit in the very back row of their high school calculus class, slumped over, the brim of their baseball cap lowered, hoping to become invisible? I’m asking for a friend, of course. The chalk marks on the board—a series of numbers—may as well have been Mandarin Chinese to me. The teacher was no help, he spit numbers faster than a rapper and made less sense than the chalk marks. My “friend” understood nothing but somehow passed by the skin of his teeth. Law school was suddenly a sure destination (or, really, any school without math).

Even Worse: College Math!

However, you needed an undergraduate degree before law school. (Ok…we’re talking about me, not my friend.) Thanks to the aforementioned miracle of passing calculus, my major at Iowa only required one math for graduation, at least at the time. That class was 22M-One, which was literally known on campus as 22M-Dumb. Still, I had to take the class twice. During the first try, halfway through the final exam, my friend got up, left his paper, and simply walked out. He knew he would flunk, so why torture himself or waste anyone else’s time? He barely passed the second time, and only did so after extensive tutoring.

Just curious, anyone have “math phobia” as bad as young me? This school daze story has a happy ending though. Eventually, I got past my major fear of math and was able to master the rules of math, especially as they relate to estate planning.

This Math Makes Sense

I know someone in your life (probably an engineer or actuary) has undoubtedly told you that math is fun and easy. But, when it comes to the IRA Charitable Rollover (AKA qualified charitable distribution (QCD)), this small bit of math really is!

You only need to remember six numbers:

- 70.5 (years)

- $100,000

- 1 (as in one plan)

- Zero (as in taxes owed if you do this right)

- Zero again (as in, zero gifts in return);

- 100% (every time I write about the IRA Charitable Rollover, I always get a certain response).

70.5 years of age

There are two threshold requirements to take advantage of a special provision known as the IRA Charitable Rollover. The first is that to be eligible you must be 70.5 years of age or older. An important nuance to note is the required annual distribution is based on the year the participant reaches age 70.5, not the day they reach that age.

The second threshold requirement is the IRA Charitable Rollover applies to IRAs only. Under the law, charitable gifts can only be made from traditional IRAs or Roth IRAs. The IRA Charitable Rollover does not apply to 403(b) plans, 401(k) plans, pension plans, and other retirement benefit plans. (I’ll discuss another great option, however, for these other retirement benefit plans, so be sure to read to the end of this blog post).

$100,000

Sure, living to 70.5 is great in itself, but it’s also the age where IRA Charitable Rollover allows individuals to donate up to $100,000 from their IRAs directly to a charity, without having to count the distributions as taxable income.

One Plan

A donor’s total combined charitable IRA rollover contributions cannot exceed $100,000 in any one year. The limit is per IRA owner, not per individual IRA account. Also, this amount is not portable (i.e., sharable) between spouses.

Zero (as in Zero Taxes)

The IRA Charitable Rollover permits taxpayers to make donations directly to charitable organizations from their IRAs without counting this money as part of their adjusted gross income (AGI). Consequently, this means not paying any taxes on them. You read that correctly: folks who are 70.5 years or older are able to transfer donations from their IRA directly to charity, up to $100,000, with ZERO taxes on that money!

What charities/nonprofits are eligible to receive the donation(s)?

Charitable contributions from an IRA must go directly to a qualified public charity. Contributions to donor-advised funds and private foundations, except in certain (narrow) circumstances, do not qualify for tax-free IRA rollover contributions.

Allow me to emphasize the gift must go directly to the charity. A donor cannot withdraw the money, and then give it to charity. Rather, the IRA administrator must send the donation straight to the charity.

Zero (as in gifts/services back from charity)

Donors cannot receive any goods or services in return for IRA Charitable Rollover amounts in order to qualify for tax-free treatment. As one philanthropist explained, “Why would you want to (potentially) mess up a $100,000 tax-free donation by getting a $25 tote bag?” No matter how good the bag looks, it’s not worth that!

70.5 years of age and IRAs only

Once again, to be eligible you must be 70.5 years or older. Also, qualifying gifts can only be made from traditional IRAs or Roth IRAs. Charitable donations from 403(b) plans, 401(k) plans, pension plans, and other retirement plans are not covered by the IRA Charitable Rollover law.

100%

Every time I write about the IRA Charitable Rollover, I receive communication from someone saying that life sucks because they don’t qualify for the Rollover. They aren’t 70.5 years old, or they have a different retirement benefit plan than an IRA, or both.

But, here’s the thing, anyone can still use their retirement benefit plan(s) to help their favorite charities.

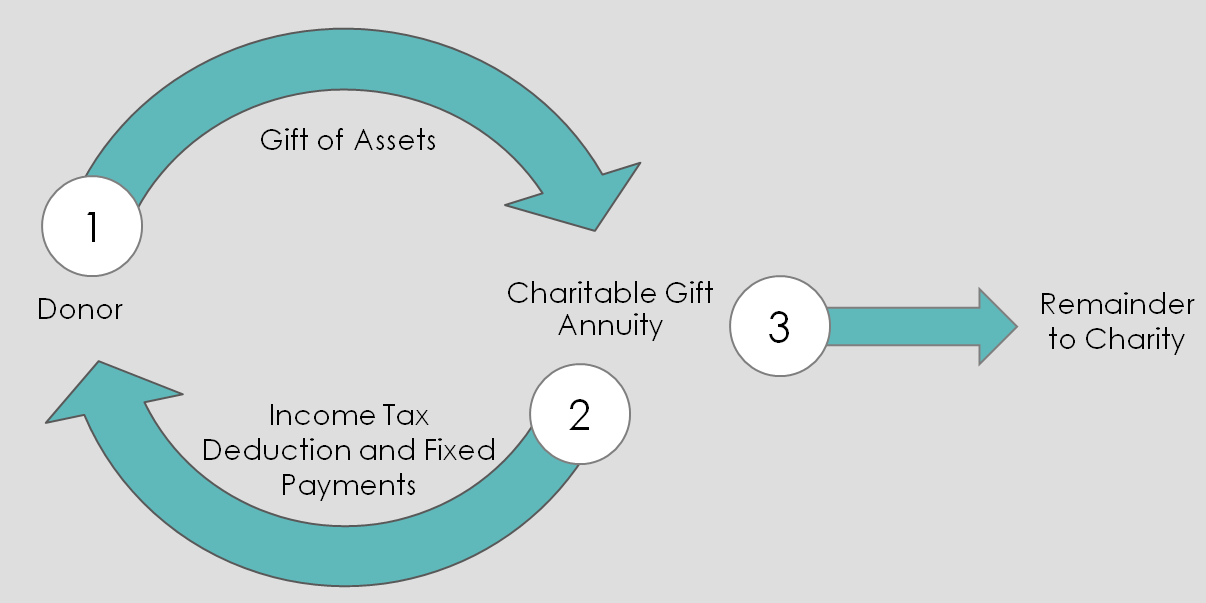

Magic of Beneficiary Designations

No matter what your age, or what your type of retirement benefit plan (IRA, 401(k), 403(b), etc.), there is a super-easy way for you to help your favorite charity. Simply contact the account holder and name your favorite nonprofit as a beneficiary! This is so simple. No lawyer or drafting of legal documents is required—the owner of the retirement benefit plan simply has to direct the account holder to change the beneficiary. There are also no taxes with this charitable giving approach because, frankly, when the donation passes to the charity it’s because you’re dead. No taxes for the nonprofit either; as a qualified nonprofit, they don’t pay taxes on donations.

Note that if the account owner is married, the spouse should be informed and may need to consent to the designation. And, please follow up with the account holder to make sure the account holder received your request and made the beneficiary changes properly in full.

Want to work through how the IRA Charitable Rollover math fits in with your planned giving goals and current/future tax strategy? Reach out to me anytime. I offer a free, no-obligation one-hour consultation. You can contact me by email (gordon@gordonfischerlawfirm.com) or on my cell (515-371-6077).