When Prince died in 2016 the world lost an icon and amazing contributor to music and art. Unfortunately, it has come to light that the award-winning artist passed away without an estate plan. Considering all of Prince’s 12 properties, eight vehicles, fine art, unreleased music, and hoarded gold bars, it’s estimated his entire estate could be worth $300 million pre-tax. Prince didn’t have any stocks or bonds but he did have about $6 million spread across four companies. A Minnesota court judge on the issue said without the will the estate’s current status is “personal and corporate mayhem.” Comerica Bank & Trust—the company that took over the Bremer Trust’s duties to administer the “Purple Rain” singer’s estate earlier this year—is still appraising the total value of the estate and itemizing everything Prince owned.

The situation has created a tragic real world example of the infighting and conflict that can occur if passing away without a will; currently there are six potential heirs to Prince’s fortune including his sister and five other half-siblings.

Now, most Iowans aren’t going to have multiple gold bars sitting around and properties valued at over $25 million total, but that doesn’t make what assets and property you do have any less important. If you don’t have a will, it can cost your family and friends a lot of time, a lot of money, and indeed lots of anxiety and even heartache. Here are four reasons you need a will.

- Without a will, probate courts and the Iowa Legislature decide everything about your estate.

If you die without a will, you are leaving it up to the legislature/courts to decide who will receive your property. Or possibly even who will get to raise your children!

- Without a will, you cannot choose a guardian for your children.

After Prince died multiple claims were put forth about potential biological and adopted children. Whether or not those claims are true, you likely do know who your children are and if you die without a will, the courts will choose guardians for your children. One of the most important aspects of a will is that it allows you to designate who will be the guardian for your children. This can ensure that your children are cared for by the person that you want, not who the court chooses for you.

- Without a will, the probate court will choose your estate’s executor.

If you die without a will, the probate court is forced to name an executor. The executor of your estate handles tasks like paying your creditors and distributing the rest of your assets to your heirs. Of course, if the probate court has to pick who will be your estate’s executor, there is always a possibility that you would not have approved of that person if you had been alive.

If you have a will, it will name an executor who will carry out all of your final wishes, pay your bills, and distribute your assets just as you wanted.

- Without a will, you can’t give your favorite nonprofits gifts from your estate.

Prince was a resident of Minnesota, and each state has different matters regarding intestate succession (dying without a valid will). If you die without a will, your estate assets—your house, savings, life insurance, trusts—will pass to your heirs under Iowa’s statute. But, if you have a will, you can include gifts to your favorite nonprofits and see that they are helped for many years to come. Prince may have wanted to give to charities given his track record while living. He gave to Black Lives Matter, Harlem Children’s Zone, and National Public Radio. Prince was actively engaged with #YesWeCode, an initiative to train black children for good jobs in the tech industry. He gave more than $1.5 million over just two years to Love 4 One Another Charities Tour and supported an environmentalist group working to fight climate change and grown green jobs among other initiatives, Green For All. Regrettably, without an estate plan Prince didn’t have a chance to support these charities through his estate in the event of his death.

Let’s be honest, the topic of estate planning can be a little, well, dry. Every lawyer, financial advisor, real estate agent, and the like will encourage you to have a quality estate plan professionally drafted, but it tends to be one of those things you’ll get to eventually. Life happens, work piles up, your to-do list grows longer and deciding what you want done with your remains after you die seems like a worry for another day. But, once in a great while a story comes up where the topic of estate planning is so necessary and uniquely integrated that it’s hard to ignore—cue the buzz-worthy podcast, S-Town. The podcast broke a record with 10 million downloads in four days, so don’t just take my word for it.

Caution: A few spoilers ahead

If you haven’t listened to S-Town and don’t want to know ANY details of what unfolds, stop reading now. Go listen and then come back to read how S-Town exemplifies some of the key reasons you need a will ASAP.

The highly bingeable story from Serial Productions (masterminded by the producers at This American Life and Serial), takes place in a small town in Alabama. As This American Life producer Brian Reed dives into what appears to be a true crime story, in line with the first season of Serial, the tale takes an unexpected twist following an unanticipated death.

The person who passed away didn’t have an estate plan. At first this may not seem like a big deal, but without a last will and testament, the individual’s death left a wake of conflict and confusion. Without an estate plan, a mother with dementia is left without defined care and guardianship; 13 dogs are left without a pet trust to declare who will care for them; property is fought over; a felony charge is issued; a religious funeral is held despite the deceased’s atheism; a house and land are sold, likely against the wishes of the individual if they had been alive; an immaculate, amazing garden maze will be destroyed; and because the deceased was “unbanked” there were no cash assets to pay for a funeral and other important costs. This person had verbally told some people what he wanted them to have in terms of property and monetary assets, but there was no written record, and such hearsay doesn’t hold up in a probate court.

S-Town is not only an example of excellent storytelling, but also a real world example of what can happen when someone dies without putting in place clear directions and wishes for property, cash and non-cash assets, pets, health care, and final disposition. You don’t want your family and friends to fight, press charges, and dig up your property in search of gold when you die. So, there’s no day like today to have your estate plan drawn up.

A good place to start is with my obligation-free Estate Plan Questionnaire.

Already have an estate plan? Good. It’s probably time you reviewed and updated it.

Feel free to contact me any time to discuss further how to start an estate plan. I offer a one-hour free consultation, without any obligation. I can be reached any time at my email, gordon@gordonfischerlawfirm.com, or on my cell, 515-371-6077.

In Iowa, Spouses Can’t Disinherit Spouses

Can Monica, my wife, disinherit me? In a word, no.

Assuming a valid marriage in Iowa, a spouse cannot disinherit a spouse. Even if a spouse wants to do so, even if that’s the spouse’s true intent—nope.

What If…?

What if in a legal will, the first-to-die spouse includes the following clause:

“I acknowledge that I have a spouse, named Gordon Fischer, who is not provided for in this will. It is my specific intention to not provide for my spouse Gordon Fischer under the terms of my will.”

Even with a clear clause like this, I, Gordon, am not disinherited. Why is this so?

Statutory “Forced Share”

An Iowa statute allows spouses to take a “forced share” against the will. In short, the surviving spouse has a choice; the spouse can inherit any property bequeathed to him/her under the will, OR the spouse can take a forced share. So, even if a will leaves nothing for the surviving spouse, the surviving spouse can take a forced share against the will.

Under Iowa law (specifically, Iowa Code § 633.238), a surviving spouse that elects against the will is entitled to:

- One-third of the decedent’s real property;

- All exempt personal property that the decedent held; and,

- One-third other personal property of the decedent that is not necessary for payment of debts and other charges.

In other words, a surviving spouse can choose (elect) after your death to basically ignore your will or trust that doesn’t provide for said surviving spouse, and take approximately one-third of your estate.

For example, if you left your entire estate to your children and not your spouse, your spouse can say, “You know, I don’t like this at all. I’ll take one-third of my dead spouse’s estate. Thank you!” And, pretty much just like that, boom, the surviving spouse can do so.

Oral Agreement to Disinherit

What if Monica and I talk about this matter and come to an oral agreement. Something like this:

Monica: I want to disinherit you. Should you be the surviving spouse, you should get nothing.

Gordon: Wow. That hurts. But if that’s what you want honey, I agree.

Is this agreement enforceable? No, for several reasons. First, it’s not written and oral agreements are generally unenforceable. Also, it doesn’t and can’t displace the plain language of an Iowa statue which allows a spouse to elect a forced share against the will, and gain one-third of the estate. You can’t orally agree to ignore a statute’s clear intent!

Written Agreement to Disinherit

But what if Monica asked me to agree, in writing, to not take a spousal share? Say, we write up a formal contract stating I’m essentially not getting anything under Monica’s will, no how, no way. I also agree in the contract that under no circumstances will I take a statutory share.

Would such a written contract be enforceable? No.

While Iowans have a great deal of freedom to contract, just like the above oral agreement example, you can’t contract in direct opposition to a clear statute.

Postnuptial Agreements

Also, interestingly, Iowa courts have ruled postnuptial agreements are not enforceable.

Postnuptial agreements are written contracts between spouses that are executed after the couple has married (as opposed to the prenuptial agreements you usually hear about). Iowa courts have struck down postnuptial agreements for nearly a century, since 1912 when the Iowa Supreme Court first found postnuptial agreements to be of no validity. In re Kennedy’s Estate, 135 N.W. 53 (Iowa 1912).

But Monica, it’s OK. Very likely you’ll be the surviving spouse anyway.

Beyond just your spouse, it’s important to have an updated estate plan to define all of your beneficiaries and wishes for your estate following your death. Have questions or need more information? Feel free to reach out any time. You can contact me by email at Gordon@gordonfischerlawfirm.com or give me a call at 515-371-6077.

I’m proud to be an active Rotarian. I’m also proud to be an Iowa lawyer.

And, I am proud of the singular, perhaps even unique, mission of my law firm. The mission of Gordon Fischer Law Firm is to promote and maximize charitable giving in Iowa.

To achieve this mission, I help individuals, families, and businesses with estate planning that ranges from simple wills to complex trusts. I assist nonprofits reach their philanthropic goals. I guide donors in increasing their charitable giving.

Naturally, my membership in Rotary and the mission of my law firm intersect perfectly when it comes to supporting the Rotary Foundation. The Rotary Foundation does so much good both here at home and around the world.

As the Rotary Foundation states on its website, the Foundation “taps into a global network of Rotarians who invest their time, money, and expertise into our priorities, such as eradicating polio and promoting peace. The Foundation grants empower Rotarians to approach challenges such as poverty, illiteracy, and malnutrition with sustainable solutions that leave a lasting impact.”

As a Rotarian, and as a lawyer, I wanted to share some of my expertise to allow Rotarians to give even more generously, so the Rotary Foundation can continue to do, and perhaps even expand, their great work.

TYPES OF CHARITABLE GIVING

It’s easiest to understand charitable giving by looking at it in two broad categories: giving during lifetime (called inter vivos transfers), and giving at death (testamentary transfers). There is a third category which lawyers call “split interest gifts”—tools that can be used during life or by operation of a will (such as, charitable gift annuities and charitable remainder trusts).

Read on to learn more about testamentary gifts made through your estate plan. Then we’ll talk about charitable giving during your lifetime. Finally, we’ll discuss two special philanthropic tools that can both be used during life and at death.

CHARITABLE GIVING THROUGH YOUR ESTATE PLAN

Estate plan is set of legal documents

An estate plan is simply a set of legal documents to prepare for the event of your death or disability. Note I said “estate plan,” and not “will.” While these terms are often used synonymously, they are not at all the same thing. An estate plan is a set of legal documents, and a will is just one of those documents, albeit an important one.

Six “Must Have” Estate Planning Documents

There are six documents that should be part of most everyone’s estate plan. Plus, you should keep these documents updated and current. Also, don’t forget about assets with beneficiary designations, such as savings and checking accounts, and retirement benefit plans. For many Iowans, that’s enough— keeping six documents and assets with beneficiary designations current.

I’ll just briefly touch on five of the six documents, before we dive into your will and charitable gifting to the Rotary Foundation.

Estate Planning Questionnaire

You should begin with an estate planning questionnaire. (Like this one on my website.) An estate plan questionnaire is an easy way to get all of your information in one place, and it should help you understand and prioritize estate planning goals.

Powers of Attorney

A power of attorney for healthcare designates someone to handle your healthcare decisions for you if you become unable to make those decisions for yourself. This essentially gives another person the power to make medical decisions on your behalf.

The power of attorney for financial matters is similar, only your designated agent has the power to make decisions and act on your behalf regarding your finances. This document gives your agent the authority to pay bills, settle debts, sell property, or anything else that needs to be done if you become incapacitated and unable to do this yourself.

Disposition of Personal Property

Another useful document is the disposition of personal property. This is where you get to be specific about items you want people to have, say, your eldest daughter getting your wedding ring, or your nephew getting your baseball card collection.

Disposition of Final Remains

Yet another helpful document is the disposition of final remains, where you get to tell your loved ones exactly how you want your body to be treated after you pass away. This could include details on burial or cremation, and what type of service(s) you want.

Where there’s a Will, There’s A Way to Help Rotary Foundation

Now let’s get to the will. With your will, you’ll be answering four major questions:

- Who do you want to have your stuff? A will provides orderly distribution of your property at death per your wishes. Your property includes both tangible and intangible things. (An example of tangible items would be your coin collection. An example of an intangible asset would be stocks.)

- Who do you want to be in charge of carrying out your wishes as expressed in the will? The “executor” is the person who will be responsible for making sure the will is carried out as written.

- Who do you want to take care of your kids? If you have minor children (i.e., kids under age 18), you’ll want to designate a legal guardian(s) who will take care of your children until they are adults.

- What charities do you want to support with your estate assets? Which of your favorite causes do you want to support at death, like the Rotary Foundation?

Four Types of Bequests

Charitable gifts in a will are called “bequests.” Generally speaking, there are four types of bequests.

- Pecuniary Bequest: A gift of a fixed or stated sum of money designated in a donor’s will. An example: “I give the sum of $10,000 (ten thousand dollars) to Rotary Foundation.”

- Specific Bequest: A gift of a designated or specific item in the will. The item will most likely be sold by the organization and the proceeds would benefit that nonprofit. An example: “I give my Grant Wood painting to Rotary Foundation.”

- Residuary Bequest: In legal terms, a “residue” of the estate is what is left of the estate after payment of debts, funeral expenses, executors’ fees, taxes, legal, and other expenses incurred in the administration of the estate, and after any gifts of specific assets or specific sums of cash. The estate residue would include all property, both personal and real estate. A residuary clause is a provision in a will that passes the residue of an estate to beneficiaries identified in the will. An example: “I give all of the residue of my estate to the Rotary Foundation.”

- Contingent Bequest: A gift in a will made on the condition of a certain event that might or might not happen. A contingent bequest is specific and fails if the condition is not made. An example: “I give the sum of $10,000 (ten thousand dollars) to my niece, Jane Smith, if still living. If my niece fails to survive me, I give the sum of $10,000 (ten thousand dollars) to the Rotary Foundation.”

Which type of bequest to the Rotary Foundation should you choose? It really depends on your personal circumstances. Consult your individual estate planner for specific advice.

CHARITABLE GIVING DURING LIFETIME

It’s been said, “you should be giving while you are living, so you’re knowing where it’s going.” Many Rotarians have intentions to donate eventually to the Rotary Foundation, often, as we’ve been discussing, at death through their estate plan. But why not give now? You can have more say about your gifts while you are still alive, and also feel the joy that comes with helping the cause you care about most. There are also lots of good tax reasons for giving now rather than later.

Imagine Rotarian Jill Donor, wanting to help her favorite nonprofit. When asked for a charitable gift to the Rotary Foundation, Donor agrees and immediately reaches for her checkbook, or goes online to donate with a debit/credit card.

It’s noble for Donor to give. However, consider this question: should Donor give cash? Or, does Donor own other non-cash assets which might be more tax-savvy? Can Donor be even more generous in support of her favorite cause, while lowering her out-of-pocket costs for charitable gifts?

Also, keep in mind that cash is only a small sliver of Donor’s overall assets and net worth. Even putting aside tax benefits, couldn’t Donor give more to the Rotary Foundation by looking at her much more robust non-cash assets? Let’s explore some non-cash gift options.

Appreciated, Long Term, Publicly Traded Stock

All sorts of non-cash assets can be used for charitable gifts to the Rotary Foundation, but for several reasons, appreciated, long-term, publicly traded stock is a wise choice. It’s convenient to give, you can save money on capital gains taxes you would have paid had you sold the stock, and it’s easy to value.

Endow Iowa Tax Credit

All Iowans should be aware of the Endow Iowa Tax Credit. Endow Iowa allows donors who give qualifying charitable gifts to receive a whopping 25% state tax credit. I have some illustrations showing what great tax savings can be realized by use of the Endow Iowa Tax Credit.

IRA Charitable Rollover

The federal law known as the IRA Charitable Rollover allows individuals aged 70½ and older to donate up to $100,000, tax free, from their IRAs directly to Rotary Foundation. There are two threshold requirements. First, you must be age 70½ or older. Second, the retirement plan account must be an IRA. Want more details? This blog post digs in.

Retirement Benefit Plans

For those not yet 70 ½ and/or who don’t have an IRA, but another type of retirement plan, think about this. Sometimes owners’ retirement benefit plans must make what are called Required Minimum Distributions, or RMDs. Since you must withdraw RMDs, anyway, why not give the money to a worthy charity like Rotary Foundation?

For those who don’t yet have to make RMDs, remember that after age 59 ½, generally you can make withdrawals from your retirement benefit plan without any tax penalty. If indeed there’s no penalty, and you make a charitable gift from your retirement benefit plan, you can presumably take an income tax charitable deduction. This should therefore be a “wash” for tax purposes.

Also, keep in mind: you can make a very meaningful gift simply by naming the Rotary Foundation as beneficiary of an IRA, 401(k), 403(b), or other retirement plan. Giving retirement assets in this way is quite easy. Simply contact the institution holding your retirement plan, request a change of beneficiary form, fill the form out completely and correctly, and return the form. Typically naming a beneficiary in this way does not require drafting or amending a will or trust.

“SPLIT INTEREST” GIFTS

A “split interest” gift is when a donor makes a gift to a qualified charity, like the Rotary Foundation, but retains the right to a portion of the gift. Typically, the gift is divided into lifetime income and asset value at death. The majority of donors retain income during their lifetime.

There are two split interest gifts which might be greatly helpful to donors wanting to support the Rotary Foundation. Let’s discuss each briefly.

Charitable Gift Annuity

A Charitable Gift Annuity (CGA) is a contract. It’s a contract that combines the benefits of an immediate income tax deduction and a lifetime income stream. Also, your future taxable estate will be reduced for the remainder value of the property transferred to charity.

A CGA is an arrangement in which you make a gift of cash, or other property, in exchange for a guaranteed income annuity for life. This is similar to buying an annuity in the commercial marketplace, except that you can claim an immediate charitable tax deduction for the excess of the value of the property over the value of the annuity, based on IRS tables. The charity must receive at least 10% of the initial net value of the property transferred in order for you to claim a charitable deduction for a portion of the purchase price.

There’s much more to say about CGAs. I wrote an article detailing more specifics, as well as their benefit, check it out here.

Charitable Remainder Trust

A charitable remainder trust (CRT) provides a unique opportunity for donors to retain lifetime income from property while obtaining a current income tax deduction (or estate tax deduction) for the remainder interest which will pass to charity.

Charitable remainder trusts are often appealing to donors with appreciated assets, producing little or no income, such as real estate or securities. This is because the assets can be sold without capital gains tax and invested to provide a higher income stream.

A CRT separates the current interest and future interests in property and disposes of each differently. Income from trust assets is paid to at least one non-charitable beneficiary (often, the grantor or the grantor’s family) for a certain period. The payments can be made for the non-charitable beneficiary’s lifetime (or joint lives for multiple beneficiaries), or over a fixed period of up to 20 years. When the non-charitable beneficiary’s interest ends, the trust assets pass irrevocably to a charity. I’m doing a deep dive into CRTs with a three-part series, you can read the first post, here.

SUM IT ALL UP

What all this means is that you, dedicated Rotarian, have a treasure chest of choices when it comes to making charitable gifts that can have an impact. Charitable giving can, and should, be a mutual positive situation that benefits the Rotary Foundation as well as the donor. Of course, this is just the tip of the iceberg. I would love to start a conversation with you about your estate planning and charitable giving goals. Feel free to reach out at any time; you can find me by email at Gordon@gordonfischerlawfirm.com or by phone at 515-371-6077. Or just grab me at Rotary Lunch!

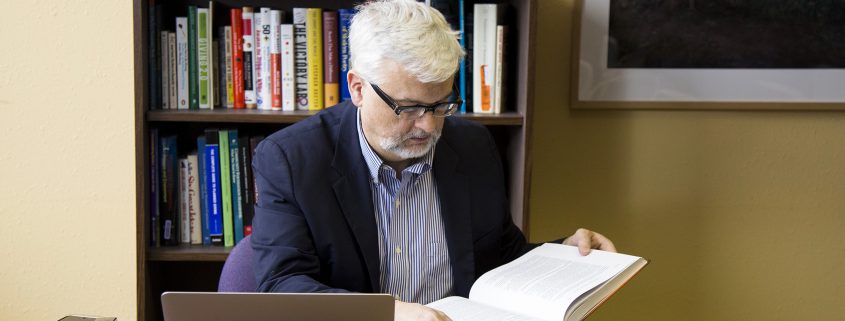

Gordon Fischer has been an active and accomplished Iowa lawyer for more than 20 years. Gordon received his law degree, summa cum laude, from Southern Illinois University. After law school, Gordon clerked for the Iowa Court of Appeals. He then joined the Des Moines firm of Bradshaw, Fowler, Proctor & Fairgrave, P.C. He became a partner and gained a reputation for skilled and conscientious litigation in all areas of law, with a focus on employment. In 2013, Gordon left the firm to become Vice President of Gift Planning Strategies for the Community Foundation of Greater Des Moines, where he helped donors plan and achieve their philanthropic goals. In 2014, he received the Chartered Advisor in Philanthropy designation from The American College of Financial Services.

Gordon serves his community and his profession in a variety of ways, on boards and commissions and as a mentor and hands-on volunteer, and through his involvement as a Rotarian. At Gordon Fischer Law Firm, P.C., he blends his legal expertise and commitment to the charitable sector and those who support its work.

I, along with all of you, just watched the totally wild end of Oscars 2017. Here are five legal lessons you can take away from this debacle.

(1) Absolutely, positively ANYTHING can happen at ANY time. So, be smart, plan ahead, and secure your future and your family’s future. A major way to do that is through estate planning.

(2) Planning is paramount. Somewhere along the line, protocols weren’t met, and a wrong envelope was handed out at the wrong time. Proper planning would have — SHOULD HAVE — prevented that.

(3) Double check EVERYTHING. Are you SURE your will is updated? Are you POSITIVE your estate planning documents are still in that safety deposit box, and your kids have access? Are you CERTAIN you updated your estate planning documents after your third kid was born? Go see your estate planning lawyer.

(4) Did Warren Beatty seem a bit confused? He and his family might consider a medical checkup, and might also consider a Healthcare Power of Attorney. I explain all about healthcare PoAs and their importance here: LINK. And I’m not picking on Warren, I’m really not. A Healthcare PoA is good for everyone. Seriously, everyone should strongly consider a Healthcare PoA.

(5) Download my Estate Planning Questionnaire. The Oscars may end in total confusion, but you shouldn’t. The Estate Planning Questionnaire will ensure a smooth and predictable ending, just like you want.

What could the Oscars possibly have to do with the estate planning?

Actually, a lot. The most celebrated films – the Best Picture Award nominees – all feature themes of death and legacy. Certainly, in some films, this theme is more pronounced than in others. But in all the films, death and legacy are present, almost as if unseen actors just offstage.

In Fences, an ex-ballplayer openly mocks death, wryly declaring more than once, and always with a wink, “Death ain’t nothing but a fastball on the outside corner.” Later, confronted with a sudden tragedy, he throws open a window and shouts into a storm, daring death to take him on.

In Manchester by the Sea, the tragedy of premature deaths washes over the entire story. Like waves relentlessly pounding the beach during a storm, the characters cannot escape memories of tragic loss.

Hacksaw Ridge is of course about death in war. The protagonist struggles, with tremendous courage, to save lives during the horrific carnage of battle.

Arrival actually features a “canary in a coal mine.” In movie’s dénouement, the characters are given a whole new way of looking at life and death, at past and present.

We shouldn’t be the least bit surprised by any of this, of course. Great art so often wrestles with the meaning of death and legacy. Think about Homer’s The Iliad and The Odyssey, to Shakespeare’s plays, all the way to recent novels like Marilynne Robinson’s Lila and Anne Tyler’s A Spool of Blue Thread.

In movies, characters so often face the riddles of death and legacy, because we do so in real life. How to give life meaning? How best to leave a legacy? Allow me to suggest that one very practical, and even relatively easy, way to secure your legacy is through estate planning.

For all of us, at some point, the credits will roll and the screen will go dark. Before that time comes, diligently plan so that your loved ones are protected and taken care of.

Perhaps most importantly for the question of legacy, through estate planning we can leave meaningful charitable gifts to our favorite charities. Without estate planning, it’s just not possible to make charitable gifts at death.

Do estate planning, do it right, so your testamentary gifts can help nonprofits for decades to come – quite a legacy for you. One might even say, proper estate planning, with a charitable component, is deserving of an award.

Now, pass the popcorn, and enjoy the show. Tomorrow, take some time to get started on your own legacy, by downloading my Estate Planning Questionnaire.

How to Avoid Income Taxes on $100,000 While Supporting Your Favorite Charity

The Individual Retirement Account (IRA) charitable rollover allows individuals aged 70.5 years of age and older to donate up to $100,000 from their IRAs directly to charities, without having to count the distributions as taxable income. This gift transfer is called a qualified charitable distribution (QCD).

The Essentials

Why is this important?

Taxpayers age 70.5 and older are required to make annual distributions from IRAs, which are then included in the taxpayers’ adjusted gross income (AGI) and subject to taxes. The IRA Charitable Rollover permits those taxpayers to make donations directly to charitable organizations from their IRAs without counting them as part of their AGI and, consequently, without paying taxes on them.

Who is eligible?

The donor can be either an IRA participant donating from his or her own IRA, or a beneficiary donating from an inherited IRA. In either case, the IRA holder must be over 70.5 years of age.

This is based on the year the participant reaches age 70.5, not the day he or she reaches that age.

What qualifies?

IRAs only. These gifts can only be made from traditional IRAs or Roth IRAs. Charitable donations from 403(b) plans, 401(k) plans, pension plans, and other retirement plans are not eligible for the tax-free treatment.

Annual cap. A donor’s total combined charitable IRA rollover contributions cannot exceed $100,000 in any one year. The limit is per IRA owner, not per IRA. Also, this amount is not portable (i.e., sharable) between spouses.

When?

The IRA charitable rollover is permanent law. Donations made pursuant to the IRA charitable rollover can be made at any time during the year.”

What charities/nonprofits are eligible to receive the donation(s)?

Charitable contributions from an IRA must go directly to a public charity. Contributions to donor-advised funds and private foundations, except in certain (narrow) circumstances, do not qualify for tax-free IRA rollover contributions.

Allow me to emphasize the gift (QCD) must go directly to the charity. A donor cannot withdraw the money, and then give it to charity. Rather, the IRA administrator must send QCD straight to the charity.

IRA Charitable Rollover FAQs

1. What about gifts to a donor from a charity, in return for QCD?

Donors cannot receive any goods or services in return for QCD in order to qualify for tax-free treatment. As one philanthropist exclaimed, “Why would you want to (potentially) mess up a $100,000 tax-free donation by getting a $25 coffee table book?”

2. What substantiation does the IRS require?

In order to benefit from the tax-free treatment, donors must obtain written receipt of each IRA rollover contribution from each recipient charity.

3. What are the specific tax advantages of QCD?

For Iowans who don’t itemize deductions, and therefore don’t get to deduct their charitable contribution, the IRA charitable rollover obviously helps.

For Iowans who do itemize, there may still be tax advantages. Although it’s a few years old, Ashlea Ebeling in Forbes breaks down the math really well.

4. Could QCD fund a split interest gift, like a charitable remainder trust?

No. QCD must be a contribution that would be 100 percent deductible if paid from the owner’s non-IRA assets, so a split-interest gift will not qualify. Therefore, IRA charitable rollover funds generally cannot be made to a charitable remainder trust, pooled income fund, or charitable gift annuity.

5. Can I still get a charitable deduction along with the IRA charitable rollover?

No. Funds related to the IRA charitable rollover are excluded from the individual’s gross income for all purposes. Of course, there is no charitable deduction for any IRA charitable rollover funds.

6. It’s been said, “You should be giving while you’re living so you’re knowing where it’s going.” But, are there are potential challenges to charitable giving during lifetime? And how does the IRA charitable rollover affect these challenges?

There are three notable challenges to lifetime giving:

- Taxpayers who don’t itemize. Most fundamentally, a taxpayer has to itemize to take advantage of the charitable deduction. A taxpayer who uses the “standard deduction,” rather than itemized deductions, of course wouldn’t see any tax benefit from the charitable deduction.

- Adjusted gross income percentage limit. The federal income tax charitable deduction is limited to a certain percentage of adjusted gross income. The percentage is either 30 or 50 percent, depending on the type of property given and the type of recipient charity. There is a five-year carry forward.

- Pease limitation. The Limitation on Itemized Deductions (known as the Pease limitation) reduces most itemized deductions by three percent of the amount by which AGI exceeds a specified threshold, up to a maximum reduction of 80 percent of itemized deductions. The income thresholds for Pease vary by filing status.

One can readily see these three potential obstacles are simply not at issue with the IRA charitable rollover. Again, simply put, a QCD does not increase AGI.

7. Can the IRA charitable rollover fulfill required minimum distributions?

Yes. The IRA charitable rollover can fulfill required minimum distributions (RMDs). So, it’s an excellent way for Iowans over age 70.5 to both fulfill RMDs and help their favorite charities.